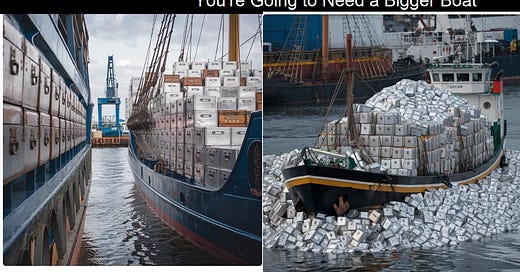

India's Silver imports in the first half of 2024 jumped to 4,554 tons from 560 tons a year ago

One country on track to take 1/3 of the supply. All this amid Vanishing Silver Supply.

We want to come out of the gate swinging the first week of September. It’s never made sense to me that many Silver inventory reports use a standard of measurement in tons or tonnes when the standard and customary unit for sale is (by the ounce), which explains the conversions below.

India's half year Silver imports jumped from 560 tons a year ago to 4,554 tons so far in 2024.

Conversion to Troy Ounces

Initial Imports (2023): 560 metric tons

Current Imports (2024): 4,554 metric tons

1 metric ton = 32,150.7 troy ounces.

2023 Imports in Troy Ounces:

560 tons×32,150.7 troy ounces ton=18,004,392 troy ounces560 tons×32,150.7 troy ounces ton=18,004,392 troy ounces

2024 Imports in Troy Ounces:

4,554 tons×32,150.7 troy ounces ton=146,387,489 troy ounces4,554 tons×32,150.7 troy ounces ton=146,387,489 troy ounces

Reuters reports: India's silver imports in the first half of 2024 jumped to 4,554 tons from 560 tons a year ago, trade ministry data showed.

Recall we had published this article a little over a week ago.

Apologies, I got the story wrong.

But in my own defense I can say that I errored on the side of caution so as not to distort the true supply / demand dynamics.

We should have stated India’s Silver imports increased 7.13 times or jumped up approximately 7 times from 2023 levels.

Our Headline below was wrong

India ranks among the top 3 BRICS nations in economic power:

Third-largest GDP within BRICS, behind China and Russia

Second-largest consumer market after China

Significant contributor to global GDP growth

Rapidly growing economy with 7.2% GDP increase in 2022-23

Fifth-largest economy globally

Second-largest BRICS economy since 2015

Recall that the country is energy starved (like most of the World) As recent as 2022 only 5% of India was equipped with Air Conditioning (in scorching hot country)

India recently slashed import duties on silver from 15% to 6%, a drastic reduction of 9 percentage points. This significant cut, announced in the Union Budget 2024, aims to enhance domestic value addition in precious metal jewelry and “reduce smuggling.”

This is also a significant tailwind for silver.

Silver is #1 conductor of Energy

Silver is the #1 storage of Energy

India needs the Energy

Reliance, Ola Electric (backed by SoftBank), and Rajesh Exports in relation to battery production in India

Reliance Industries

Reliance Industries, one of India's largest conglomerates, is actively involved in battery manufacturing:

Reliance New Energy, a subsidiary, was selected as one of the beneficiaries of India's Production Linked Incentive (PLI) scheme for Advanced Chemistry Cell (ACC) battery storage.

The company was awarded incentives for 5 GWh of battery manufacturing capacity.

Reliance is setting up a battery giga factory in Jamnagar, Gujarat.

They have also bid for an additional 10 GWh capacity under a recent re-bidding of the PLI scheme.

Ola Electric (SoftBank-backed)

While not directly related to SoftBank, Ola Electric, which is backed by SoftBank, is involved in battery production:

Ola Electric was selected as one of the three beneficiaries of the PLI scheme for ACC battery storage.

They were awarded the largest capacity of 20 GWh under the initial PLI scheme.

Ola is setting up an electric cell giga factory in Krishnagiri district, Tamil Nadu.

The plant will have an initial production capacity of 1 GWh, expandable to 20 GWh.

Ola expects its giga factory to be operational by February 2024.

Rajesh Exports (Much of their military use is coded “Jewelry” import)

Rajesh Exports, primarily known as a gold refiner, has diversified into battery manufacturing:

The company was selected as one of the three beneficiaries of the PLI scheme for ACC battery storage.

They were awarded incentives for 5 GWh of battery manufacturing capacity.

Rajesh Exports has signed an agreement with the Union Ministry of Heavy Industries and the Karnataka government to set up a 5 GWh lithium-ion cell factory in Karnataka.

World consumers and EV manufacturers are informed that Silver Solid State batteries are superior to Lithium-ion batteries (double the range, double the life, Charges twice as fast, 40% lighter)

The company has incorporated a wholly-owned subsidiary, ACC Energy Storage Pvt Ltd, to execute the project.

Their facility is being set up in Dharwad, Karnataka.

Here’s the kicker: Most so-called “silver talk” lacks the understanding that Silver is, first and foremost, a monetary metal.

I’m the most guilty of overlooking this. It’s understandable that we all forget this because modern-day perceptions of money are confused with paper currency (gold and silver substitutes). However, it's crucial to note that most of Silver’s industrial uses have only recently emerged, a fact that many may not be aware of.

Silver, once again reigning supreme as a monetary metal, will kick off this biggest Silver bull run the World has ever seen (opinion)

Silver has played a pivotal role in the history of money since the inception of coinage. The story begins in ancient Lydia, where the first coins were minted using electrum, a natural alloy of gold and silver. However, it was the discovery of rich silver deposits in Laurion, near Athens, that truly catapulted silver into monetary prominence.

The ancient Greek city-states, particularly Athens, leveraged these silver mines to mint their famous "owl" coins, which became the first widely recognized international currency in the eastern Mediterranean.

As the Roman Empire rose to power, it adopted and expanded the use of silver coinage, with the denarius becoming the principal silver coin for centuries.

Following the fall of Rome, silver continued to dominate monetary systems across Europe. The monarchs of Spain, Portugal, France, the Dutch Republic, and England all took turns monetizing silver, often exploiting newly discovered silver deposits in their colonies.

However, the era of silver's monetary supremacy began to wane as governments and bankers introduced paper currencies.

This process of demonetization occurred in phases across different regions, as financial institutions sought to replace tangible silver with more easily manipulated paper representations of wealth.

The industrial revolution marked a shift in silver's primary use. With the advent of electrical technologies, pioneered by inventors like Edison and Tesla, silver found new applications in industry.

This trend has continued to the present day, with most of the silver ever used industrially being consumed in recent decades.

Interestingly, we are now witnessing a resurgence of interest in silver as a safe haven asset and being remonetized.

This renewed attention comes as the BRICS nations (Brazil, Russia, India, China, and South Africa) seek to challenge the hegemony of the US dollar in global finance.

As geopolitical tensions rise and economic uncertainties persist, silver's dual role as both an industrial metal and a store of value is once again coming to the fore