Government Policies Driving Unprecedented Silver Consumption. Shortage Looms as Industries Compete for Scarce Supply

More Evidence Indicating We will Run out of Silver by 2025

The question you should ask yourself is simple.

If you knew that if you bought 100 ounces of Silver meant that The Government will set up a whopping 10 X investment environment (to back you 10X would you do it?)

Then continue reading.

We have been tracking the substantial industrial demand for Silver over the past 50 years, and we see a promising future demand. The order of importance is as follows:

1. Military use (bombs, shells, missiles, torpedoes, fighter jets, tanks, electronics, computers)

2. Aerospace (space stations, spacecraft, satellites, rockets)

3. Solar (move on that below)

4. Electric cars and trains (Samsung's new Silver solid-state battery is projected to use 1 kilogram of Silver per car)

5. Hydrogen fuel cell energy (Silver is a cheaper catalyst than platinum)

6. AI

7. Robotics

Now, what do you notice about all of these silver uses?

They are mostly:

Driven by public funding, such as in the military and most aerospace projects, Silver plays a crucial role in these sectors.

Public energy infrastructure projects (like solar initiatives and electric trains)

Or part of a subsidy/tax incentive package. (read below the staggering incentives and how all these incentives promote massive silver use)

The numbers are staggering if you consider:

1.) Solar and wind have overtaken fossil fuels on the EU power grid.

2.) BRIC ++ states are quickly moving in this direction too

3.) As are UAE, Dubai, Qatar, Saudi Arabia (Arab World)

4.) A fully decarbonized global energy system by 2050 could come with a $215 trillion price tag - source https://about.bnef.com/new-energy-outlook/

