The specter of hyperinflation—where prices double or triple within months—has haunted economies from Weimar Germany to Zimbabwe and Venezuela. Today, the United States faces a convergence of three classic triggers: supply-chain disruptions, labor constraints, and excess money creation. With a new $5 trillion debt ceiling increase poised to flood the economy with borrowed dollars, the risk of runaway inflation is no longer academic. If history is a guide, the Federal Reserve may wait until the outcry is deafening before deploying a digital dollar (CBDC) as a last-ditch rescue.

1. Supply-Chain Disruptions: The First Domino

The COVID-19 pandemic shattered global supply chains, leaving ports from Los Angeles to Seattle clogged and critical goods stranded. Now, economic warfare—tariffs, sanctions, and threats of 100% duties on imports from China and other non-dollar trading partners—pushes supply chains to the breaking point. When essential materials and components become scarce, their costs surge. Producers, squeezed by higher input prices, pass these costs to consumers, fueling a cost-push inflation that can spiral out of control.

“Supply chain disruptions contributed about 60% of the above-trend run-up of headline inflation in 2021 and 2022.”

2. Labor Constraints: The Second Spark

Mass deportations and restrictive immigration policies threaten to gut industries reliant on immigrant labor, from agriculture to construction. As the labor pool shrinks, wages rise—costs that businesses again pass on to consumers. The result is a resource crunch: fewer workers mean less output, even as demand remains strong. This dynamic played out during the pandemic, and economists warn that renewed deportations could add up to three percentage points to inflation for years.

“Deporting 7.5 million undocumented workers would produce three years of higher inflation, which would peak at 3.1 percentage points.”

3. Easy Credit and Excess Money Creation: The Final Accelerator

With the passage of the “big beautiful bill,” the U.S. is set to inject $5 trillion in new debt into the economy—on top of pandemic-era stimulus and existing deficits. When governments respond to rising costs by printing money or flooding markets with cheap credit, confidence in the currency erodes.

People rush to spend before their money loses value, accelerating the velocity of money and locking in a self-reinforcing inflationary spiral.

“If the money supply grows faster than overall economic growth, inflation will occur. If the difference becomes too wide, hyperinflation occurs.”

The Vicious Cycle—And the Historical Echo

These forces are not isolated. They reinforce each other:

Supply shortages drive up costs.

Labor constraints push wages higher.

Easy credit absorbs costs—temporarily—while stoking demand.

More money chases fewer goods, worsening shortages and raising expectations for future inflation.

This cycle mirrors the run-up to hyperinflation in Weimar Germany, Zimbabwe, and Venezuela, where supply shocks, labor disruptions, and unchecked money creation led to economic collapse and political upheaval.

The Fed’s Dilemma—and the Digital Dollar Endgame

Historically, central banks have been slow to act, tightening policy only after inflation becomes intolerable. In the coming crisis, the Federal Reserve may again wait for a “loud cry out” before intervening. But this time, a new tool is on the horizon: the central bank digital currency (CBDC). By offering high interest rates on digital savings accounts, the Fed could directly curb spending and restore confidence—sidestepping the blunt force of rate hikes that punish the poor and stifle growth.

“A more direct, more efficient, and more effective way to stop inflation is possible by creating Federal Reserve digital currency bank accounts offering exceptionally high interest rates.”

The stage is set. If these three forces continue to intensify, the U.S. could face the kind of hyperinflationary spiral that has toppled economies before. The only question is whether policymakers will act in time—or wait until the crisis is too loud to ignore.

Safeguard your Wealth

Safeguard your Life … with Silver

Follow Eric Sprott’s Playbook: Buy Silver at Under $2 an Ounce

—Discover the Hidden Mining Stock Poised for Explosive Gains

Eric Sprott’s Blueprint for Mining Stock Success

Legendary investor Eric Sprott has built his fortune by following a simple, yet powerful, strategy for picking winning mining stocks. His approach is laser-focused on two critical factors: the size and quality of the deposit—measured in ounces in the ground—and the outlook for the underlying metal price. Sprott insists: “The deposit is number one. The metal price outlook is number two. ”

