How do Empires Collapse?

How do ruling elites try to prevent the collapse? Historically, this has been solved by distracting your own population and creating an enemy and fighting him.

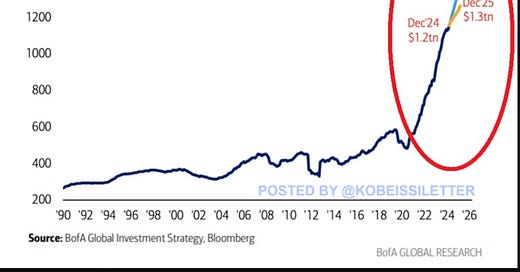

Rising US Debt and Interest Payments: A Crisis Unfolding

The United States is facing a fiscal crisis as interest payments on its national debt continue to soar. Over the past year, these payments have reached a staggering $1.2 trillion, surpassing defense spending, which stood at $900 billion during the same period. Projections indicate that if interest rates remain stable, these costs could balloon to $1.5 trillion by the end of the year, doubling in just four years. Even if the Federal Reserve cuts rates by 100 basis points, interest costs are still expected to hit approximately $1.3 trillion in 2025, assuming no recession or significant economic slowdown occurs.

The Debt Trap

This escalating debt burden is not merely a financial challenge but a symptom of a deeper systemic issue. The US government's reliance on borrowing to service its existing debt creates a vicious cycle, often referred to as a debt trap. Currently, about 26% of all tax revenues are dedicated to paying interest alone, a stark contrast to countries with AAA ratings, which typically allocate between 1% and 5% for this purpose. This diversion of funds means less investment in the economy, exacerbating the problem. It's a Ponzi scheme, where the central bank buys government debt with money "made out of thin air," a strategy that can continue as long as the US dollar remains the world's reserve currency. However, this approach is unsustainable and will eventually lead to catastrophe.

Impact on Everyday Investors

The implications of this debt burden are far-reaching for everyday investors:

Budget Pressure: As more tax dollars are diverted to interest payments, less money is available for essential public services like highways, parks, and Social Security payments. This could lead to reduced government spending in critical sectors, impacting economic growth and public welfare.

Future Tax Implications: To address the growing debt burden, the government may eventually resort to higher taxes. This could affect consumer spending and business profitability, potentially leading to economic stagnation.

Market Volatility: The rising debt and interest costs could trigger bond market reactions, influencing mortgage rates and stock valuations. This volatility could make investment decisions more challenging and riskier.

Dollar Stability: Excessive debt is eroding confidence in the US dollar, prompting countries to diversify their reserves by buying more gold. This shift could further destabilize the dollar and impact global investments.

Investment Considerations: High debt levels favor gold and silver as investment hedges. As investors seek safer assets, demand for these commodities is likely to increase, driving up their prices.

The Central Bank's Dilemma

To ease the government's debt servicing burden, the central bank may lower interest rates. While this makes borrowing cheaper, it also devalues the reserve currency, leading to higher price levels. However, once rates are lowered, the ability to combat rising prices by raising interest rates is diminished, risking stagflation. This scenario poses a significant challenge: how to prevent economic stagnation from spiraling into depression without the traditional monetary policy tools.

Historical Precedents

Historically, nations facing similar economic predicaments have often resorted to distracting their populations by creating external enemies and engaging in conflicts. This strategy, while effective in the short term, does not address the underlying economic issues and can lead to further instability.

The Gold Movement: A Strategic Shift?

Amidst this financial landscape, a significant movement of gold from London to New York has been observed. JPMorgan Chase and other major banks are shipping billions of dollars worth of gold across the Atlantic. This massive transfer could be part of a broader strategy involving the US Treasury and the Federal Reserve.

Theory 1: Revaluing Gold to Reduce Debt

One theory suggests that this gold movement is a joint effort between public companies like JPMorgan Chase and a US Treasury-Federal Reserve venture aimed at revaluing gold. By increasing the value of gold reserves, the US could potentially reduce the principal amount of its debt. This strategy would involve using gold as collateral to offset a portion of the national debt, thereby easing the financial burden on taxpayers. However, implementing such a plan would require significant changes in monetary policy and international agreements, making it a complex and unlikely scenario.

Theory 2: Preparing for a Gold Standard

An alternative theory posits that JPMorgan and the U.S. Treasury are bringing gold back to the US to facilitate an audit and potentially implement a gold standard. This theory is supported by recent announcements, including President Trump's plans to audit Fort Knox gold reserves, which have not been comprehensively audited since 1953.

The creation of a US Sovereign Wealth Fund could be part of a broader strategy to replace the Federal Reserve or complement its functions, potentially paving the way for a return to a gold-backed currency.

Now why would Congress sneak an entire section about revaluing Treasury gold from $42 to current market value or some other astronomical value, at the very end of the BITCOIN-Act-FINAL bill?

Some Facts and a Table

The United States holds 8,133.46 metric tonnes of gold in its reserves.

