The federal government's revenue primarily comes from various taxes and other sources.

Individual income taxes are the largest contributor, accounting for nearly half of all federal receipts. In 2023, they comprised 48% of total revenues.

Payroll taxes, which fund Social Security and Medicare, are the second-largest source, making up about 35% of federal revenues.

Corporate income taxes are another significant source, though their contribution has declined over time. In 2022, they accounted for 9% of federal revenue.

Other sources include excise taxes on specific goods like gasoline and alcohol, customs duties on imports, and estate and gift taxes

Federal Outlays

The major categories of federal spending include:

Social Security: The largest mandatory spending program, providing benefits to retirees and disabled individuals.

Medicare and Medicaid: Health insurance programs for the elderly, disabled, and low-income individuals.

National Defense: As per the latest figures, defense spending amounts to $874 billion.

Interest on the Debt: This has risen significantly, now reaching over $1 Trillion according to the latest Treasury figures.

Challenges in Treasury Sales

The U.S. government has faced increasing difficulties in selling Treasury securities. Several factors contribute to this challenge:

Global Shift: Many countries are diversifying their reserves away from U.S. Treasuries, with some opting for gold as an alternative

BRICS Expansion: The growing influence of BRICS ++++ (Iran, Saudi Arabia, Egypt, Thailand and dozens more) and their new currency have attracted nations seeking to exit the U.S. dollar

Why? Because who wants to have your funds stolen by USA (also called sanctions).

Sanctions Concerns: Countries are wary of potential U.S. sanctions and are looking for alternatives that offer more financial autonomy

Debt Burden: The U.S. national debt, close to $36 trillion, raises concerns about long-term fiscal sustainability

Changing Oil Dynamics: The dismantling of the Saudi oil peg to the U.S. dollar has destroyed confidence in the dollar's dominance. Almost all countries are selling US treasuries and quickly accumulating Gold as this is now the best practice for buying oil.

These factors combined have led to a challenging environment for U.S. Treasury sales, as investors increasingly seek alternatives that offer greater stability and independence from U.S. financial systems

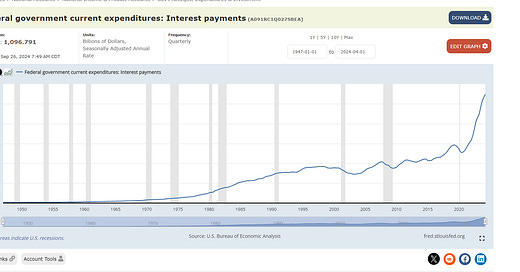

The graph from the Federal Reserve Bank of St. Louis shows a sharp upward trajectory in federal government interest payments, illustrating the concept of a fiscal doom loop.

This phenomenon occurs when interest payments on existing debt grow so large that they necessitate more borrowing, creating a self-reinforcing cycle of escalating debt.

Compounding interest exacerbates this problem. As the debt grows, interest accumulates not just on the principal, but also on previously accrued interest. This exponential growth is evident in the chart's steep curve.

The doom loop becomes inescapable when:

Interest payments consume an ever-larger portion of the budget

New revenue sources are unavailable or insufficient

Cutting spending becomes politically unfeasible

Mathematically, if the interest rate exceeds the growth rate of the economy, the debt-to-GDP ratio will increase indefinitely, leading to a potential debt crisis. This crisis can manifest as default, severe austerity measures, or currency devaluation.

Given the trajectory shown in the chart, without significant fiscal reform or extraordinary economic growth, the U.S. faces an increasingly challenging financial position.

I’m not saying that hyperinflation in the US is inevitable or imminent, though it remains a growing possibility. That is especially true as World War 3 plays out and a multipolar world order potentially emerges that could change everything.

In the meantime, I believe ever-increasing currency debasement potentially worse than what the US experienced in the 1970s—though not necessarily imminent hyperinflation—is an unstoppable trend you can bet on.

That’s why I think the gold price is set to skyrocket.

The last time the US experienced runaway inflation was in the 1970s.

Then, gold exploded from $35 per ounce to $850 in 1980—a gain of over 2,300% or more than 24x.

I expect the percentage rise in the price of gold to be at least as significant as it was during the 1970s.

While this megatrend is already well underway, I believe the most significant gains are still ahead. - Nick Giambruno

Hyperinflation can kick in when a government rapidly increases the money supply, often to fund excessive spending or war efforts, without a corresponding increase in economic output. This leads to a severe devaluation of the currency and a loss of public confidence. As the currency loses value, people rush to convert their money into tangible assets, creating a self-reinforcing cycle.

Gold typically skyrockets during hyperinflation for several reasons:

Safe haven: Gold is seen as a store of value and hedge against currency devaluation.

Limited supply: Unlike fiat currency, gold cannot be printed at will.

Historical precedent: Gold has maintained value through numerous economic crises.

Global demand: As currencies weaken, international buyers seek gold as a stable asset.

Preservation of purchasing power: Gold tends to retain its value relative to goods and services.

As hyperinflation erodes faith in paper currency, the demand for gold intensifies, driving its price upward dramatically.

end of segment

US Debt places everyone at risk

The debt crisis permeates every level of the economy, much like a ripple effect in a pond. Just as a stone's impact spreads outward, affecting even distant water molecules, financial strain reverberates through Wall Street, Main Street, and individual households.

This interconnectedness mirrors a forest ecosystem, where the health of each tree, from the tallest oak to the smallest sapling, depends on the well-being of the entire woodland community. The intricate web of financial relationships binds us all, making everyone susceptible to the consequences of mounting debt.

Silver and Gold restore balance to nature.

I started discussions with Mr. Alberto Morales about 6 months ago and this is when we decided there was a fit between his Silver Mining operation and the Silver Academy’s criterion for endorsing Silver Miners.

Alberto Morales is CEO of Andean Precious Metals. We met over zoom numerous times and had various discussions about his distinctive business model.

Andean Precious Metals has developed a robust business model that effectively mitigates risk while capitalizing on Bolivia's silver resources. The company operates the San Bartolomé processing plant, the largest oxide plant in Bolivia, which allows it to purchase silver concentrate from various sources, including artisanal miners.

This unique industrial processing model focuses on cash flow generation and profitability.

The key advantage of Andean's approach is its ability to adjust purchasing prices based on the spot price of silver. When silver prices are low, the company pays less for concentrate, and when prices are high, it pays more.

This flexible pricing strategy ensures a consistent operating margin, protecting the company from potential losses due to market fluctuations.

Furthermore, Andean's model supports local economies by providing a reliable market for small-scale and artisanal miners, contributing to the formalization of the silver mining sector in Bolivia.

This approach not only benefits the company but also aligns with Bolivia's interests in maintaining local control over its mineral resources.