Sprott seeks out companies with massive, undeveloped deposits in safe, investor-friendly jurisdictions. He particularly favors junior miners that have been overlooked by the market—often because their resources are considered low-grade or uneconomic at current prices. But when metal prices rise, these same resources can suddenly become highly valuable. For example, a company with a billion ounces of silver and a $100 million market cap allows you to buy silver in the ground for just pennies per ounce. This offers extraordinary leverage if silver prices surge, as Sprott predicts they will

Why Silver? The Perfect Storm for a Moonshot

Sprott is emphatic about silver’s potential. He cites soaring US debt, relentless government deficits, geopolitical instability, and surging industrial demand—especially from solar, batteries, and military technology—as powerful catalysts for a historic silver rally. With a 200 million ounce annual supply deficit and above-ground inventories rapidly shrinking, Sprott sees silver prices potentially soaring to $50–$70 per ounce, or even higher if the historic gold-to-silver ratio reasserts itself. At $70 silver, producers with $20 costs would generate $50 per ounce in profit—an 800% increase in margins compared to lower prices

Applying Eric Sprott’s Playbook to Dolly Varden Silver

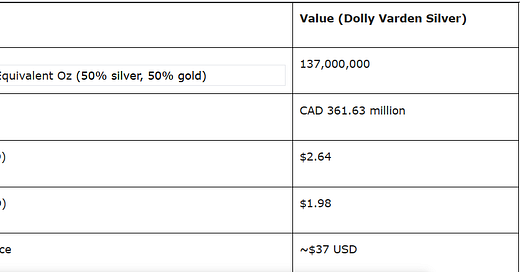

Ounces in the Ground: Dolly Varden Silver (TSXV:DV) boasts approximately 137 million silver-equivalent ounces. (50% silver, 50% gold)

Market Cap: As of June 2025, Dolly Varden’s market cap is about CAD 361.63 million.

Cost Per Ounce:

CAD: $2.64 per ounce

USD: $1.98 per ounce (at 0.75 exchange rate)

Current Silver Price: ~ Chopping sideways in range of $36.50 to $37 USD

If you buy Dolly Varden Silver stock today, you’re effectively purchasing silver in the ground for less than $2 USD per ounce—a fraction of the current spot price. If silver prices rise to $50, $70, or beyond, as Sprott forecasts, the leverage could deliver outsized gains, especially if the company expands its resource base or improves economics at higher prices.

Key Takeaway

By following Eric Sprott’s playbook, you’re investing in a massive silver resource at a steep discount to the spot price—positioning yourself for potentially explosive gains as silver prices take off. The combination of a large deposit and a bullish metal price outlook is the ultimate recipe for mining stock success

Dolly Varden Silver’s 100% held, 163 sq. km. Kitsault Valley project is located in the southern tip of the Golden Triangle of British Columbia, just south of the high-grade Brucejack and Eskay Creek gold mines.

The project hosts a high-grade mineral resource of silver and gold and is considered prospective for hosting further precious metal deposits.

end of segment

disclaimer - This news article is sponsored by Dolly Varden Silver and Jon Forrest Little has received payment to write this news article. The information provided is intended for informational purposes and should not be considered financial advice, investment advice or a recommendation to buy or sell any securities.

Moreover,

Information contained herein has been obtained from sources believed to be reliable, but there is no guarantee as to completeness or accuracy. Because individual investment objectives vary, this Summary should not be construed as advice to meet the particular needs of the reader. Any opinions expressed herein are statements of our judgment as of this date and are subject to change without notice. Any action taken as a result of reading this independent market research is solely the responsibility of the reader.

The Silver Academy is not and does not necessarily profess to be a professional investment advisor, and strongly encourages all readers to consult with their own personal financial advisors, attorneys, and accountants before making any investment decision. The Silver Academy and/or independent consultants or members of their families may have a position in the securities mentioned.

Mr. Little does consult on a paid basis both with private investors and various companies. Investing and speculation are inherently risky and should not be undertaken without professional advice. By your act of reading this independent market research letter, you fully and explicitly agree that The Pickaxe and/or The Silver Academy will not be held liable or responsible for any decisions you make regarding any information discussed herein. Clients do pay for various Silver articles that promote mining equities but these are less than 10% of the newsletter per content analysis.