The history of fuel usage and energy transitions is closely intertwined with the evolution of global reserve currencies, reflecting the changing centers of economic and political power throughout history.

Wood as Fuel in Ancient Metalworking

During the Bronze Age (approximately 3300 BCE to 1200 BCE), wood-fired ovens were essential for smelting copper and tin to create bronze. The Romans later expanded this practice to produce various metal items on a larger scale.

Sources of Wood Fuel:

Oak

Pine

Beech

Olive

Cedar

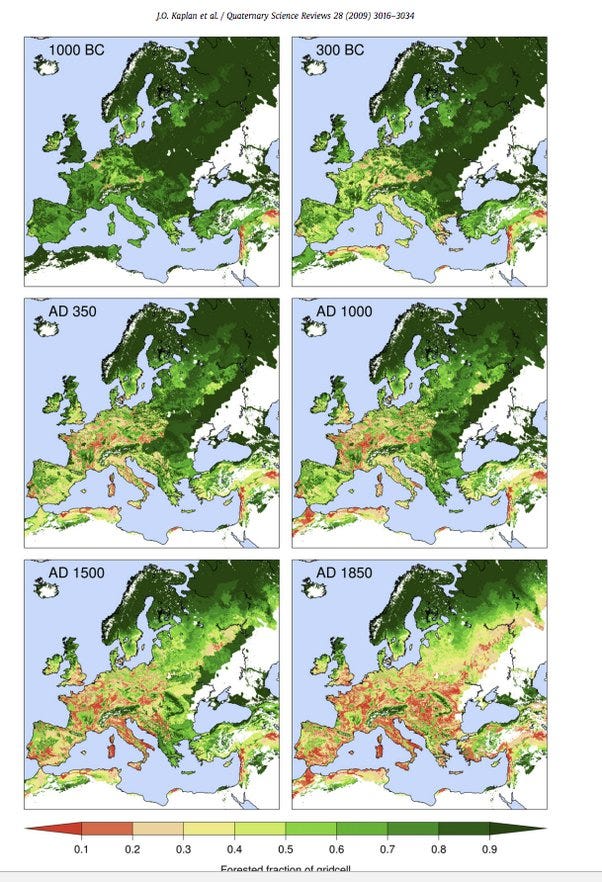

The Romans utilized these wood sources extensively, leading to significant deforestation in some areas around the Mediterranean. Cyprus, indeed, derives its name from the cypress tree, which was once abundant on the island.

How heavily Forested was Rome?

It was VERY forested. It was said that during times of Hellenic Period, squirrel could go from Greece to Spain from tree to tree without ever setting foot on the ground.

Sumadija can be roughly translated as “Forestland”. As you can imagine it was full of trees. Today, Sumadija still has forests, but far less.

During this period, the Roman denarius emerged as a prominent currency. Introduced around 211 BC, it became the standard silver coin of the Roman Republic and early Empire. The denarius served as an early reserve currency, facilitating trade across the vast Roman territories.

Transition to Coal and Shifting Economic Powers

Coal began to replace wood as the primary fuel source for metal smelting and other industrial processes in the 18th century, coinciding with the Industrial Revolution. This transition occurred around 1709 when Abraham Darby successfully used coke (derived from coal) to smelt iron.

During this period, several currencies rose to prominence as reserve currencies:

The Florentine florin (13th-16th centuries)

The Venetian ducat (13th-16th centuries)

The Portuguese real (15th-17th centuries)

The Spanish real (16th-19th centuries)

The Dutch guilder (17th-18th centuries)

The French livre (17th-18th centuries)

Wood to coal.

The shift to coal provided several advantages:

Higher heat output

More consistent temperatures

Reduced deforestation

Enabled larger-scale industrial operations

As coal fueled the Industrial Revolution, the British pound sterling emerged as the dominant global reserve currency in the 19th century, reflecting Britain's economic and imperial power.

Pittburgh becomes the Energy Capital of the World

With some of the World’s largest coal deposits

Oil discovered in Pittsburgh (most think its the Texas and Oklahoma gusher, nope, Pittsburgh area)

Gulf Oil headquarters in Pittsburgh

US largest natural gas formation under Pittsburgh (Marcellus Formation)

Westinghouse’s Nuclear plant also in Pittsburgh

Tesla vs Edison current wars; Westinghouse headquarters in Pittsburgh

AI and Robotics Capital of USA via Pittsburgh’s research at Carnegie Mellon

Mr. Westinghouse gave employees option to be paid in Silver Coins because he understood the evils of inflation

The Rise of Oil and American Dominance

Oil started to supplant coal as a major energy source in the early 20th century. The transition gained momentum in the 1920s and 1930s, driven by:

The proliferation of automobiles

Advancements in oil extraction and refining technologies

Oil's higher energy density and easier transportation

By the 1950s, oil had become the dominant global energy source, powering everything from transportation to electricity generation and industrial processes.

This period coincided with the rise of the United States as a global superpower and the establishment of the U.S. dollar as the world's primary reserve currency, replacing the British pound sterling.

Modern Energy Landscape and Currency Dynamics

Today, we rely on a diverse mix of energy sources:

Coal: Still widely used for electricity generation and some industrial processes, particularly in developing countries.

Oil: Remains crucial for transportation and petrochemical industries.

Natural Gas: Increasingly important for electricity generation and heating due to its lower emissions compared to coal.

Nuclear: Provides baseload electricity in many countries, though its adoption has slowed due to safety concerns and high costs.

Renewables: Solar, wind, hydroelectric, and other renewable sources are growing rapidly, driven by environmental concerns and improving technologies.

In the current global financial system, the U.S. dollar remains the dominant reserve currency.

However, BRICS are challenging US dollar hegemony and using Gold for oil as part of this strategy.

There are ongoing discussions about potential shifts in the reserve currency landscape, particularly with the rise of China's economic power and the increasing use of the renminbi in international trade.

Energy Transitions and Their Impact

Each energy transition has had profound effects on society, industry, and the environment, often coinciding with shifts in global economic power and reserve currencies:

Wood to Coal:

Enabled the Industrial Revolution

Led to urbanization and the growth of factory towns

Coincided with the rise of the British pound as a global reserve currency

Coal to Oil and Natural Gas

Revolutionized transportation with the internal combustion engine

Shifted geopolitical power towards oil-producing nations

Paralleled the ascendancy of the U.S. dollar as the primary reserve currency

Oil to Diversified Sources:

Raised awareness of environmental issues and climate change

Spurred technological innovations in energy efficiency and renewables

Occurring alongside discussions of potential shifts in the global reserve currency system

As we move forward, the energy landscape continues to evolve, with each transition building upon the lessons and technologies of the past while addressing new challenges and opportunities. These changes may well be accompanied by further shifts in the global economic order and reserve currency system.

sponsored by VisitPittsburgh.US (lol, just kidding)