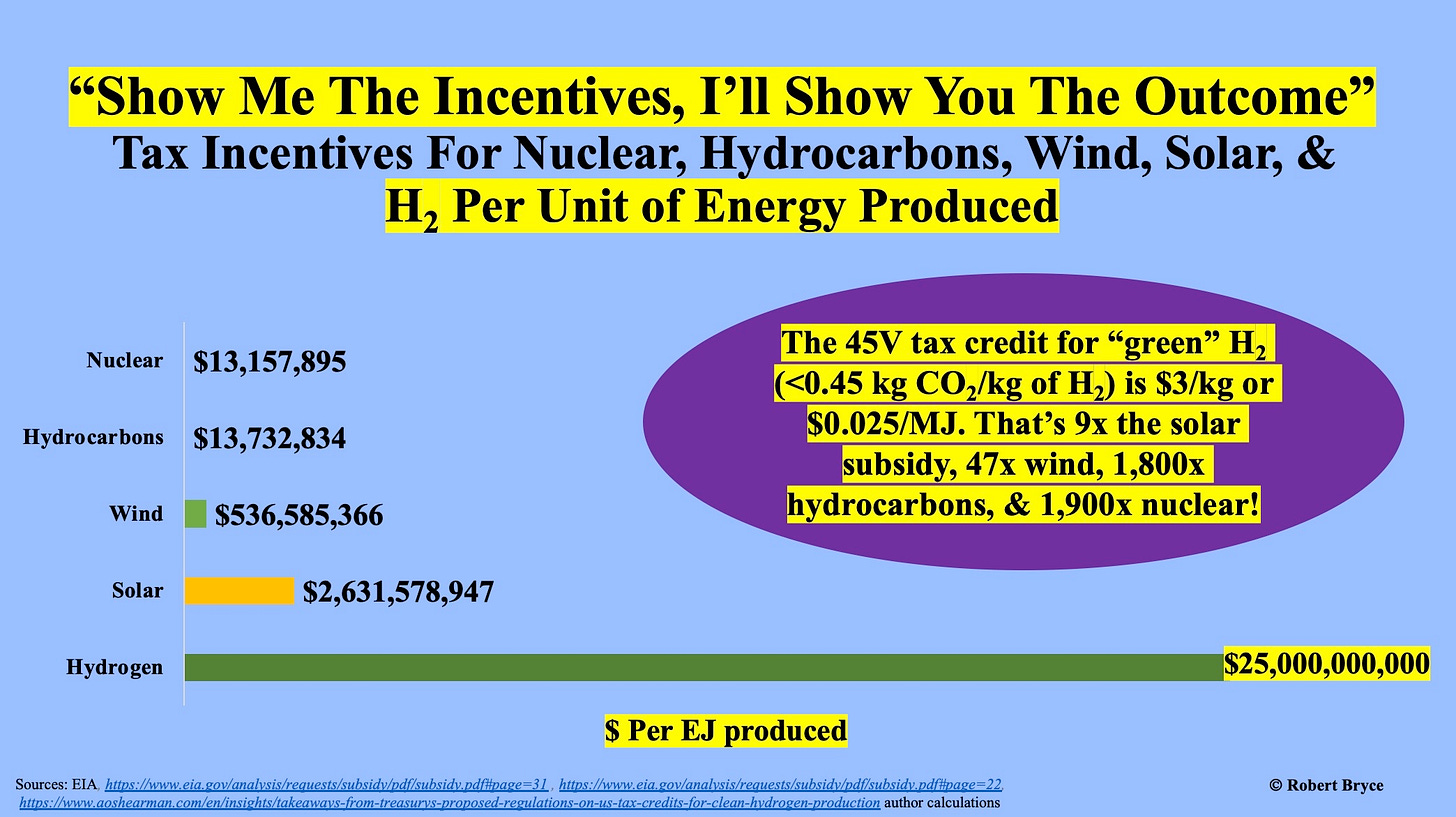

5.) Solar Is Getting 302 Times More In Federal Subsidies Than Nuclear

6.) “Green” Hydrogen Subsidies Are 1,900x Larger Than What's Given To Nuclear

In 2022, about 12 gigawatts of utility-scale solar capacity was installed in the U.S., according to the Solar Energy Industries Association — but 358 gigawatts of new solar capacity is expected to be deployed between 2023 and 2030, driven by the incentives in the Inflation Reduction Act, according to the latest New Energy Outlook from BloombergNEF.

Important, the old standard of 1 gigawatt = 500,000 ounces of Silver has been adjusted upward to 700,000 ounces of Silver (increasing the silver loading is more efficient when doing the net cost- benefit analysis of labor and materials per energy return)

To calculate the amount of silver required for solar installations, we can use the information that each gigawatt (GW) of solar panel capacity requires about 700,000 troy ounces of silver. Based on this, we can construct the following table:

For 12 GW in 2022: 12×700,000=8,400,00012×700,000=8,400,000 ounces of silver.

For 358 GW from 2022 to 2030: 358×700,000=250,600,000 ounces of silver.

Hitting the Silver Trifecta.

Use Silver powered robots to install Silver Intensive solar panels to power Silver Consuming AI data centers

Silver, a versatile element, proves instrumental in various technological advancements. In robotics, its physical properties and electrical conductivity make it ideal for wiring and ensuring efficient energy transfer.

Within the solar power sector, silver is a crucial component of photovoltaic cells, enhancing their efficiency in converting sunlight into electricity. Additionally, AI data centers rely on silver's high thermal conductivity to manage the immense heat generated by powerful processors.

Therefore, employing robotics for labor in solar farm installations, which inherently involves silver-dependent technologies, can be likened to achieving a "silver trifecta."

“If we’re going to build 100 gigawatts of solar a year, we just don’t have enough humans or time to get that done,” said Gregg Wallace, a partner at venture capital firm Building Ventures. “We need superhuman speed, but there are simply not enough workers for the level of renewable energy buildout we need to meet our own promised goals and to keep up with China,” he said.

