Gold Rush at the Fed: Expanding Vaults to Counter BRICS 40% Gold Currency Move. $420 Silver per ounce by 2026 very likely.

Fed's $2.5B Renovation: Gold Vaults Grow as BRICS Pay Emerges

In Jaws, the unforgettable line "You're going to need a bigger boat" is delivered by Chief Brody during a scene that captures the film's tension.

After a harrowing encounter with the great white shark, Brody, (visibly shaken) and glances at the small fishing vessel. The stark contrast between the shark's size and their inadequate boat underscores the gravity of their situation.

Hong Kong airport to boost gold vault capacity to 1,000 tonnes

Hong Kong's Airport Authority is planning a significant expansion of its gold vault capacity, increasing it from 150 tonnes to 1,000 tonnes.

This move aims to bolster Hong Kong's position as a global trading hub for precious metals, particularly in response to growing competition from Singapore.

The expansion comes as the current facility is reaching full capacity due to increasing demand.

Initially, the capacity will be increased to 200 tonnes, with further expansions planned to reach the 1,000-tonne target.

This development is crucial for Hong Kong's gold trading industry, which has a century-long history but has experienced a slowdown in recent decades.

In contrast, Singapore has recently upped its game with a new six-storey vault near Changi Airport, capable of storing 500 tonnes of gold and 10,000 tonnes of silver.

This competitive pressure likely influenced Hong Kong's decision to expand its facilities.

Speculation on Federal Reserve Renovations

The Federal Reserve's $2.5 Billion Renovation: Just One Day's Interest on the $36 Trillion National Debt

Disclaimer: My opinions are not “necessarily” the opinions of our sponsors

The recent $2.5 billion renovation of the Federal Reserve might involves expanding gold storage capabilities. This speculation aligns with the thesis that BRICS nations are accumulating gold, potentially forcing the US to back its treasuries with gold to address the debt crisis.

The Gold-Backed Treasury Theory

Economists like Judy Shelton, Luke Gromen, and Jim Rickards have posited that backing US treasuries with gold could be a solution to the debt crisis. This theory gains traction as BRICS nations increase their gold reserves, potentially challenging the US dollar's global dominance.

If true, the Federal Reserve's renovations could be part of a larger strategy to prepare for a potential shift in global monetary policy. Increased gold storage capacity would be crucial if the US decides to partially or fully back its currency or debt with gold.

This global trend of expanding gold storage facilities, from Hong Kong to potentially the Federal Reserve, might indicate a shifting perspective on gold's role in the international monetary system.

As geopolitical tensions rise and economic uncertainties persist, gold's importance as a safe-haven asset and potential monetary anchor seems to be growing.

Jim Rickards, Luke Gromen and Judy Shelton perspectives

Rickards and Gromen arrive at their gold price projections using similar methodologies, but with different assumptions about money supply and gold backing ratios.

Rickards uses the U.S. M1 money supply of $17.9 trillion and assumes a 40% gold backing. He divides 40% of the money supply resulting in $27,533 per ounce.

Gromen's higher estimate of $40,000 per ounce likely stems from using a different money supply figure (possibly M2 or M3) or assuming a higher gold backing percentage.

The principle remains the same: dividing a portion of the money supply by the available gold reserves.

Both analysts emphasize that these projections are based on the potential need to restore confidence in the monetary system through partial gold backing of the currency.

Revaluing gold at a significantly higher price could potentially address the $35 trillion debt crisis in several ways. By increasing the value of the U.S. Treasury's gold reserves to, say, $20,000 per ounce, the government could create trillions of dollars in new assets without increasing the money supply.

This newfound wealth could be used to buy back a substantial portion of outstanding U.S. debt, effectively reducing the debt-to-GDP ratio. The process would involve adjusting the Gold Certificate Account held by the Federal Reserve, allowing the Treasury to monetize the revalued gold and use the proceeds to pay down debt. This strategy, while complex, could provide a path to debt reduction without relying on traditional methods like tax increases or spending cuts, potentially offering a unique solution to the current fiscal challenges.

Judy Shelton, a long-time advocate for returning to a gold standard, could play a significant role in a potential future Trump presidency. Despite her previous unsuccessful nomination to the Federal Reserve Board, Shelton's economic views align closely with Trump's criticism of current monetary policies.

If appointed to a key position, she might push for backing U.S. Treasuries with gold as a method to address the debt crisis.

Shelton's approach would likely involve gradually increasing the gold backing of U.S. Treasuries. This could start with a small percentage and incrementally increase over time. The process might involve auditing and potentially expanding U.S. gold reserves, as well as establishing a fixed exchange rate between gold and the dollar. Shelton argues that this would restore fiscal discipline, stabilize the dollar, and increase confidence in U.S. debt instruments.

However, implementing such a policy would be complex and controversial, potentially requiring significant changes to the current monetary system and facing resistance from many economists and policymakers.

Gold to Silver Ratio breaking down (in silver’s favor)

chart by Tim Hack (who is not a hack analyst)

https://x.com/realTimHack/status/1849290534268907666

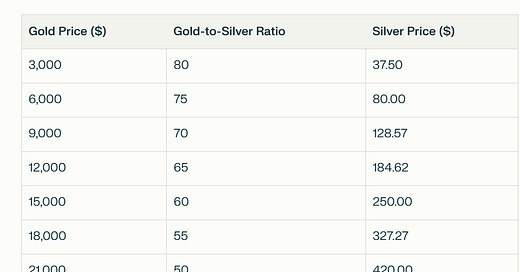

$420 Silver per ounce by 2026 is in play

Silver TA analyst Tim Hack (who is not a hack) documenting Silver’s 31X move to the upside

These numbers are quite conservative because we still have not priced in:

Market

crashcorrectionCommercial Real Estate failure event

Debt crisis

Energy Crisis

CBDC panic , another gold rush

harbinger, catalyst, impetus,signpost