Historic Alert: Dow Jones-to-SILJ Ratio Plunges to All-Time Low—Sprott Signals Buy Signal for Silver Miners!

More data points that support elite group of 4 Silver Miners

The Dow Jones-to-SILJ ratio has collapsed to a record low, signaling silver miners are primed for a historic rally—this is the ultimate moment to buy!

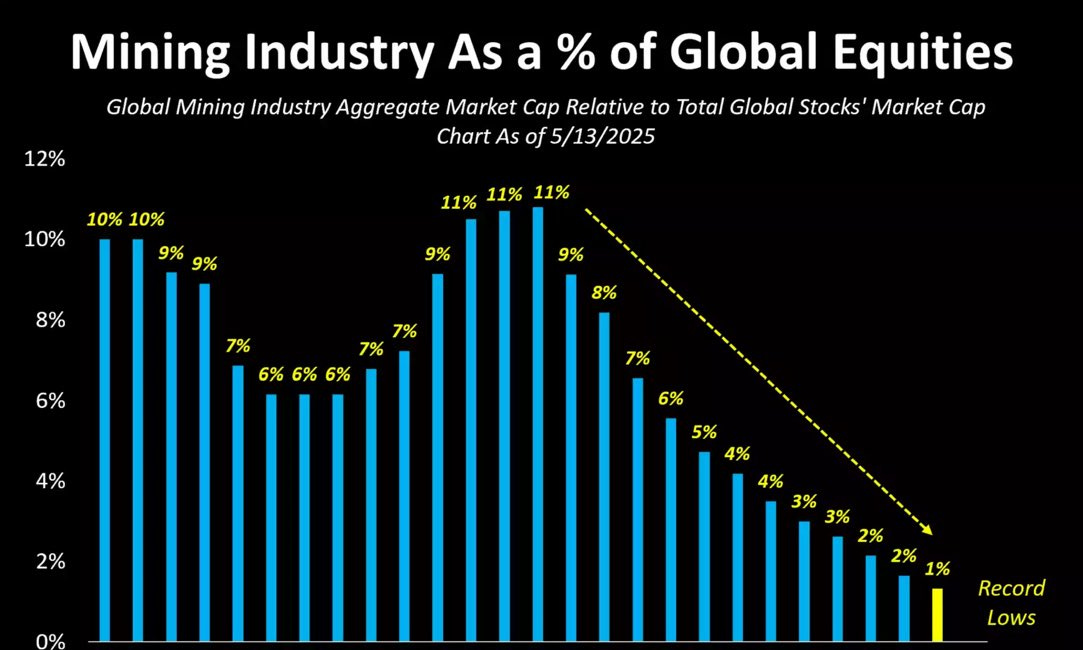

Chart 1- Gold miners are monstrously undervalued meaning Silver miners are hyper-leveraged for explosive move

Call to Action - Position yourself now meaning you are getting in (entry point) lowest in history

highlighting a rare, bullish setup for silver miners

Chart 2 - Look at the Rocket shot as this is the lowest point in history.

Call to Action: Never before has it been this glaring to witness life changing wealth buying Silver mining equities (timing the bottom)

Call to Action

Stack physical Silver (remember that the average American can not afford a set of tires)

We recommend a minimum of 500 ounces of silver that you hold

Keep in mind gold to silver ratio is heading to 50 and that the gold to silver ratio is breaking down in favor of silver to play catch up big time.

We have set a $68 dollar per ounce target for Silver which Eric Sprott and Mike Maloney believes - conservative

We recommend buying $10,000 to $20,000 in these four Silver mining equities and each time there is a dip accumulate more.

For leverage exposure to silver we endorse these four miners

these are pure silver mines (not silver as by product mines)

First 3 of these picks are in production right now

We have selected our picks based on the strength of:

Their balance sheets

Their Ore grades

Their Metallurgy

Their Management talent

Their Jurisdiction.

and most importantly their volume of ounces in the ground

First 3 in production.

Andean Precious Metals: TSXV: APM, OTCQX: ANPMF

The company operates the largest commercial silver oxide processing plant in Bolivia's Cerro Rico region - the San Bartolomé facility. This strategic asset has produced over 65 million ounces of silver equivalents since 2009, demonstrating Andean's significant production capabilities.

Their robust balance sheet provides the company with financial flexibility and stability in a volatile industry.

The company follows a two-pronged growth strategy, focusing on organic growth in Bolivia and expansion through mergers and acquisitions in the wider Americas. This approach positions Andean for sustainable long-term growth and diversification.

Andean has successfully extended the life of the San Bartolomé mine from eight months to potentially 10 years or more, showcasing the company's operational expertise and ability to maximize asset value.

The company is committed to sustainable mining practices and community engagement, contributing approximately $75 million annually to the local economy through wages, royalties, and taxes. This dedication to social responsibility strengthens Andean's social license to operate.

By acquiring Golden Queen Mining Company (USA), Andean Precious Metals has taken a significant step towards achieving its vision of becoming a multi-jurisdictional mid-tier producer in the Americas, while positioning itself for sustainable long-term growth

Aya Gold & Silver: TSX: AYA, OTCQX: AYASF

Aya Gold & Silver Inc. is a leading silver producer, uniquely positioned as the only pure silver mining company listed on the TSX, with a strong operational base in Morocco. The company has recently reported record revenues of $13.7 million in Q2 2024, reflecting a remarkable 42% increase from the previous year, showcasing its robust growth trajectory and commitment to maximizing shareholder value. With ongoing expansions at the high-grade Zgounder Silver Mine, Aya is set to increase its processing capacity to 2,700 tonnes per day in 2024, further solidifying its market presence. Additionally, Aya's strategic exploration efforts have led to significant mineral resource estimates, including a recent discovery at the Boumadine project, which highlights the company's potential for future growth and profitability. Committed to sustainability, Aya Gold & Silver integrates responsible mining practices into its operations, ensuring long-term value creation for its stakeholders

Kuya Silver: CSE: KUYA, OTCQB: KUYAF

Kuya Silver is at the forefront of silver mining with its dual-track strategy, actively mining the high potential Bethania Silver Mine in Peru and developing the historic Silver Kings Project in Ontario. With robust mining and exploration programs underway, Kuya is poised to unlock significant value from its assets. Kuya Silver's experienced management team, led by industry veterans, is dedicated to maximizing shareholder value through strategic growth and operational excellence. As the demand for silver continues to rise, Kuya Silver stands ready to capitalize on emerging opportunities in the market.

Silver Academy endorses a Junior Miner too

Summa Silver - (TSXV:SSVR) (OTCQX: SSVRF)

Summa just merged with Silver47 and have over 246,000,000 ounces of Silver (eq) in top tier jurisdictions Alaska, New Mexico, Nevada

The Red Mountain Project in Alaska alone contains 168.6 million silver-equivalent ounces, including critical metals like antimony and gallium.

The Hughes Project in Nevada boasts 45.9 million silver-equivalent ounces, with high-grade intercepts such as 3,971 grams per tonne over 2.8 meters.

The Mogollon Project in New Mexico features 32.1 million silver-equivalent ounces, with drilling results showing intercepts of 448 grams per tonne over 31 meters.

More on Summa Silver below:

Unlocking Hidden Value: Summa Silver’s Rise in a World of Overpriced Stocks

The Silver Spark: Lighting Up the Mining World

Read more : on the merger between Summa Silver and Silver47

end of segment

https://mineralwealth.substack.com/p/disclaimers-pickaxe-silver-academy