Have We Reached Peak Stupidity? The Answer is No.

Hawk tua memecoin loses investors 88% in minutes.

Hailey Welch gained fame on TikTok for her viral "Hawk Tuah" meme, where she made a distinctive spitting sound.

The 21-year-old internet personality's popularity grew rapidly, leading to the creation of her "Talk Tuah" podcast.

Capitalizing on her viral fame, Welch launched the $HAWK memecoin on the Solana blockchain in December 2024

The launch was initially successful, with the market cap soaring to nearly $500 million.

However, within 20 minutes of the launch, the value of $HAWK plummeted by 88%, crashing to only $60 million.

This sudden crash led to a "rug pull," a type of cryptocurrency scam where developers abandon a project and run away with investors' fund.

Key details of the event include:

The $HAWK team allegedly owned 97% of the available coins and sold their share within 20 minutes of the coin going live.

Some investors reported significant losses. One claimed to have lost $33,000 in just 10 minutes.

The incident is being investigated as a potential "pump and dump" scheme, where the price was artificially inflated before a mass sell-off.

At least one investor has filed a complaint with the U.S. Securities and Exchange Commission.

Crypto experts speculate that the collapse could have been caused by "sniping," where large investors acquire the majority of tokens, leaving small buyers at risk.

While the exact amount stolen is unclear, the rapid decline from $500 million to $60 million suggests a significant loss for investors. The incident has sparked outrage on social media, with many accusing Welch and her team of fraud.

The purpose of this article is to discuss one of the most serious misallocations and raise awareness of a distortion in the market that must be fixed as soon as possible.

I bet you didn't know your investments could make or break our future!

Let's dive into the absurdity of crypto and how it relates to the unseen and looming silver crisis.

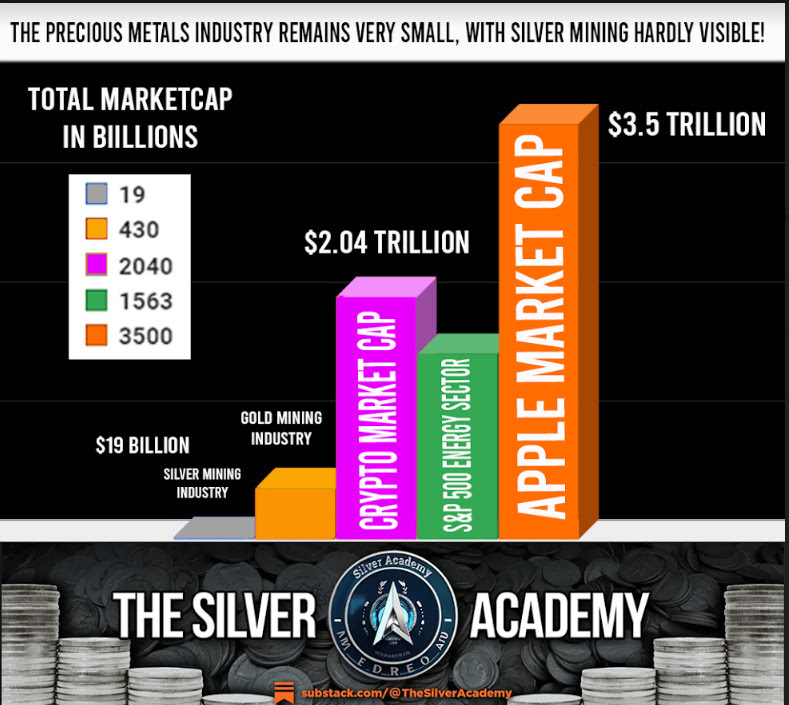

Cryptocurrencies are booming, with a market cap of two thousand and forty billion dollars.

Before we proceed with our analysis, it's vital to stress the need for caution in crypto investments. The risks are high, and it's essential to be alert and well-informed when considering these investments, to make responsible decisions.

