Gold Surges Past Euro as Top Reserve Asset—We are Witnessing the Start of a Global Currency Meltdown

Gold Just Toppled the Euro—Is the Dollar Next to Collapse? The Shocking Truth Behind the Global Financial Earthquake

special report by Jon Little intern Mr. Carmine Lombardi

Gold Dethrones the Euro: The Dawn of a New Monetary Era

For centuries, gold has shimmered at the heart of human commerce—from the pharaohs of Egypt to the vaults of modern central banks. Its luster as a store of value, a unit of account, and a medium of exchange has survived the rise and fall of empires, the tumult of wars, and the collapse of currencies. Now, as the world teeters on the precipice of a new financial epoch, gold has reclaimed its throne, overtaking the euro as the second-most important global reserve asset, according to the European Central Bank. The implications are seismic: we are witnessing not just a shift in asset allocation, but a profound transformation in the architecture of global trust.

But how did we get here—and what does this mean for the future of money?

A Historical Crossroads

The modern era of gold as a reserve asset began with the gold standard, which allowed nations to convert paper money into bullion at fixed rates. England led the charge in 1821, and by the early 20th century, most developed countries had followed suit. Yet, the gold standard crumbled under the weight of world wars and economic crises, and by 1971, the United States unilaterally severed the dollar’s link to gold, ushering in an era of fiat currencies and floating exchange rates. For decades, gold languished in the shadows, its role diminished—until now.

Is history repeating itself, or is this something new?

The Flight to Gold

In 2024, gold’s share of global official reserves surged to 20%, eclipsing the euro’s 16% and trailing only the dollar’s 46%. This reversal wasn’t accidental. Central banks—led by heavyweights like China, India, Turkey, and Poland—have been on a historic buying spree, snapping up over 1,000 tons of gold annually for three consecutive years. The motivations are clear: diversification, inflation hedging, and, most critically, a loss of faith in the stability of traditional reserve currencies.

Why are central banks suddenly so eager to hoard gold?

The Collapse of Confidence

The answer lies in the crumbling edifice of the U.S. financial system. The dollar, once the bedrock of global finance, is under siege. U.S. Treasuries—long considered the world’s safest investment—are wobbling under the weight of $36.56 trillion in national debt, with interest payments set to surpass military spending in 2025. JPMorgan Chase CEO Jamie Dimon warns of a looming “crack” in the bond market, a crack that could shatter the retirement dreams of millions and send shockwaves through the global economy.

Are U.S. assets still the safe haven they once were?

