IRAN STRIKES BACK: The World knows how to work around US Sanctions, The US has No Tools left to fight Gold

Gold For Drones.

Disclaimer. my opinions are not the opinions of our sponsors

Leading up to Today’s Counter Attack

Gold for Drones

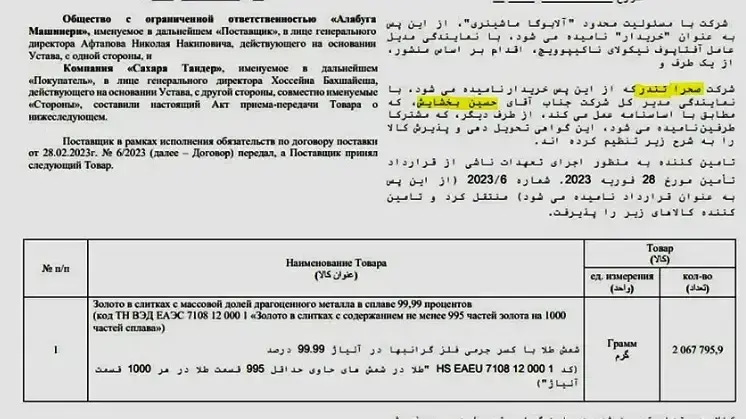

Based on leaked documents, Russia paid Iran approximately $1.75 billion for Shahed-136 drones, with part of the payment made in gold ingots

The deal also included setting up a production line in Russia for these drones, allowing domestic manufacture and reducing dependency on Iranian imports

On Tuesday, October 1, 2024, Iran launched a major missile attack against Israel, marking a significant escalation in the long-standing conflict between the two nations.

This attack came in response to a series of events that heightened tensions in the region.

The immediate trigger for Iran's retaliation was Israel's assassination of Hassan Nasrallah, the longtime leader of Hezbollah, in Lebanon last week.

Hassan Nasrallah, the longtime leader of Hezbollah, was killed by an Israeli airstrike on Friday, September 27, 2024

Israel announced his death on Saturday, September 28, 2024, and Hezbollah later confirmed his passing.

This assassination occurred during a series of intense Israeli airstrikes that shook Beirut on Friday night.

The strike targeted Hezbollah's headquarters in Beirut, resulting in the death of Nasrallah and other senior Hezbollah commanders.

The killing of Nasrallah is considered a significant development in the ongoing conflict between Israel and Hezbollah, with potential far-reaching implications for the region

It came after a 12-day period of escalating violence between Israel and Hezbollah, which had already resulted in numerous casualties and displacements in Lebanon

This killing was part of a broader Israeli offensive against Hezbollah, an Iran-backed militant group, which included airstrikes throughout Lebanon resulting in over 1,000 fatalities in less than two weeks.

Earlier on Tuesday, Israel had commenced a ground offensive in southern Lebanon, targeting what they described as "Hezbollah terror targets" in border villages.

This operation was characterized by the Israeli military as "limited, localized, and targeted ground raids"

In the hours leading up to the attack, U.S. officials warned of an imminent Iranian strike. A senior White House official stated that they had "indications that Iran is preparing to imminently launch a ballistic missile attack against Israel"

The U.S. actively supported defensive preparations to protect Israel

When the attack began, air raid sirens sounded across Israel.

The Israel Defense Forces (IDF) confirmed that Iran had launched ballistic missiles at the country

The assault was more substantial than Iran's previous attack in April, which involved over 300 drones and missiles.

U.S. officials anticipated that the targets in Israel would be military and governmental installations rather than civilian areas.

They expected the attack to involve greater firepower and potentially multiple missiles launched simultaneously to overwhelm Israel's air defense systems.

This Iranian retaliation represents a sharp escalation in the conflict and could potentially tip the region further into turmoil.

The attack came despite diplomatic efforts by the U.S. and France to broker a ceasefire between Israel and Hezbollah

As the situation continues to develop, there are concerns about the potential for further escalation and the risk of a broader regional conflict.

