If I get Murdered it will Be Because I Told the Truth. Banks Are OUT OF MONEY.

WITHDRAW AS MUCH AS YOU CAN THIS WEEKEND

Europe isn’t just a testing ground for 15-minute cities, COVID mandates, and the war on farmers-it’s also where authorities rehearse what happens when your bank account is wiped out by hackers. In 2024, the European Central Bank launched its first-ever cyber resilience stress test on 109 major banks, simulating devastating cyberattacks that disrupt daily banking operations and leave customers locked out of their funds.

These exercises force banks to activate emergency plans and restore data from backups, revealing just how vulnerable the financial system-and your savings-are to digital catastrophe. Europe’s simulations are a preview of the chaos that could soon hit the United States.

Dateline: Spain, Today

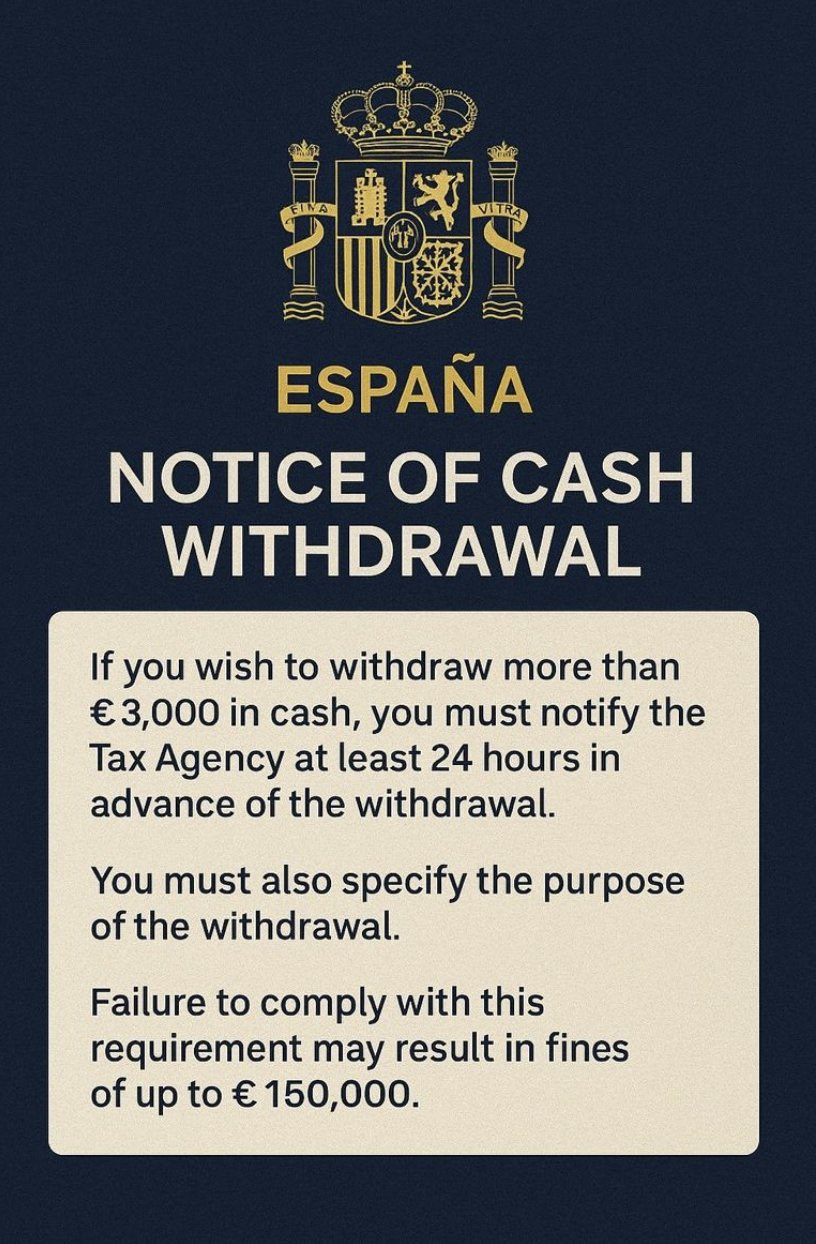

What if the money in your bank account isn’t really yours? What if, with a single bureaucratic misstep, you could lose not just access to your funds-but face a penalty so steep it could ruin you overnight? In Spain, this dystopian scenario is no longer a fever dream, but a codified reality: fail to notify the authorities before withdrawing over €3,000 in cash, and you could be staring down a fine of up to €150,000. Is this the future for all of us?