Banking on the Brink

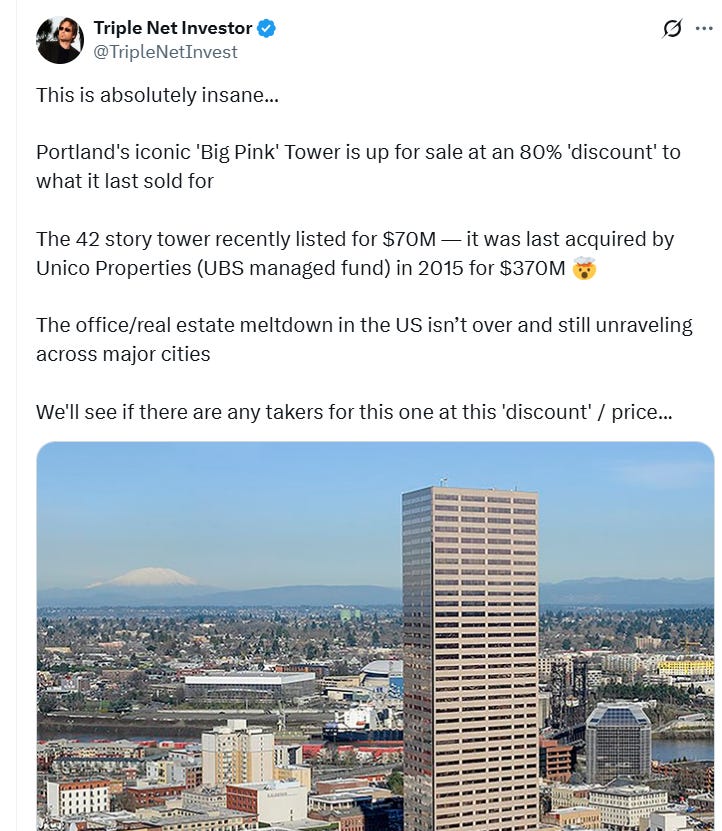

The rot doesn’t stop at the Treasury market. U.S. banks are hemorrhaging money, with more than 235 institutions reporting losses in at least four of the last eight quarters. The commercial real estate sector is in freefall, with iconic skyscrapers like Portland’s “Big Pink” selling at 80% discounts and an estimated $950 billion in commercial mortgages set to mature in the next year at a much higher rate than was priced in by the owner groups. The office market meltdown is far from over, and the contagion is spreading across 95% of U.S. cities.

What happens when the banks and the buildings both crumble?

Silver: The Unsung Hedge

Amid this turmoil, silver is emerging as a critical hedge against inflation and currency debasement. While gold grabs the headlines, silver’s dual role as an industrial metal and a monetary asset makes it uniquely resilient. Surging demand from green technologies, coupled with stagnant supply, is driving prices higher. The gold-silver ratio remains historically elevated, signaling that silver may be undervalued relative to gold—and poised for a breakout.

Is silver the overlooked linchpin in the new era of monetary uncertainty?

A Sovereign Debt Crisis in the Making

The United States is barreling toward a sovereign debt crisis, with projections that extending recent tax cuts could add $37 trillion to the national debt by 2054. The fiscal recklessness is not unique to America—governments worldwide are buried in debt, eroding the credibility of fiat currencies and fueling the rush to precious metals.

Will the world find a new anchor for trust, or will the chaos deepen?

The New Era

The ECB’s announcement is more than a footnote in financial history—it is a thunderclap signaling the end of an era and the birth of a new monetary order. As central banks stockpile gold, as Treasuries lose their luster, as banks falter, and as real estate crumbles, the world is searching for stability. Gold and silver are not just commodities; they are the barometers of trust in a system that is rapidly losing its moorings.

What will it take to restore confidence—and who will lead the way?

If Central Banks see the Writing on the Wall SO SHOULD US ALL

Flock to Silver because it’s Gold to Silver Ratio is narrowing.

Between each seismic shift in this unfolding crisis, one question lingers: Are we prepared for what comes next? The flight to gold is not just a market trend; it is a referendum on the future of money itself. As the world watches the dollar stumble, as banks and real estate buckle, and as silver quietly asserts its value, the only certainty is uncertainty.

Will you be ready when the dust settles—or will you be left holding paper in a world that demands something real?

Silver Miners poised to explode starting now

CALL TO ACTION

Silver & Gold: The People’s Armor Against Engineered Collapse

When empires crumble and currencies evaporate, silver and gold remain. These metals are not investments—they are time-tested guardians of human labor, outlasting every fiat experiment, political regime, and central bank scheme. While digital tokens and paper promises dissolve in the fires of engineered crises, physical precious metals persist. They cannot be devalued by keystrokes, inflated into oblivion, or confiscated through digital surveillance.

History’s lesson is clear: Gold survived the fall of Rome, the collapse of Weimar Germany, and the 2008 financial crash. Silver anchored trade through revolutions and famines when trust in rulers evaporated. Today’s ruling class fears these metals precisely because they exist outside the Babylon system’s control. Every ETF, crypto coin, or Treasury bond is ultimately a derivative—a fragile IOU tethered to the same corrupt institutions orchestrating economic warfare against the masses.

