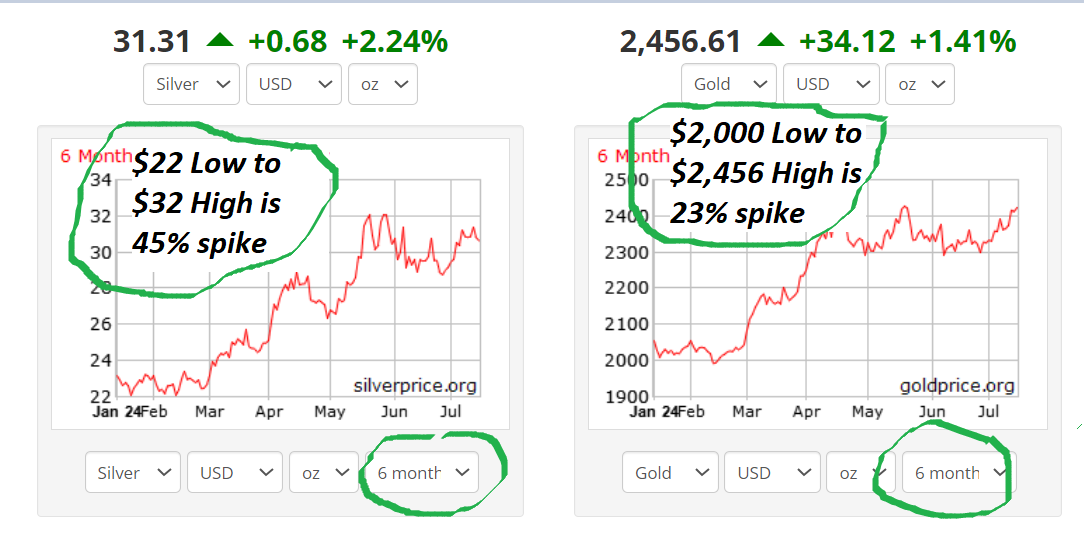

Gold Hits All Time High. Silver up 45% in only 6 Months.

Mr. Market Believes BRICS and Trump are Going with a Hybrid Gold Standard

Mr. Market is Pricing this in

Contents: The Next 5 Years

Abstract: It’s All One Thing by Vince Lanci of GoldFix

The Currency

The Unit and Technology

The BiS Role

The G7 Problem, Solved With Gold and Silver

The Store of Value

The BRICS Challenge to U.S. Dollar Hegemony

The Three Phase Plan

The End of Dollar Dependency

The National Approach to Internationalism

Related

Abstract: It’s all one thing.

Given the following realities; the BRICS and those that wish to trade with them must go on a gold standard in part or in whole. Why?

It’s all about supply chains and payment chains.

The US must rebuild supply chains to remain self-sufficient in certain commodities or it must trade with the BRICS on the BRICS terms. And that means with Gold in hand

The BRICS, in turn, must build payment chains (and value-added portions of supply chains) to replace the SWIFT system. Either that or they must then remain dependent on the US. And that means with the USD in hand

The alternative to ignoring these choices between economic self-sufficiency and a Gold standard for continued international trade is: isolation, misallocation and misuse of resources, and finally escalation of war.

What follows is a description of the situation, a contextual overview of the BRICS plan, and how the G7 must continue to respond over the next 5 years.

1- The Currency:

The BRICS are in the process of creating a settlement medium (currency, medium of exchange) for international trade comprised of Gold and other assets deemed separable from Dollar influence.

Delivery and receipt of this Settlement Medium concurrent with the reciprocal goods ( the goods bought with the Settlement medium) exchanged for said Medium will make final all transactions negotiated.

This Currency will entitle to the bearer a uniform basket of assets (commodities, currencies, bonds etc) deemed worthy as stores of value amongst the users endorsing it. On demand and likely physically accesible to make participant accounts current

2- The Unit and Technology:

The currency will make use of Blockchain. In doing so this will serve as an immutable contract between negotiating parties. In combination with other precautionary measures,¹ it will give reasonable assurances against fraudulent representations as to what the currency has actually backing it.

The combination of UNIT type prorata measurements, Blockchain type security, and Current Accounting economics it is believed will serve to solidify the nascent currency’s denomination, reliabililty, and value.

3- The BiS Role:

Pursuant to a Mercantile tradition, is also expected this will not be currency a nation’s people use (at least at first) just national governments.² This will in practice be an interbank dealer market³ product at least initially.

It is believed the West’s G7 will participate in this BRICS trade. If political expediency and image is a problem at first, then they will use the BiS and/or commercial banks⁴ across international lines. These banks will “make a market” and swap Western currency for the BRICS unit. They will presumably thus sleeve or manage the risk of the trade⁵.

The Western bank will then use their BRICS trade partner or banking counterpart with whom they also have a line of credit, to transact on the BRICS platform.