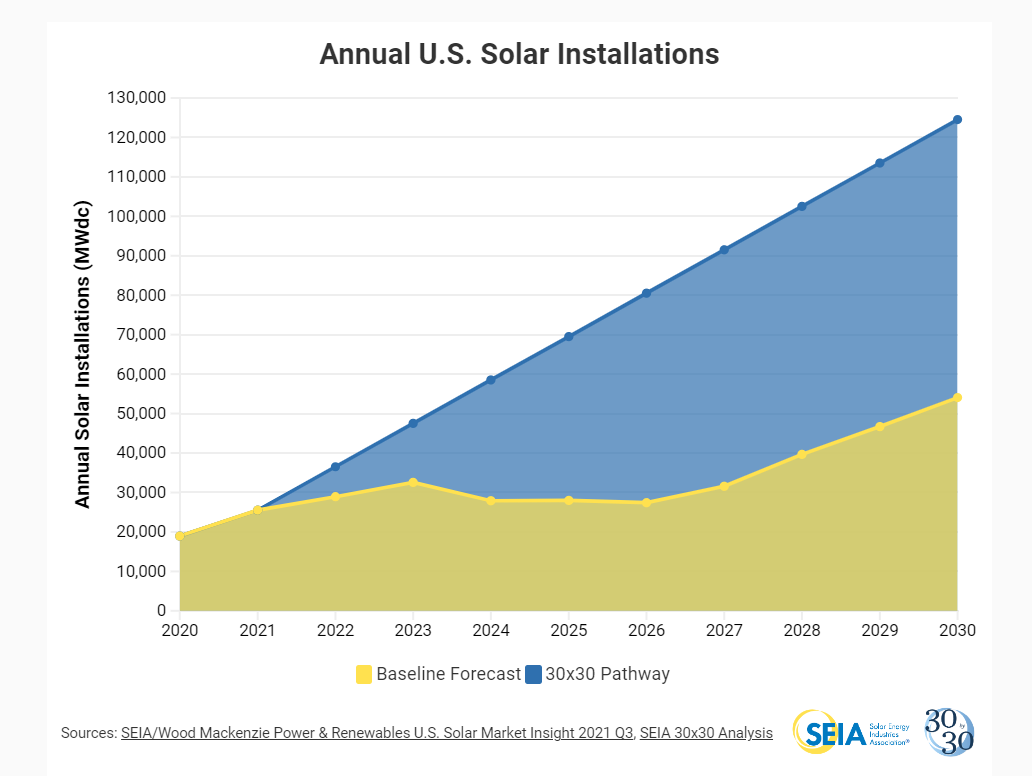

Reaching 30% of generation means that in 2030, the U.S. solar industry will:

install nearly 125 gigawatts (GWdc) annually – up from 19 GWdc in 2020

have built nearly 850 GWdc of total capacity – up from 95 GWdc at the end of 2020

inject more than $120 billion into the economy annually – up from $25 billion in 2020

employ more than 1 million Americans – up from 230,000 in 2020

offset nearly 700 million metric tons (MMT) of CO2 annually – up from 100 MMT in 2020

Solar installations need to ramp up quickly to stay on track and tackle climate change.

To reach 30% of generation and stay on track to decarbonize the electricity grid, average solar installations must increase from roughly 30 GWdc over the next decade to more than 48 GWdc

In other words, annual solar installations must increase by 60% above current forecasts between 2022 – 2030 to reach the Biden administration’s long-term climate goals

Delaying progress toward that goal, either through congressional inaction, trade disruption or other barriers will have serious climate consequences

Remaining on a business-as-usual path for just 3 years would cost the U.S. 417 million metric tons of CO2 emissions – the equivalent of keeping 11 coal-fired power plants online from 2020 – 2030

To catch up after a 3-year delay would require a staggering 436 GWdc of total installations between 2028 – 2030

Massive Deployment Needed to Reach 30%

To account for 30% of all electricity generation in the U.S., the solar industry will need to deploy more than 700 GWdc over the next decade to reach nearly 850 GWdc of total installed capacity. Over the 9-year period between 2022 – 2030, total solar installations must increase by nearly 130% beyond the baseline forecast from the most recent U.S. Solar Market Insight report.

sources:

https://www.seia.org/research-resources/30-2030-new-target-solar-decade

https://www.linkedin.com/pulse/surging-solar-panel-installations-draining-global-silver-g3wgc

https://www.wsj.com/articles/the-global-solar-power-boom-is-driving-a-surge-in-silver-demand-4ac20435

https://payneinstitute.mines.edu/solar-surge-puts-pressure-on-silver-supply/

https://boabmetals.com/blog/solar-energy-powering-silver-demand/

https://sprott.com/insights/sprott-energy-transition-monthly-silver-demand-grows-as-solar-leads-renewables/

https://carboncredits.com/silver-lining-soaring-demand-outstrips-supply-pushing-prices-higher-solar-energy/

https://www.imf.org/en/Blogs/Articles/2021/12/08/metals-demand-from-energy-transition-may-top-current-global-supply

https://onlinelibrary.wiley.com/doi/full/10.1002/pip.3661

https://www.cbsnews.com/newyork/news/silver-could-be-the-new-oil-noble-gold-investments-sponsored/

Sounds like stackers need to ramp up their games, then, especially at today’s ridiculously low prices!