Workers and villagers must reclaim sovereignty by holding tangible wealth. Central banks hoard gold for a reason—it is the ultimate collateral in a collapsing world. To store silver is to reject leveraged illusions. To own gold is to armor oneself against coercion. While the Fed plays God with digits, real power lies in what endures: the people’s money, forged by Earth, not elites.

end of segment

Call to Action

Stack physical Silver (remember that the average American can not afford a set of tires)

We recommend a minimum of 500 ounces of silver that you hold

We recommend buying 10,000 to 20,000 in these 3 Silver mining equities and each time there is a dip accumulate more.

For leverage exposure to silver we endorse these 3 miners

3 Silver miners that are pure silver mines (not silver as by product mines)

All 3 of these picks are in production right now

We have selected our picks based on the strength of:

Their balance sheets

Their Ore grades

Their Metallurgy

Their Management talent

Their Jurisdiction.

and most importantly their volume of ounces in the ground

Silver Academy’s top 3 picks

Andean Precious Metals: TSXV: APM, OTCQX: ANPMF

The company operates the largest commercial silver oxide processing plant in Bolivia's Cerro Rico region - the San Bartolomé facility. This strategic asset has produced over 65 million ounces of silver equivalents since 2009, demonstrating Andean's significant production capabilities.

Their robust balance sheet provides the company with financial flexibility and stability in a volatile industry.

The company follows a two-pronged growth strategy, focusing on organic growth in Bolivia and expansion through mergers and acquisitions in the wider Americas. This approach positions Andean for sustainable long-term growth and diversification.

Andean has successfully extended the life of the San Bartolomé mine from eight months to potentially 10 years or more, showcasing the company's operational expertise and ability to maximize asset value.

The company is committed to sustainable mining practices and community engagement, contributing approximately $75 million annually to the local economy through wages, royalties, and taxes. This dedication to social responsibility strengthens Andean's social license to operate.

By acquiring Golden Queen Mining Company (USA), Andean Precious Metals has taken a significant step towards achieving its vision of becoming a multi-jurisdictional mid-tier producer in the Americas, while positioning itself for sustainable long-term growth

Aya Gold & Silver: TSX: AYA, OTCQX: AYASF

Aya Gold & Silver Inc. is a leading silver producer, uniquely positioned as the only pure silver mining company listed on the TSX, with a strong operational base in Morocco. The company has recently reported record revenues of $13.7 million in Q2 2024, reflecting a remarkable 42% increase from the previous year, showcasing its robust growth trajectory and commitment to maximizing shareholder value. With ongoing expansions at the high-grade Zgounder Silver Mine, Aya is set to increase its processing capacity to 2,700 tonnes per day in 2024, further solidifying its market presence. Additionally, Aya's strategic exploration efforts have led to significant mineral resource estimates, including a recent discovery at the Boumadine project, which highlights the company's potential for future growth and profitability. Committed to sustainability, Aya Gold & Silver integrates responsible mining practices into its operations, ensuring long-term value creation for its stakeholders

Kuya Silver: CSE: KUYA, OTCQB: KUYAF

Kuya Silver is at the forefront of silver mining with its dual-track strategy, actively mining the high potential Bethania Silver Mine in Peru and developing the historic Silver Kings Project in Ontario. With robust mining and exploration programs underway, Kuya is poised to unlock significant value from its assets. Kuya Silver's experienced management team, led by industry veterans, is dedicated to maximizing shareholder value through strategic growth and operational excellence. As the demand for silver continues to rise, Kuya Silver stands ready to capitalize on emerging opportunities in the market.

btw, notice then we write about silver we can do so without mentioning the word solar (sure solar is a user of silver but so is 20,000 other applications including robotics, aerospace and military)

Recall that nations like UK are now requiring Solar panels on all new builds.

Silver goes on its big runs when it is used monetarily (not just industrially) and I will explain this greater in detail over the next 3 months

end of segment

our opinions are not our sponsors opinions

editorial department is separate from promotions department

not financial advice

Buy physical Silver

Buy our 3 picks, Silver miners