GUIDE TO CRISIS INVESTING & Silver Miners: Top Rated Contrarian Investment Set to Soar 10X as Markets Decline

Investors overlook silver's critical role in emerging technologies, creating a rare opportunity for savvy buyers.

The dialogue between our colleagues Nick Giambruno and Doug Casey can be reframed as an engaging and insightful interview session between two prominent financial strategists, offering actionable advice for navigating crisis investing.

Crisis Investing + Insights from Doug Casey and Nick Giambruno

Nick Giambruno: Doug, you are widely regarded as a leading authority on crisis investing. Could you share your background and approach to this unique investment strategy?

Doug Casey: Certainly, Nick. My journey began with my book "Crisis Investing" in 1979, which became a bestseller. The concept is rooted in the dual nature of crises: danger and opportunity. While most people focus on the danger, the hidden opportunities are where fortunes are made.

Crisis investing is about being a contrarian—buying when others are fearful. Markets often reach inflection points where they become either overvalued or undervalued. When a market drops by 90% or more, it’s time to evaluate whether it’s ripe for speculative investment. This approach requires courage but offers unparalleled rewards.

Principles of Crisis Investing

Buy When Blood is in the Streets:

Casey emphasized Baron Rothschild's famous adage, explaining that successful speculators capitalize on politically driven market distortions. For instance, during the collapse of the Soviet Union, Russian oligarchs acquired undervalued assets for pennies on the dollar amidst public panic.Turn Lemons into Lemonade:

Casey highlighted that speculation thrives in imperfect markets distorted by government interventions such as inflation, taxes, or war. Identifying these distortions allows investors to find high-potential opportunities with calculated risks.Risk Management:

Contrary to popular belief, Casey argued that investing during crises can be less risky because low prices reduce downside risk. He stressed that true speculative opportunities are not just high-potential but also low-risk.

Case Studies: Turning Crisis into Profit

1. Zimbabwe (formerly Rhodesia):

In 1978, amidst civil war and economic turmoil, Casey had an opportunity to purchase a luxurious castle resort for $85,000. Although he missed the deal, the property later sold for $13.5 million—a testament to identifying undervalued assets during crises.

2. Hong Kong (1986):

During fears of Chinese takeover, Casey purchased a penthouse apartment for $40,000 when prices were depressed due to public anxiety. After renovations costing an additional $40,000, he later sold it for $1.2 million—a remarkable return driven by contrarian thinking.

Tips for Aspiring Crisis Investors

Identify Undervalued Markets:

Look for markets experiencing extreme pessimism or political instability where assets are significantly undervalued.Focus on Essentials:

During crises, invest in companies providing essential goods and services or tangible assets like gold and real estate.Diversify Globally:

Explore opportunities worldwide to mitigate risks and capitalize on regional crisesBe Patient and Contrarian:

Success requires going against mass psychology—buying when others are selling out of fear.

Nick Giambruno: Doug, your experiences underscore the immense potential of crisis investing. Any final thoughts for our audience?

Doug Casey: Crisis investing is not just about financial gain; it’s about understanding market psychology and leveraging political distortions to your advantage. Remember, every crisis holds an opportunity—it’s up to you to seize it. This discussion between two financial visionaries offers timeless lessons on turning adversity into opportunity through strategic crisis investing.

Jon Forrest Little weighs in.

the ignorant masses are chasing the latest fad like zombie tech and crypto whereas the humble dude with a ball cap knows the truth about silver mining to pop 10x

Silver presents a compelling contrarian investment opportunity due to its overlooked status in the tech-obsessed financial world. While investors chase overvalued tech stocks, cryptocurrencies, and AI companies, they often ignore the fundamental role silver plays in these industries.

Silver is essential for electronics, conducting energy, solar panels, and emerging technologies, yet its price remains depressed.

This disconnect between silver's industrial importance and its current market valuation creates a unique opportunity for contrarian investors to capitalize on a potentially undervalued asset

I only endorse a very handful elite Silver miners that are pure silver mines (not silver as by product mines)

I selected our picks based on the strength of:

Their balance sheets

Their Ore grades

Their Metallurgy

Their Management talent

Their Jurisdiction.

and most importantly their volume of ounces in the ground

The Pickaxe Picks

Andean Precious Metals: TSXV: APM, OTCQX: ANPMF

The company operates the largest commercial silver oxide processing plant in Bolivia's Cerro Rico region - the San Bartolomé facility. This strategic asset has produced over 65 million ounces of silver equivalents since 2009, demonstrating Andean's significant production capabilities.

Their robust balance sheet provides the company with financial flexibility and stability in a volatile industry.

The company follows a two-pronged growth strategy, focusing on organic growth in Bolivia and expansion through mergers and acquisitions in the wider Americas. This approach positions Andean for sustainable long-term growth and diversification.

Andean has successfully extended the life of the San Bartolomé mine from eight months to potentially 10 years or more, showcasing the company's operational expertise and ability to maximize asset value.

The company is committed to sustainable mining practices and community engagement, contributing approximately $75 million annually to the local economy through wages, royalties, and taxes. This dedication to social responsibility strengthens Andean's social license to operate.

