3 charts that say Go Gold in our Bear Market Today

Gold vs SPX in 2007 bear market.

During the 2007-2009 bear market, the S&P 500 lost approximately 10% of its value, while gold prices surged.

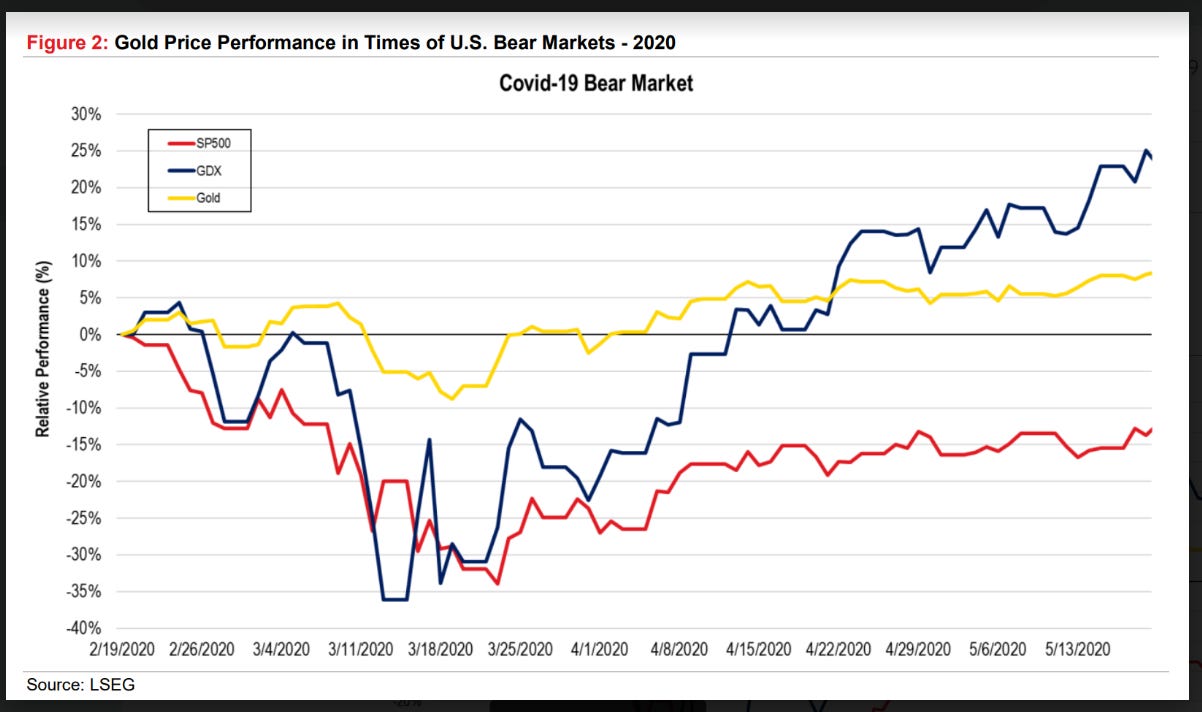

Gold vs SPX in 2020 COVID

In 2020, during the COVID-19 pandemic, the S&P 500 initially plummeted down 35% before a slight dead cat bounce. Gold, however, reached new highs, peaking at over $2,000 per ounce as investors sought safe havens amid economic uncertainty.

Gold vs SPX in 2022

In 2022, the S&P 500 experienced significant volatility and declines, while gold prices remained relatively stable, with slow and steady growth as the year progressed. Gold did its job maintaining its status as a safe haven during market turbulence

end of section

Pickaxe Picks

Seniors:

Newmont Gold: NEM

Intermediates and Producers:

Aya Gold & Silver Inc: AYASF

Andean Precious Metals: ANPMF

Juniors

Dolly Varden Silver: DOLLF

*Kuya Silver: KUYAF

Outcrop Silver: OCGSF

*Kuya Silver just entered production

end of section

Silver Mining: Morocco is Open for Business While Mexico is Teetering Towards Nationalizing

Morocco is the opposite of Mexico