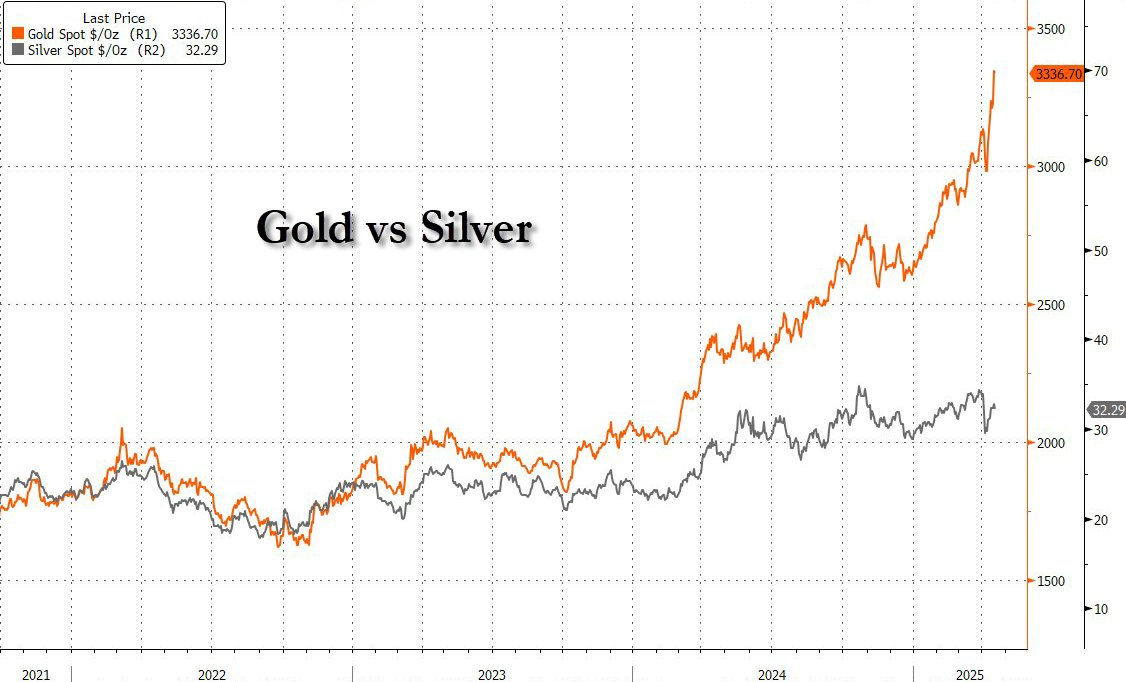

The Market’s Loudest Divergences: Gold vs Crude and Gold vs Silver.

Gold is screaming. Silver is whispering. Oil is languishing. Why does this matter—and what could snap the gap shut?

Let’s start with the numbers. As of April 2025, one ounce of gold buys more than 50 barrels of Brent crude—a ratio reached only four times in 45 years. Gold has ripped to record highs above $3,430 per ounce, while Brent languishes near $67, barely off multi-year lows. In a single chart, you see fear at full price in bullion and almost no risk premium in crude.

But why such a historic divergence? And what geopolitical currents are swirling beneath the surface?

How Did We Get Here?

When the US froze Russian assets and banned them from SWIFT in 2022, the world’s central banks got the message: dollar reserves could be weaponized. Russia, along with China, India, and other BRICS nations, began ramping up gold reserves, seeking an “asset no one can freeze” and experimenting with gold-for-oil trade to bypass sanctions. The result? BRICS+ now controls 42% of global FX reserves and is actively pursuing de-dollarization, with gold as the preferred escape hatch.

So, is this just a story of gold’s rise? Not quite. Oil has its own tale.

Why Is Oil So Cheap?

Oil’s weakness isn’t just about sluggish demand. Yes, the IEA cut demand growth forecasts, and US production is at record highs—over 13.6 million barrels per day. But the real kicker? Managed money is barely interested: CFTC data shows WTI net longs at just 10% of their long-run average, while gold longs are near the 88th percentile. The US Strategic Petroleum Reserve, meant for emergencies, sits at 40-year lows after being drained for political reasons, yet the Department of Energy has standing bids near $70, putting a soft floor under crude.

So, what’s different this time? And what could trigger a snap-back?

Will the Gap Close? And How?

Every historic spike in the gold:oil ratio—1986 glut, 1998 Asia crisis, 2008 GFC, 2020 COVID—mean-reverted by at least 40% within a year. The ratio is a compressed macro spread: a “risk-off” liquidity bid for gold versus “real-economy” energy demand for oil. When the spread gets this wide, it rarely sits still for long.

But here’s the bucket brigade: What if BRICS keeps buying gold? What if oil demand surprises on the upside as Asia reopens and supply risks return? What if the US election injects new volatility into both markets? And what if the next geopolitical shock hits a world with thin oil inventories and crowded gold trades?

What Should Investors Listen For?

Central bank gold buying: Still surging, especially from China, India, Russia, Poland, Turkey and others

More Dumping of US Treasuries then a Fed Pivot as Trump’s tantrums will prevail over an unpopular Jerome Powell.

Physical oil market tightness: Inventories are thin, and any supply shock could send crude spiking.

Geopolitical flashpoints: Russia, Iran, and US-China tensions are all wildcards.

Energy equities: Pricing in recession, yet offering double-digit free cash flow yields at $60 oil—a disconnect the forward curve doesn’t fully show.

Don’t Forget Silver—and Oil

As much as gold’s story captivates, its “little sister” silver and even oil itself may offer asymmetric opportunities if the pendulum swings back. History says it will.

So, is this divergence a warning shot or a generational opportunity? Either way, the market’s loudest divergence is telling us to listen—because when extremes like this snap back, they rarely do so quietly

Silver to Close the Gap

A bullion bank or a member of one of the other groups involved are extremely alarmed at this moment.

Inevitably, one entity (player in the silver manipulation scheme) will attempt to reduce its short positions first, thereby exposing the others, without realizing that it is already too late to avoid significant consequences.

Ultimately, all shorts will be affected. It would be prudent to prepare for considerable market volatility, as a major movement appears imminent.

The #silversqueeze is beginning, and it seems unstoppable at this point.

end of segment

our opinions are not our sponsors

editorial is separate from promotions

not financial advice