To convert this amount into troy ounces, you can use the conversion factor of 1 metric tonne being equal to 32,150.7466 troy ounces. Therefore:

US Gold in Troy Ounces=8,133.46×32,151

US Gold ≈261,496,811.44 troy ounces

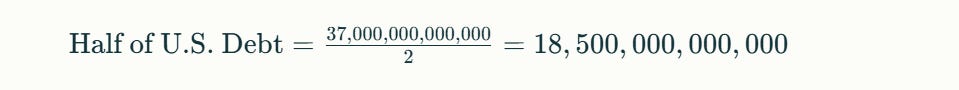

US Debt 37 Trillion

To make a dent in the principal let’s consider backing half of the debt ( $37 Trillion by the Gold US says it has)

Now putting this all together in a table

Now we know the powers that be are not going to value gold at $70,746 and recall we just used half the debt in our calculation (Now we are beginning to see just how massive 37 trillion debt figure really is)

Getting back to the question asked above…

The U.S. government is estimated to own around 200,000 bitcoins, acquired through criminal and civil asset forfeitures. (This sentence should make anyone nervous understanding that many of these seizures are done unilaterally without an indictment, judge and jury. Just like when Trudeau seized hard working truckers bitcoin with no legal cause.)

This amount is part of the newly established Strategic Bitcoin Reserve, which aims to hold these assets indefinitely without selling them. The value of these holdings fluctuates with the market price of Bitcoin. As of recent reports, the U.S. government's Bitcoin holdings are valued at approximately $16 Billion to 19 Billion, depending on the current Bitcoin price. Bitcoin’s volatility is a concern as are all the other facts I’ve reported over the past two years ( can be seized, hacked, compromised, knocked out by Electro Magnetic Pulse, cyber wars, power grid failures or blockchain rendered obsolete by Quantum computing)

Updating Table including Bitcoin and setting Gold at current market value instead of the absurd $42 (antiquated) figure

However, transitioning to a gold standard would severely limit the Federal Reserve's flexibility and politicians likewise hate the discipline of a constrained monetary system.

The rising US debt and interest payments present a critical challenge for policymakers and investors alike. (ASIDE- reason investors struggle is because of the existing dearth of talent within the ranks of policymakers)

While the movement of gold from London to New York could be part of a strategic financial maneuver, its exact purpose remains speculative and all of us reading this newsletter understand that the ruling class won’t divulge what they are really planning. Instead, the villagers get whipsawed from crisis to crisis. (I still haven’t recovered from all the Covid gaslighting and neither have the millions of people that lost their businesses) You can bet that the ruling elite lives and dies by the line “Never let a crisis go to waste”

How do empires collapse?

How do ruling elites try to prevent the collapse?

Historically, this has been solved by distracting your own population and creating an enemy and fighting him.

Look for more wars (Let’s see … we just started economic wars with Canada, Mexico, China and Europe)

Since taking office, President Trump has made many military threats and initiated strikes.

He has threatened to use military force to take control of Greenland citing national security concerns.

Trump has also directed the Pentagon to prepare military options for the Panama Canal.

Additionally, the U.S. launched air strikes against Houthi rebels in Yemen, citing their attacks on maritime activity in the Red Sea.

These actions reflect Trump's

assertiveaggressive foreign policy stance

When questioned about the potential reaction from Iran and China regarding U.S. military actions, particularly in the context of joint naval drills between Iran, China, and Russia, President Trump expressed confidence in U.S. military strength. He stated, "We are stronger than all of them. We possess more power than all of them," during an interview with Fox News while aboard Air Force One.

Editors Note:

Is US really stronger than all of them?

Not a country that ranks 20th in Math

Not a country that is $37 Trillion in Debt

Not a country whereby others are dumping US treasuries to escape the toxic orbit of US Dollar

Not a country whereby members of Congress trade on stock market after receiving inside briefings

Not a country where US President kids are given special favors (Hunter Biden made of 33 million “brokering Energy deals in Ukraine”)

Not a country where war profiteers are over-paid and part of the kleptocracy (what I refer to as “welfare for the rich”)

Not a country that drains the Strategic Petroleum Reserves to try and fool consumers into believing there is no inflation to rig 2022 mid term elections

Not a country that makes up inflation figures to fool the villagers

Not a country that debases its own currency so workers work harder for less

The Definition of Hubris

Trump Looks Straight from the Golf Course to Watch US Bomb Yemen

Tomorrow, we have an essential update on Trump’s Tariffs taxes on Mexico and China are really taxes on you and me. (though they are intended to spark domestic production) and how these Tariff taxes will fall on the backs of the middle and lower classes.

The good news is that Silver will be soaring as Mexico and China are teaming up in a classic game of triangulation to stick together to fight their common foe (the USA) and use Silver as their weapon of choice.

end of segment

These opinions are mine and not the opinions of sponsors

Editorial Department is separate from promotions department

Not financial Advice