By acquiring Golden Queen Mining Company (USA), Andean Precious Metals has taken a significant step towards achieving its vision of becoming a multi-jurisdictional mid-tier producer in the Americas, while positioning itself for sustainable long-term growth.

Aya Gold & Silver: TSX: AYA, OTCQX: AYASF

Aya Gold & Silver Inc. is a leading silver producer, uniquely positioned as the only pure silver mining company listed on the TSX, with a strong operational base in Morocco. The company has recently reported record revenues of $13.7 million in Q2 2024, reflecting a remarkable 42% increase from the previous year, showcasing its robust growth trajectory and commitment to maximizing shareholder value. With ongoing expansions at the high-grade Zgounder Silver Mine, Aya is set to increase its processing capacity to 2,700 tonnes per day in 2024, further solidifying its market presence. Additionally, Aya's strategic exploration efforts have led to significant mineral resource estimates, including a recent discovery at the Boumadine project, which highlights the company's potential for future growth and profitability. Committed to sustainability, Aya Gold & Silver integrates responsible mining practices into its operations, ensuring long-term value creation for its stakeholders

*Dolly Varden Silver: TSXV: DV, OTCQX: DOLLF

Dolly Varden Silver Corporation is a leading mineral exploration company making significant strides in the heart of British Columbia's Golden Triangle, focusing on its 100% held Kitsault Valley Project. This project boasts an impressive resource estimate of 64 million ounces of silver and 1 million ounces of gold, positioning Dolly Varden as a key player in the precious metals sector. The company is committed to sustainable mining practices while leveraging its rich history, including the past-producing Dolly Varden and Torbrit silver mines, to unlock further potential in the region. With a strong management team and recent discoveries enhancing its growth prospects, Dolly Varden Silver is poised for a bright future in the booming silver market. Investors can look forward to exciting developments as Dolly Varden continues to advance its projects and expand its resource base.

Kuya Silver: CSE: KUYA, OTCQB: KUYAF

Kuya Silver is at the forefront of silver mining with its dual-track strategy, actively mining the high potential Bethania Silver Mine in Peru and developing the historic Silver Kings Project in Ontario. With robust mining and exploration programs underway, Kuya is poised to unlock significant value from its assets. Kuya Silver's experienced management team, led by industry veterans, is dedicated to maximizing shareholder value through strategic growth and operational excellence. As the demand for silver continues to rise, Kuya Silver stands ready to capitalize on emerging opportunities in the market.

Note * denotes a discovery project vs an operating mine.

We are also looking at these astounding discoveries

Summa Silver: SSVRF

Scottie Resources: SCTSF

West Red Lake Gold: RLGMF

Episode #1 of MineralWealth & Mining Masterclass, sponsored by Summa Silver, is a must-read.

Having been to their Mogollon project in SW New Mexico, I'm confident in its potential. I'm willing to bet that when all is said and done, Mogollon's mineral resource estimate will rank in the top 3 of any US Silver Discovery yet to be advanced.

The only project that could surpass Mogollon is their own Hughes project in Tonopah, a promising venture that's worth keeping an eye on.

Here it is Episode #1 , Mineral Wealth and Mining Masterclass sponsored by Summa Silver ( Ticker: SSVRF )

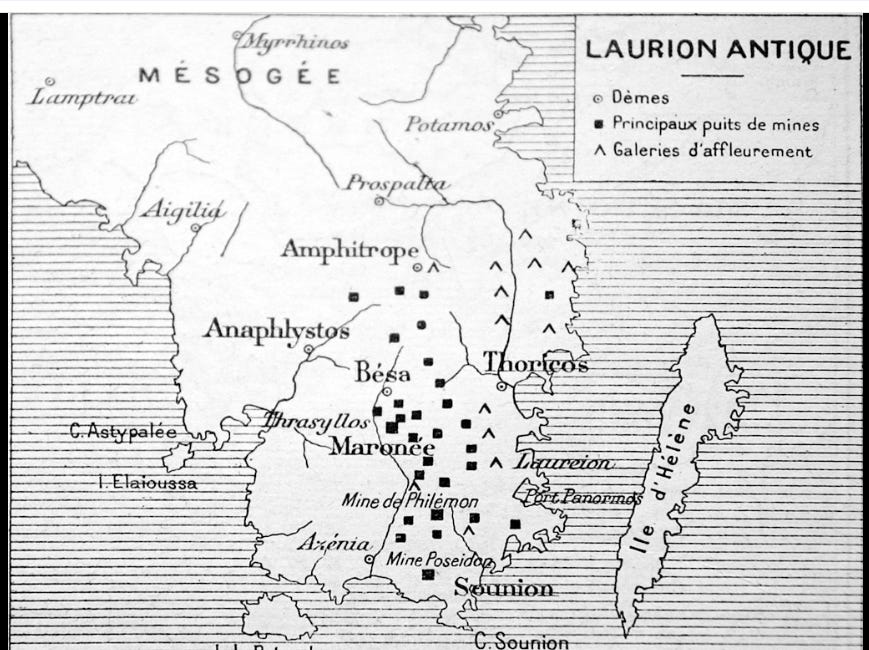

From Ore to Empire: How Laurion's Silver Shaped Athens' Architectural and Naval Power

Introducing the Mineral Wealth & Mining Masterclass