Investing in No-Name Crypto Coins: The Absurdity of Valuing Digital Fads Higher Than Gold—A Recipe for Financial Disaster

The Crypto Craze: A Dangerous Game of Digital Russian Roulette

Op-Ed by Carmine Lombardi

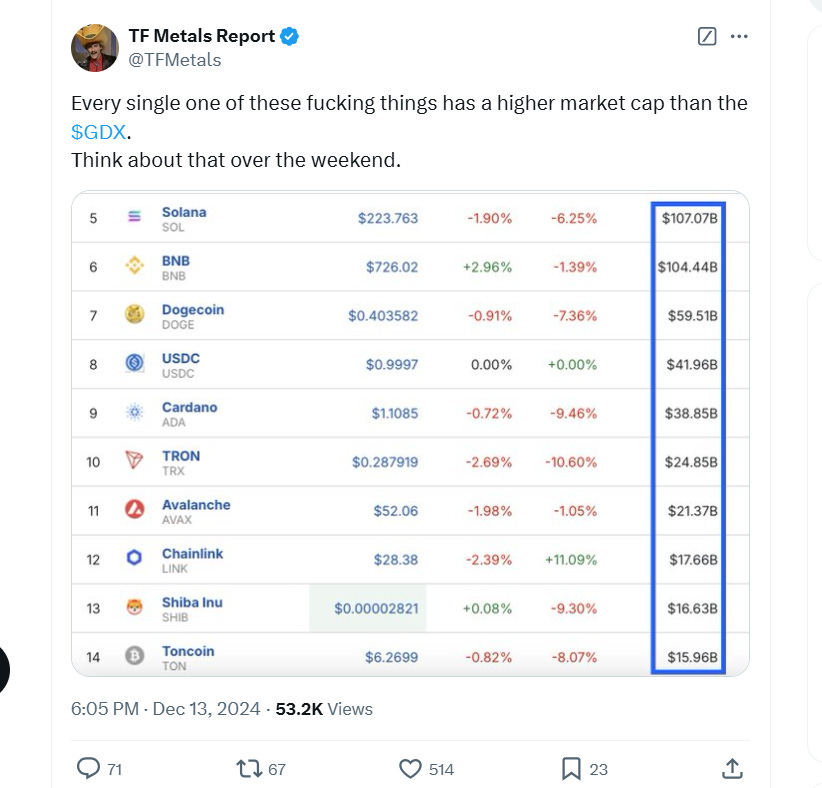

In the ever-evolving landscape of financial markets, a disturbing trend has emerged that demands our immediate attention. A group of unremarkable cryptocurrencies, which I've dubbed "Liquidity Sinks," have somehow managed to achieve market capitalizations surpassing that of GDX, a fund representing the gold mining industry. This alarming development exposes the reckless speculation and misplaced faith in digital assets that have never weathered a true economic storm.

Consider the following list of cryptocurrencies: Solana, BNB, Dogecoin, USDC, Cardano, TRON, Avalanche, Chainlink, Shiba Inu, and Toncoin. These digital tokens, many of which began as jokes or memes, now command billions in market value. Yet, not a single one has proven its resilience through a recession, let alone the test of time that gold has endured for millennia.

The risks associated with these digital assets are numerous and severe. Unlike physical gold, cryptocurrencies can be seized by authorities, frozen by exchanges, or stolen by hackers. The entire crypto ecosystem relies on a fragile digital infrastructure that could crumble in the face of electromagnetic pulses, cyberattacks, or power grid failures. As geopolitical tensions rise and warfare evolves, the vulnerability of these digital assets becomes even more apparent.

Moreover, the breakneck pace of technological advancement poses an existential threat to cryptocurrencies. The recent unveiling of quantum computing capabilities by tech giants like Google could render current blockchain technology obsolete, potentially wiping out billions in crypto wealth overnight.

The volatility and speculative nature of these assets cannot be overstated. Many investors seem to be relying on the greater fool theory, hoping to profit by selling to someone willing to pay an even higher price for these intrinsically valueless digital tokens. This is not investing; it's gambling with potentially devastating consequences.

Contrast this with GDX, a fund that invests in tangible assets backed by companies with real-world operations. Gold mining stocks represent ownership in businesses that extract a precious metal that has been valued across cultures and throughout history. Gold has survived wars, famines, the rise and fall of empires, and countless economic cycles.

The crypto market's liquidity is often illusory, masking the true risks of these assets. High liquidity can create a false sense of security, leading investors to believe they can easily exit their positions. However, in times of crisis, this liquidity can evaporate instantly, leaving holders stranded with worthless digital tokens.

It's crucial to recognize that many of these cryptocurrencies are little more than speculative vehicles, with no intrinsic value or real-world utility. Their prices are driven by hype, social media trends, and often, manipulative practices that would be illegal in regulated markets.

The collapse of FTX serves as a stark reminder of the dangers lurking in the crypto world. What was once considered a leading exchange turned out to be a house of cards, built on fraud and mismanagement. This incident alone should give pause to anyone considering investing in lesser-known crypto assets.

As we navigate an increasingly uncertain economic landscape, it's imperative to prioritize sound investments over speculative gambles. The allure of quick gains in the crypto market is tempting, but the risks far outweigh any potential rewards. Instead of chasing digital mirages, investors would be wise to consider time-tested assets like gold, which have proven their worth through centuries of economic turbulence.

Let me get the last word on this, the current state of the cryptocurrency market, particularly these "Liquidity Sink" tokens, represents a dangerous departure from rational investing.

It's high time we recognize this crypto craze for what it is: a perilous game of digital Russian roulette, where the odds are stacked against the average investor. Let's not confuse speculation with investment, or hype with value. The stakes are simply too high.

TF Metals Report is the work of Craig Hemke (a popular Silver and Gold Analyst)

This table starkly illustrates that none of these cryptocurrencies have experienced a full economic recession cycle, highlighting their untested nature in challenging economic conditions.

end of segment

Not worried. The crypto Ponzi is beginning to eat its own tail, with the early adopters selling out at crazy prices to later, greater fools. Sure, that keeps cash out of gold and silver -for now. And keeps sales going and premiums lower for the rest of us.

If the crypto bros don’t understand what they’re getting into, it’s not anybody else’s problem at this point. There has ban plenty of education and warning out there. Sure, some people are making huge profits, and good for them, I guess. As for those who will lose, well, we each have to make our choices and take the consequences, good or bad, don’t we? When every last trick in the book has finally been pulled and it’s the metals holders ’ turn to take their gains (to everything a season and all that….), the crypto baggies will be putting their assets up for sale at bargain basement prices. The shopping will then commence! Maybe that’s not nice, but you can’t save those too sure of their own beliefs to listen to the wisdom of the ages. Might as well reward yourself if you hung on and stayed with truth and value until the bitter end instead of chasing the latest, greatest scheme. If you don’t buy up the bargains, Black Rock will, and no virtue in that, is there?