Why are governments making it so hard to access your own cash?

Spain’s new rules demand that anyone withdrawing €3,000 or more must notify the tax agency in advance, using a digital certificate, PIN, or electronic ID. For withdrawals over €100,000, you need to give 72 hours’ notice. Even frequent smaller withdrawals-say, €800 or €900-can trigger red flags if they look suspicious. The message is clear: every move you make with your money is now under surveillance.

But what happens if you don’t comply?

Banks are required to block withdrawals if the paperwork isn’t in order. They must report suspicious transactions, even if you’re just under the threshold. Fail to notify, and you could be fined anywhere from €600 to a staggering €150,000, depending on the “seriousness” of your violation. The tax office is watching, and ignorance is no excuse.

Could this really happen elsewhere?

It already is. Across Europe and the United States, banks are quietly tightening the screws. In the U.S., banks routinely limit cash withdrawals-sometimes to as little as $500 a day at ATMs, or $5,000 a week at the branch, unless you “order ahead”. Even then, you may be grilled about your intentions, and your transaction will be reported to the authorities if it’s deemed “large” or “unusual.” Try to withdraw $4,000 for home repairs? The bank might simply tell you, “We don’t have it.” Your money? Not really. Legally, your deposit is an unsecured loan to the bank-Professor Richard Werner has documented that your funds are not held in custody, but are used as the bank sees fit.

Is this just about fighting crime-or is there a deeper agenda?

Governments claim these rules fight tax evasion, money laundering, and terrorism. But critics argue this is about control. The war on cash is accelerating, with stadiums and national chains like Starbucks refusing to accept physical currency. The push for central bank digital currencies (CBDCs) is relentless. The Bank for International Settlements (BIS) openly discusses the need to track “how and by whom every 100-dollar bill is spent”. Every digital transaction leaves a trail, every movement can be monitored, every account can be frozen at the touch of a button.

What does this mean for your privacy and autonomy?

Digital ID systems, now required for major financial transactions, are a surveillance tool. Every time you use your digital ID, metadata about your location, time, and activity is logged. Over time, this builds a detailed profile of your life-accessible to governments and, potentially, hackers. The excuse is always “security,” but the result is a profound loss of privacy and autonomy.

Could the EU’s financial woes make things even worse?

With the eurozone teetering on the edge of recession and insolvency rates soaring, governments are desperate for revenue. Asset seizure regimes are being harmonized across the EU, with new powers to freeze and confiscate assets at unprecedented speed-even for suspected violations5. If the state can seize your assets on suspicion, do you really own anything at all?

So, what’s left as a lifeline?

GOLD and SILVER

If your money in the bank is just a number on a screen, subject to state approval and instant freezing, what can you trust? For centuries, gold and silver have been the ultimate stores of value-tangible, private, and outside the financial surveillance grid. When access to your own money requires government authorization, and when digital systems can be switched off or manipulated, physical precious metals may be your last remaining financial lifeline.

Will you wait until the next blackout, the next “emergency,” or the next round of asset seizures to realize what’s at stake? Or will you act now, before the door to financial freedom slams shut for good? The war on cash is here. The window to protect your wealth is closing. The choice, for now, is still yours.

Withdraw at least 90% of the funds in your account or LOSE IT ALL

- Video Proof They don’t have the funds (fractional reserve banking is a ponzi scheme, it’s all by design)

THEFT

I was scared to post this video so if I end up dead missing please share this post… it’s because I’m brave enough to get the TRUTH OUT

end of segment

opinions expressed here are not our sponsors

editorial department is separate from promotions department

not financial advice

Withdraw your money from Banks immediately

You have been warned now over 50 times

This post is for entertainment purposes only