Gold: Cornerstone of Global Reserves but the Real Sleeping Giant is Silver

Unlocking Silver's Potential: The Case for a Return to Historical Gold-Silver Ratios

In an era of economic uncertainty, gold continues to shine as the bedrock of central bank reserves worldwide. Major central banks maintain significant gold holdings, with emerging markets leading recent purchases to bolster their financial stability.

This trend underscores gold's enduring appeal as a safe-haven asset and a hedge against economic turbulence.

While emerging economies are actively increasing their gold reserves, developed nations still dominate in terms of overall holdings.

This disparity highlights the strategic importance of gold in the global financial landscape. A recent World Bank paper recommends a gold allocation of up to 22%, a guideline many central banks are following or exceeding.

Interestingly, private and institutional investors remain underexposed to gold, despite its proven track record as a portfolio stabilizer. Financial experts suggest an optimal gold allocation between 14-18% to balance risk and returns.

This discrepancy between central bank and private investor behavior presents a compelling opportunity for savvy investors.

The rising gold price serves a dual purpose: it not only reflects economic uncertainties but also acts as a covert mechanism for recapitalizing central bank balance sheets.

With a projected 2030 price target of $4,800, the relative share of gold reserves in developed markets could soar to an impressive 50%, further cementing gold's role in the global financial system.

However, the real sleeping giant in the precious metals market is silver. While gold captures headlines, silver's potential for explosive growth often goes unnoticed. Any move towards the historic gold-to-silver ratio, even to 50 ounces of silver per one ounce of gold, could send silver prices skyrocketing

Contrary to popular belief, developed markets have as much interest in maintaining a stable and robust gold price as emerging markets. This alignment of interests across the global economic spectrum further reinforces gold's position as a cornerstone of international reserves.

As we navigate through uncertain economic waters, both gold and silver stand poised to play pivotal roles in shaping the future of global finance. While gold continues to be the foundation of central bank reserves, investors would be wise to keep a close eye on silver – the unsung hero of the precious metals world.

Previously this week we launched the MineralWEALTH & Mining Masterclass

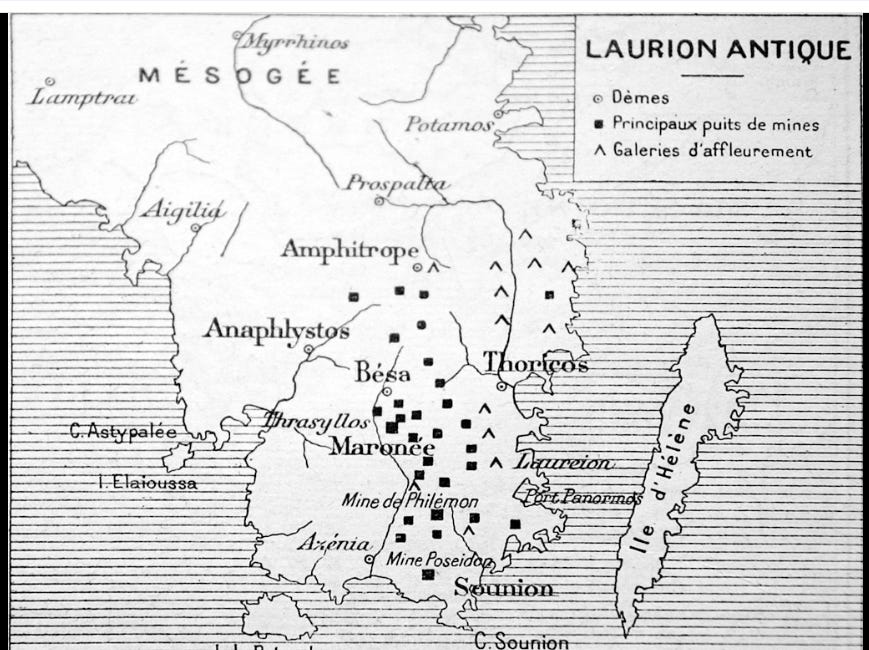

From Ore to Empire: How Laurion's Silver Shaped Athens' Architectural and Naval Power

Introducing the Mineral Wealth & Mining Masterclass

We learned that the first two great empires (Athens followed by Rome) fueled their power and empire growth by silver. Athens sourced their Silver from the Mines of Laurion and Rome sourced their Silver from Silver mines in Spain.

The Byzantine empire came next but ran into trouble sourcing nearby Silver.

Portugal became a leading maritime power during the Age of Exploration, leveraging its strategic position at the tip of the Iberian Peninsula. This location facilitated vital trade routes with Northern Africa, particularly Morocco, which was rich in gold and silver. The Portuguese established strong trade networks, allowing them to access these precious metals and enhance their economic and political influence in Europe during the 15th and 16th centuries

Morocco today is still a powerhouse in Gold and Silver production.

I endorse only 5 miners based on:

ore grade

their balance sheet

jurisdiction

metallurgy

volume of silver underneath

Aya Gold and Silver, Zgrounder Mine, Morroco

Ticker: OTCMKTS: AYASF

Not financial advice