4- The G7 Problem, Solved With Gold & Silver:

It is believed the West’s G7 Central Banks will need to have BRICS currency exposure in their reserve to better hedge their own economic risks. Failing literally having that BRICS currency, the G7 CBs and sovereign wealth funds will simply continue to accumulate the assets (Gold, Silver etc) deemed important (or hard to get on demand like Gold and Silver) within the Store of Value basket the BRICS created. in other words, they will simply reverse engineer the basket and buy the parts needed.

The G7 CBs can then trade by creating their own mirror basket of Eastern Currencies, bonds, and Gold in what will likely be an IMF/SDR type of basket for risk purposes if ever needed.

5- The Store of Value:

This basket of assets will serve as the store of value most trusted for trade between participating countries. It will be used initially for repetitive fungible commodity trade between the member nations at first. These include but are not limited to foodstuffs and energy. This has two very important advantages.

Food and Energy are purchased repeatedly, are based on longstanding existing trade deal/ relationships, and are necessary to the lifeblood of the nations involved in their trade. Failure to deliver these assets alone is almost a declaration of war, as this type of trade maintains interdependent neighborly behavior.

Food and Energy are commodities. Little to no added value is put into them. They are uniform, substitutable, across international lines and within the sphere are plentiful. This makes them the perfect match for a basket made up of Stores of Value also largely based on commodities. ⁶

Presumably, as trust grows between these nations and in the system itself, goods with value added to them will be included. Conversely, as trust grows, one should also assume other assets will be added to the basket deemed stable stores of value, like Sovereign bonds and more currencies. Especially those backed with Gold or some other real asset.

How this is all potentially put together on the BRICS end is next.

6- The BRICS Challenge to Dollar Hegemony

For over a decade, discussions have simmered about moving away from the U.S. dollar. Recently, these ideas have taken a more concrete shape, driven by the BRICS nations, which are positioning themselves as a counterbalance to Western influence.

To solidify this status, BRICS needs two critical elements: an independent currency system and a framework for military-political security among its members. While the latter is less urgent at present, the creation of an alternative currency could soon become a reality.

7- The Three Phase Plan

BRICS is advancing a three-step plan to establish a new international currency. This includes:

adopting a gold standard, ⁷

creating a unified payment system with advanced technologies,

and promoting central bank digital currencies (CBDCs).

This initiative aims to reshape the global economy, challenging the dominance of the U.S. dollar established since the Bretton Woods Conference.

The BRICS nations have been increasing their gold reserves, now totaling 6.3 thousand tons. As the world's largest gold buyers since 2022, their actions signal a clear intention to develop a new global currency

The success of this new currency will hinge on the economic and demographic strengths of the BRICS countries. Together, they account for $29.5 trillion, or roughly 30% of global GDP, and a population of 3.5 billion people, providing a strong foundation for the currency’s circulation.

8- The End of Dollar Dependency

To achieve financial independence from Western systems, BRICS is developing its own payment systems and strengthening digital currencies. Russia's Ministry of Finance is working on a platform to facilitate money transfers between BRICS countries, aiming to reduce the impact of Western sanctions.

China leads in digital currency implementation, with the People's Bank of China making significant strides. Although currently limited to domestic use, China’s digital currency has substantial turnover. Beijing is expanding its cross-border CBDC project, mBridge, involving Hong Kong, Thailand, the UAE, and 25 observer countries.

Russia is also progressing with its digital ruble, launched in a pilot project in August 2023. This digital currency is now accepted in 11 Russian cities, with plans for further expansion.

9- The National Approach to Internationalism

Russia has boosted the use of national currencies in transactions with friendly nations to 75%. This shift necessitates a new system similar to SWIFT, designed to handle transactions in national currencies. This system, integrated with the digital currencies of BRICS members, will operate on blockchain technology.

Experts believe that moving away from the dollar and introducing national currencies is a crucial first step towards creating a new monetary unit.

The Bretton Woods system, which has dominated the global economy for 80 years, is nearing its end. In the emerging landscape, the unilateral dominance of one financial system will be impossible, and BRICS is set to become a significant player in international relations.

end of section

Next we will see an explosive price action in miners

Silver Academy endorses only 4 miners

Let’s take a look at our group of 4 elite miners performance over last 6 months

Silver Academy vets the miners they endorse based on scale, grade, jurisdiction and other key metrics.

and this is just the beginning of the precious metals run.

1.) Andean Precious Metals past 6 months

2.) Outcrop Silver past 6 months

3.) Kuya Silver past 6 months

4.) Dolly Varden Silver Corp past 6 months

Conclusion:

1. Obtain physical Silver Metal from Sprott Money (Larisa Sprott is scheduled to appear this week on SilverWars channel) We will be discussing this topic:

Is Silver Your Missing Piece?

Sprott Money's Silver Solution

How Silver Solves 5 Pressing Problems

Sprott Money has US and Canada locations

Here is their EZ to use e-commerce portal (smash the blue button)

Get positioned in the aforementioned 4 miners ASAP, (while they are still inexpensive)