Iran's Gold imports up 6 X in Six Months as Iran Skillfully evades US sanctions

Now that the World knows how to work around US Sanctions, The US has No Tools left to fight Gold

The head of Iran's Customs reported that approximately 43 tons of gold bullion, valued at $2.5 billion, were imported into the country during the first six months of the Iranian calendar year, from March 21-September 20.

The figure represents a sixfold increase compared to the same period last year, when only 7.3 tons, worth $466 million, were imported.

Mohammad Rezvanifar noted that most of the gold was cleared through the International Imam Khomeini Airport in Tehran, with a small percentage handled by customs offices in various other locations across the country.

In a similar period last year, 7.3 tons of gold bullion, valued at $466 million, were imported into the country. This year, "96.8% of the imported gold bullion was brought in and cleared through Imam Khomeini Airport Customs,” he said on Tuesday.

Regulatory shifts impacting gold imports

Iran has been adjusting its approach to foreign exchange regulations in response to international sanctions. Exporters, particularly those dealing in petrochemicals, steel, and oil products—key sectors in the country's non-oil exports—have been allowed to import gold as an alternative to repatriating foreign currency earnings.

However, a directive issued in June by the Central Bank, halted the practice for some exporters. Observers have pointed out that the surge in gold imports may reflect broader efforts by the country to shield its economy from currency shortages and manage international trade amid sanctions.

Conflicting reports on Central Bank's gold reserves

The rise in gold imports comes amid conflicting reports regarding the true state of Iran’s gold reserves. During Mahmoud Ahmadinejad's presidency, the Central Bank stopped regularly disclosing its gold reserves and import data, attributing the decision to the impact of sanctions.

In 2011, then-Governor Mahmoud Bahmani said that Iran’s reserves stood at 500 tons—a figure that was later debunked. Subsequent reviews under Hassan Rouhani's government revealed that the actual reserves in 2011 were around 45 tons.

In July, Mohammadreza Farzin, the Central Bank governor appointed by Ebrahim Raisi, without mentioning the amount of gold reserves, said: “One of the main goals of the Central Bank is to increase currency reserves, and it can be confidently stated that free currency and gold reserves are increasing.”

The August gold rush

An unprecedented public rush to buy gold occurred on August 18, driven by social media campaigns promoting the superstition of "good fortune" on that particular day. The sudden surge in demand shocked officials, with the vice president of the Iran Gold and Jewelry Union noting that he had never seen such a phenomenon in his 64 years in the market.

Although specific data on the amount of gold sold that day hasn’t been released, the Customs report on gold imports might help explain the surge. Some have speculated that the promotions to increase gold sale to citizens were linked to entities within the government to offload gold imported for currency stabilization. Thus, the owners of those 42.8 tons of gold likely managed to sell a portion of the imported gold during the rush.

Gold-for-drones

Iran's use of gold in international transactions has a long history, often as a tool to bypass international restrictions on currency flows. In February, a hacking group exposed documents from Tondar Sahra, a company involved in drone technology and reportedly linked to the Islamic Republic’s military.

The hacked documents showed Russia paid Iran approximately $1.75 billion in a deal for Shahed-136 drones. Part of the payment was made with several tons of gold ingots.

The leaked files also detail the establishment of a production line in Russia for these drones, set up by Alabuga Special Economic Zone, a Russian state-backed entity. This arrangement allows Russia to manufacture Shahed drones domestically, reducing costs and dependency on imports from Iran.

During Ahmadinejad's tenure, it was revealed in a court session involving Babak Zanjani, an Iranian oil sales middleman, that 1.5 tons of gold had been purchased from Africa. Zanjani testified that the gold, coordinated by the Central Bank, was seized in Turkey and later found to be fake when it arrived in Dubai.

The views expressed on TheSilverIndustry.substack.com are not necessarily those of the Silver Academy.