Reason Crypto investing is HIGH RISK

crypto can be seized

This is the most laughable, pathetic and scary 7 words. Crypto has never gone through a recession

crypto can be hacked

crypto is not decentralized

crypto is not private

future wars are cyber wars which can vaporize your investment

quantum computing will make blockchain obsolete

all computing has built in obsolescence ( are we on Windows 10 or Windows 11? are we on iPhone 15 or iPhone 16, my mom has a flip phone that has better reception than my android because the antenna is like a horseshoe across the top radius)

crypto can expire

crypto can be debited when government decides you owe a fee, a fine, an IRS penalty and there is no judge, no jury, and your guilty and never found innocent

crypto is subject to human counter party

meaning that is hyped by people that hold it hoping another stupid person will fall for the pyramid scheme

the only exception would be a crypto that acts like a stable coin (gold backed or silver backed like Kinesis)

When the lights go off you have no crypto whereas gold and silver shimmer in the candlelight (or kerosene lantern)

The crypto market cap equals an insane figure of $2.4 Trillion dollars

Whereas silver mining investments are dangerously low, at just 19 billion dollars!

Please understand that this whopping disparity means that your buying Silver miners at bargain basement levels. If I were in sales I would say that everything that is not nailed down to the floor will be eliminated in this once in a lifetime sales event.

That's a 100-fold difference! Silver isn't just shiny metal; it's vital for our tech and future. It powers trains, solar panels, vehicles, the low altitude economy, the internet, phones and satellite communications.

The Samsung solid-state silver battery outlasts and outperforms lithium-ion batteries.

The Silver battery performance is superior in these 5 ways:

the normal range for lithium ion is 300 miles whereas Silver battery goes 600

the normal charging time for lithium ion is 25 minutes whereas Silver battery is 10 minutes.

the lifespan of silver battery doubles (remember the battery is the most expensive part of the electric car for obvious reasons, battery equals energy)

the weight is 40% less

better torque per drive cycle

So, why the disparity? Crypto hype, social media pumpers, YouTube celebrities promote crypto products destined for the Grave.

The companies they promote like Alex Mashinsky's Celsius disintegrate. YouTube broadcasts are chalked full of quasi experts and hype men creating a culture which siphoned investments from silver to digital currencies.

Again the absurd Crypto market cap is 100 times that of All Silver Miners Combined. Imagine an ant scaled up 100 times—it'd be the size of a large dog or small bear. A hummingbird scaled up 100 times would be the length of a city bus or whale shark.

The solution? Think critically and invest responsibly.

Silver is essential for our technology and future generations. Stay tuned for our series on the pitfalls of crypto and the importance of silver investment.

Don't let hype dictate our future; your choices matter.

Hawk Tua isn’t the first time this has happened there have been hundreds of “rug pull” cases just like it.

Here are three other examples of pump and dump schemes in cryptocurrency:

E-coin: On February 6, 2018, this little-known cryptocurrency experienced a massive price surge of 4,742% in just one day. It rapidly climbed from the bottom of the TOP-500 to the TOP-20 in terms of market capitalization. This occurred during a period when the overall cryptocurrency market was stagnant, raising suspicions about the sudden interest in an otherwise unattractive project.

U.Cash: This cryptocurrency appeared less than a month before its pump and dump event. It initially grew due to scalpers capitalizing on the hype around a new project. After a price collapse, a second wave of pumping followed, which is unusual for most projects. This pattern strongly suggests that developers implemented pump and dump tactics.

Santa Floki (HOHOHO): In late December 2021, following a tweet by Elon Musk featuring his puppy Floki in a holiday costume, this cryptocurrency experienced a staggering growth of over 5,000% in just a few hours. The coin, initially worth $0.00000065, skyrocketed and then crashed just as quickly. Within a few months, the project was completely delisted.

These examples demonstrate the common characteristics of crypto pump and dump schemes: rapid, unexplained price increases, often triggered by social media hype or misleading information, followed by swift crashes that leave most investors with significant losses.

What is the opposite of Peak Stupidity.

Peak Wisdom

Gold and silver offer stability as finite resources that can't be artificially inflated like fiat currencies. Their lack of counterparty risk and intrinsic value in over 10,000 industrial applications contribute to their enduring worth. Gold's consistent purchasing power, exemplified by its ability to exchange one gram for a barrel of oil, underscores its reliability as a store of value across time.