Gold and Silver Unite. Political Tariff Debates Do Not.

While politicians fight over Tariff percentage points scaring consumers, Gold are Silver are points of unity

Behind the headlines of geopolitical tensions and economic uncertainty, a silent revolution is unfolding. Private citizens, states, segments of the Christian Church and nations are casting a resounding "NO" vote against fiat currencies through their actions rather than words.

The unprecedented accumulation of gold reserves speaks volumes about the growing distrust in paper money and the global financial system it underpins.

While mainstream media fixates on inflation figures and interest rate decisions, the true story lies in the vaults filling with precious metals. This shift represents a fundamental reassessment of monetary value, as countries seek refuge in an asset that has outlasted empires and withstood the test of time. The gold rush among nations signals a profound, if understated, rejection of the current fiat-based paradigm

The great Keynesian experiment and Modern Monetary Theory, once hailed as economic saviors, have led us down a treacherous path.

The unbridled printing of fiat currency to fund endless wars and unsustainable social programs has ushered in an era of unprecedented chaos. As nations drown in debt and central banks manipulate markets, we witness the bitter fruits of these misguided policies: rampant poverty, social upheaval, and economic stagnation.

Unemployment soars while the value of people's savings evaporates. The promise of prosperity through monetary expansion has proven to be a mirage, leaving us standing at the precipice of financial ruin. In these dark times, glimmers of hope emerges from an ancient source (gold and silver)

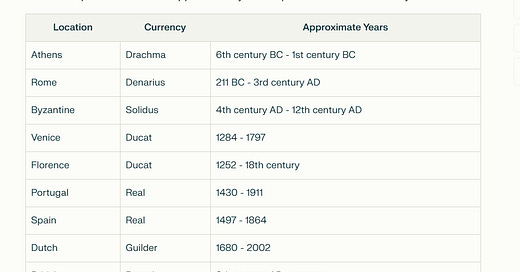

In this newsletter we started talking about the first silver coin and followed empires or currencies that have come and gone (on this table below)

In an era marked by economic uncertainty and geopolitical fractures, gold and silver could re-emerge as financial and monetary unity—assets capable of bridging divides between nations and restoring trust in a fractured global system. As central banks accelerate gold purchases at a record pace. a quiet renaissance of precious metals is unfolding, offering a path to recalibrate sovereign balance sheets and foster international cooperation.

The Golden Thread of Stability

Central banks have added over 2,700 tonnes of gold since 2022—the fastest accumulation in modern history. This isn’t mere speculation; it’s strategic. Institutions from Poland to China view gold as a stabilizing force amid currency volatility and mounting debt burdens, which now exceed $320 trillion globally.

By anchoring reserves to this finite asset, nations gain flexibility: gold’s scarcity provides intrinsic value that fiat currencies lack, while its price resilience during crises offers balance-sheet insulation. Even historically dollar-centric economies now recognize gold’s unique ability to transcend political rivalries—a neutral benchmark all nations can trust.

BRICS’ Visionary Blueprint

This shift aligns with Russian economist Sergey Glazyev’s proposal to redefine global trade through gold. His BRICS-backed framework pegs a barrel of oil to a gram of gold creating a commodity-backed monetary architecture independent of any single nation’s currency. Such a system could stabilize prices for energy, food, and critical minerals while circumventing sanctions-driven financial warfare. If adopted, it would mark a return to the classical gold standard’s core strength: using a universally accepted asset to harmonize exchange rates and trade flows

Debt Dilemmas and Precious Metal Solutions

With interest payments now eclipsing defense spending in many nations, gold’s revaluation could offer salvation. Historical precedents show that raising gold’s nominal price (as the US did in 1934) can dramatically reduce debt-to-GDP ratios

Today, a similar reset—coupled with silver’s potential role in local transactions—could help nations escape the debt spiral while preserving purchasing power for citizens battered by inflation.

Lessons From the Classical Gold Standard

The late 19th century’s gold-backed system proved that stable exchange rates foster prosperous trade networks. When every currency tied to gold, comparative advantage thrived without currency manipulation. While imperfect, this system minimized the trade imbalances seen today—like Europe’s automotive surplus with the US—by aligning price signals across borders. Modern adaptations could address past rigidity through hybrid models, blending gold’s discipline with digital settlement efficiency.

A Foundation for Renewed Trust

As distrust festers over trade policies and currency weaponization, gold offers a reset button. Its apolitical nature makes it ideal for rebuilding multilateral frameworks—whether through BRICS’ commodity baskets or Western central banks’ reserve diversification. Unlike fiat currencies, gold can’t be inflated away or frozen by sanctions, giving all nations equal footing in negotiations.

The road ahead requires boldness, but the pieces are falling into place. From Warsaw’s vaults to Moscow’s exchange proposals, gold is again becoming the lingua franca of global finance—a shared language that transcends borders. In this metals-mediated future, unity is possible—We Just need some of the Politicians to get out of the way.