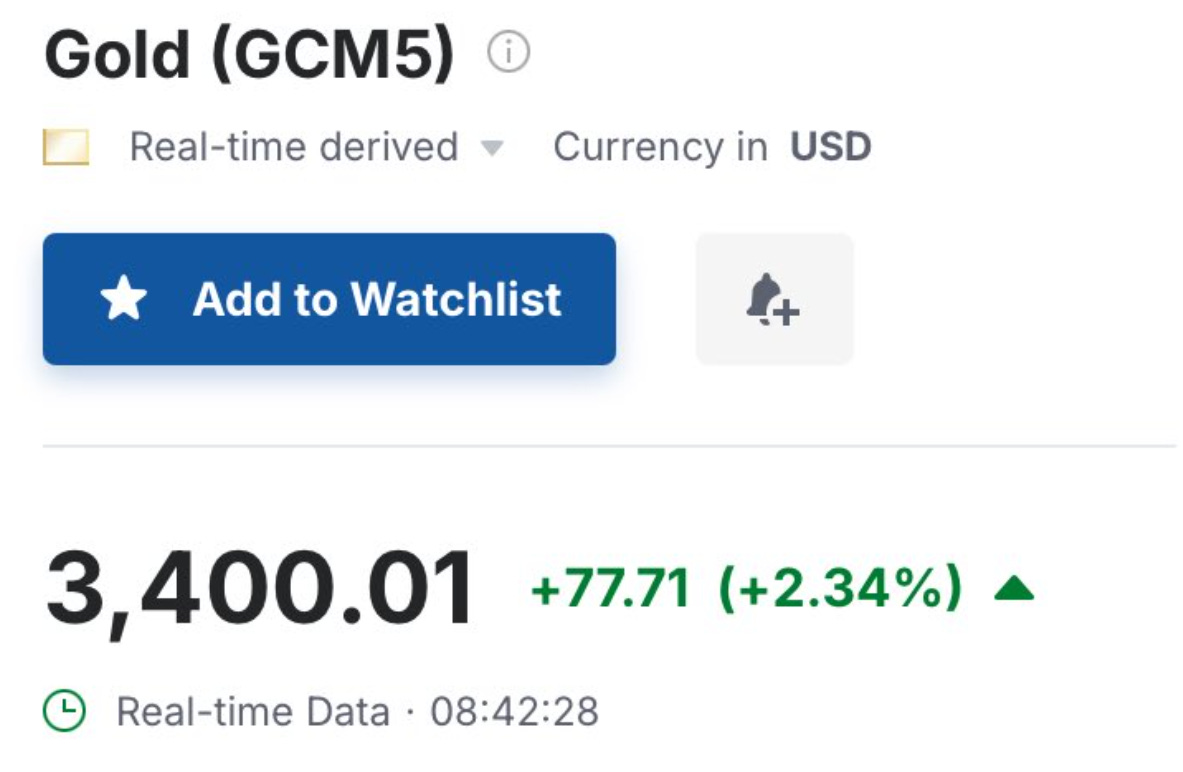

Gold Tops $3,400. Silver up 2.7%: US trade balance falls to -$140.5 billion

The worst month in history

Gold has become the world’s most coveted refuge, and its meteoric rise in 2025 is rewriting the rules of global finance. As the S&P 500 rebounds-up 17% from its April lows-gold is surging even faster, now trading above $3,394 per ounce, notching a 119% gain since 2020 and outpacing the S&P 500 by a staggering 35 percentage points in that period. Silver, too, is catching a bid, up 12% in 2025 and trading at $32.40 per ounce, as investors rediscover the “poor man’s gold.”

But why is this happening now?

Gold: The Ultimate Safe Haven in a World on Edge

Why is gold outpacing stocks even as the S&P 500 rallies?

The answer is uncertainty-uncertainty over tariffs, over the erratic direction of U.S. policy, over the lack of foreign buyers for U.S. Treasuries, and over the very stability of the global financial order. The surge in gold is not just a story of U.S. investors hedging against inflation or volatility. It’s a global phenomenon, powered by relentless central bank buying, especially from China, which has added hundreds of tons to its reserves as part of a broader push to reduce reliance on the U.S. dollar.

