Gold and Silver: Safeguarding Wealth from The Great Taking

The Evil Federal Reserve have taken it all. People just don't realize it yet. Thank God you read this First.

David Webb's book "The Great Taking" argues that significant changes in financial laws and regulations over the past few decades have fundamentally altered the nature of asset ownership, particularly for deposits and securities. Here's a summary of how the book indicates deposits are unsecured:

Legal Framework Changes

Webb contends that modifications to the Uniform Commercial Code (UCC), particularly Articles 8 and 9, have transformed the legal status of financial assets. These changes have shifted ownership from direct legal title to a concept called "security entitlement," which is essentially a claim on ownership rather than outright ownership itself.

Security Entitlement vs. Direct Ownership

Under this new framework, when individuals deposit money in a bank or invest in securities, they no longer possess direct legal ownership. Instead, they hold a "security entitlement," which is a weaker form of ownership that leaves them vulnerable in case of financial institution failures.

Collateral Pool and Prioritization

In the event of a major bank failure or financial crisis, Webb argues that these legal changes allow for the creation of a general collateral pool. Within this pool, the assets of individual depositors and investors (including stocks, mutual funds, 401(k)s, IRAs, and pensions) are used first to cover the losses of big banks and their derivative positions.

Unsecured Creditor Status

The book posits that these legal modifications have effectively relegated individual depositors and investors to the status of "unsecured creditors." This means that in a financial crisis or bankruptcy scenario, their claims on assets would be subordinate to those of secured creditors, which typically include large financial institutions.

Role of the DTCC

Webb highlights the central role of the Depository Trust and Clearing Corporation (DTCC) in this system. He argues that most financial assets ultimately reside with the DTCC, and in a collapse scenario, individual investors would be treated as unsecured creditors at the DTCC level.

Derivatives Market Risk

The book emphasizes the enormous size of the derivatives market (estimated at quadrillions of dollars) as a significant risk factor. Webb suggests that in a collapse of this market, the chances of individual investors recovering their assets are slim, as these assets would likely be used to cover derivative losses.

Lack of Public Awareness

A key point in Webb's argument is that these changes have been implemented quietly over time, without widespread public knowledge or debate. This lack of awareness leaves many individuals unaware of the potential risks to their financial assets

SprottMoney.com is a Private Bank

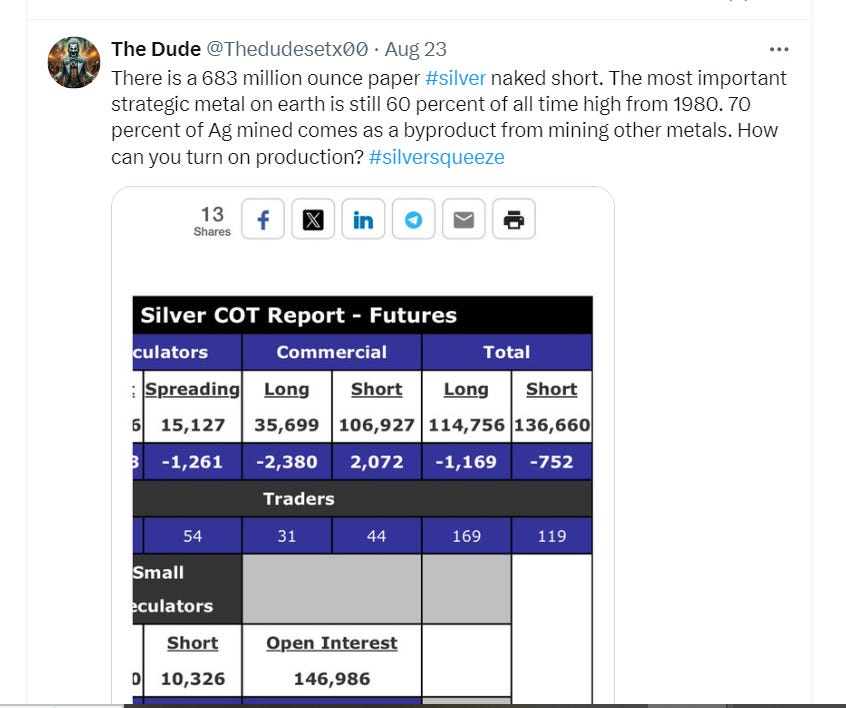

Buy physical gold and/or silver the bankers put on sale (by short selling)

Take possession of your gold after ordering from SprottMoney.com

Or Trust Eric and Larisa to store it (I do, you can too)

I decided on this by looking at my shifty neighbors and thought, Nahhh, I will go with Eric and Larisa Sprott

Keeping physical gold and silver outside the traditional financial system can potentially serve as a hedge against the risks outlined in "The Great Taking."

Unlike bank deposits or securities held in electronic form, physical precious metals stored securely at home or in private vaults are not subject to the same legal framework of "security entitlements" or the potential claims of financial institutions. Gold and silver have historically been viewed as stores of value and can maintain their worth independently of the banking system.

In a scenario where digital assets or bank deposits are compromised or subject to "bail-in" measures, physical precious metals could provide a form of wealth preservation that remains under the direct control of the owner.

However, it's important to note that while this strategy may offer some protection against systemic financial risks, it comes with its own set of challenges, including security concerns, liquidity issues, and potential regulatory restrictions. As with any investment strategy, diversification and careful consideration of individual circumstances are crucial.