But here’s what’s really interesting:

China now controls 40% of global gold open interest, and its trading activity in the illiquid Asian sessions has triggered some of the most dramatic price moves in recent memory. When China raised margin requirements at the Shanghai Futures Exchange, gold prices tumbled $300-only for physical buyers to swoop in, snapping up bullion at a discount before the market rebounded. The Shanghai Gold Exchange is now expanding its warehouse network to Hong Kong, a move that will further internationalize China’s influence and the yuan’s role in global gold pricing.

So, what about silver?

Silver: The Forgotten Contender

Can it really keep up with gold’s breakneck pace?

While gold grabs headlines, silver is quietly staging its own comeback. Its dual role as both a monetary and industrial metal means it is uniquely positioned to benefit from both safe-haven flows and the ongoing demand from green technologies. Goldman Sachs notes that while gold will likely continue to outperform, silver’s strong correlation with gold means any renewed surge in gold demand will lift silver as well.

Let’s dig a little deeper.

Tariffs, Tumult, and the Flight to Safety

How are global politics and tariffs reshaping the precious metals landscape?

President Trump’s unpredictable tariff policies have sent shockwaves through global markets, driving investors out of risk assets and into the safety of bullion. Trump even spent a day discussing tariffs on foreign films. In a couple of weeks the classic rock band AC/DC (from Australia) is playing Pittsburgh’s Football stadium for two days. Is Trump going to put tariffs on foreign musicians, actors, plays, ballet performances, theatre, art too.

Every new threat of a trade war, every hint of a deal, and every ambiguous statement from Washington or Beijing is met with a surge of volatility. The S&P 500 to gold ratio-a key recession indicator-has fallen 23% in the past year, the steepest drop since the COVID-19 crash, flashing a warning sign for the U.S. economy.

Below is an example why the World and why you should be scared to death of US President, US Treasury, Federal Reserve (and the only thing backing the dollar, US Military)

A reporter asks a very simple question

“China continues to say that China and USA are not engaged in any consultation or negotiation on tariffs. Can you clarify is the administration talking to Beijing specifically about tariffs or not?

US Treasury Scott Bessent replies: “We’re not going to talk about who is talking to whom”

No wonder gold is going ballistic. Recall the headline I wrote “Gold drops like a rock when people trust the system, it soars to the moon when they don’t”

Here is the exchange. The Trump administration is intentionally breaking things and our livelihoods hang in the balance.

But here’s a plot twist:

Stocks vs. Gold

Why are stocks and gold telling two completely different stories right now?

Equity markets are rallying on sentiment and hope-hopes for trade deals, hopes for Fed rate cuts, hopes that the worst is over. But gold is rallying on something more concrete: the hard reality of risk, distrust, and the search for real value in a world where paper promises are increasingly suspect. “Gold appears poised for what can only be termed another remarkable year,” says analyst Ross Norman, noting that current demand is driven by price strength, creating a self-reinforcing cycle.

Now, here’s the trillion-dollar question:

What Happens If China Goes All-In?

What could happen if China decides to back the yuan with gold?

As China expands its gold infrastructure and central banks keep buying, the stakes are rising. If China were to make the yuan the world’s gold-backed reserve currency, could the U.S. dollar survive such a tectonic shift? And how high could gold-and silver-go if the world’s largest economies abandon paper for metal?

In a world where uncertainty is the only certainty, gold and silver are not just safe havens-they are the last line of defense. Are you prepared for the next move in this global chess match?

While President Trump floats ideas like reopening Alcatraz and slapping 100% tariffs on foreign films, the U.S. is witnessing a leader who, in just the past three business days, has joked about wanting to be Pope and faced open questions about his mental capacity from world leaders and mental health experts. In this climate of political spectacle and deepening uncertainty, gold and silver are thriving. Investors are flocking to these safe-haven assets, driving gold to fresh highs, as the chaos in Washington only strengthens their appeal

It’s not too late to get in on life changing wealth.

Retail sentiment has not even kicked in yet

US mint coin sales for April are in.

The gold bull market has yet to begin.