High-Grade Silver Revived in Nevada and New Mexico.

Silver's Second Act: Millions of Ounces Await. We are in a Silver Crisis. The Silver Deficit is the Largest Mining Story of the Decade. If You miss this opportunity, remember YOU WERE WARNED.

First some Breaking News

The Silver Academy recognizes that its tone needs to improve. The toxic culture of “attack” journalism for clicks needs to be reexamined.

In less than 4 months, industry leaders and analysts (including The Silver Institute) have acknowledged The Silver Academy research project has given us "a seat at the table." Last week, talks with Michael DiRienzo and Hecla Mining CEO Phillips S Baker Jr. discussed possible synergies. They will publish their World Silver Survey in April, and we will publish the Global Silver Report shortly after that.

The tone of the Silver Academy is turning more positive.

Before any “sensationalized skirmishes” or "immature trolling" by The Silver Academy, Michael DiRienzo was scheduled to appear on The Pixy Podcast. This is still on the GoldChain. iQ YouTube schedule for early February 2024.

Moreover, invites are going out to Carly and Lauren of Hecla Mining for feature on “Women on The Rocks, Revitalizing Mining with Female Force." This programming will be the The Silver Academy’s anchor emphasis for future YouTube broadcast series.

But it’s not just women this channel is promoting it’s about #RSPCT #AllColors #AllCultures #AllCreatures #AllFaiths #AllGenders.

This is not about being Woke, This is about being Wise.

We remain firm in our belief that data is missing from SI's World Silver Survey (aerospace, military, robotics, trains, colliders, AI, quantum computing, fuel cells, silver-zinc batteries, silver plating, and dozens more applications). But our tone has changed from calling their organization deceptive to a cooperative spirit of possibly "working together."

Phillips Baker said it best, "Can't you find another villain besides the Silver Institute?" Those are some sound words.

This change in tone will likely be more productive to serve the greatest good for the most significant many.

"Really, trying to take on and tackle the monstrous task of documenting all the Silver use and supply can not be executed by one research project."

So, the public will be best served between their survey and the Global Silver Report, and investors will have more data points to make the best investment decisions surrounding supply and demand dynamics.

Our Silver Research has been posted by credible silver publications other than ours. Below, you will read some historical research that has yet to be released. This is critical research because of the Silver deficit in an environment where demand spikes by the second. We are in a massive deficit. This is a Silver Crisis. Key silver deposits can not be rushed to market, and Mexico's production has fallen off a cliff; the US is 79% import-reliant. So, this story is about pristine US silver deposits that are almost ready to go. The hope is that they will be advanced to market all at a time when identifying silver is critical.

The key takeaway is there have been zero to few recent silver discoveries. It's crucial to start summarizing silver in the ground. There are lots of old-producing districts that are inactive and being revived. They were abandoned because of market conditions, labor conditions, and world wars, and it wasn't profitable. But the main reason was that the old timers basically chased a vein with the technology they had (pickaxe, mule, shovels, and wheelbarrows)

Here are some leading silver-producing districts.

Nevada: Nevada is the largest silver-producing state in the United States. It is home to significant silver mines, including the Rochester Mine, which is the largest primary silver producer in the state.

Alaska: Alaska is another major silver-producing state in the U.S. The Greens Creek mine, owned by Hecla Mining, is a significant silver producer in Alaska.

Idaho: Idaho is also a prominent silver-producing state, with the Galena Complex being a notable silver mine in the state.

Arizona: Arizona has a long history of silver mining and is among the top silver-producing states in the country. The state's silver production is often a byproduct of copper mining.

Utah: Utah is another state with a significant silver production, often as a byproduct of copper and lead mining.

New Mexico - SEE BELOW

Some History of Inactive Mines due to market conditions, labor conditions, World Wars and lack of new technologies

Comstock Lode, Nevada: The Comstock Lode was the first crucial silver-mining district in the United States, with production mainly from 1869 to 1893. It has been mostly inactive since the 1920s

Tonopah, Nevada: Discovered in 1900, the Tonopah district was the last great silver-mining district to be developed in Nevada. It produced a significant amount of silver through 1921 and there is a lot of unfinished silver mining business in Tonopah, and I mean A LOT!!!!

Blackrock Silver and Summa Silver are actively exploring and developing two massive Tonopah Nevada silver projects.

The Western acreage (updated mineral resource estimate well over 1 million ounces. The Eastern Summa acreage is advancing high-grade veins the old timers couldn't access because the best silver was just out of their technological grasp. The Eastern veins could yield even more, but between the West and East, this Tonopah region will be critical to the US's future energy, industrial applications, aerospace, and national security.

Andrew Pollard states, "This is the largest high-grade undeveloped mining district in USA." Combining Summa Silver and Blackrock silver ounces in the ground could be between 2.5 and 4 million ounces beneath the earth's surface. We will know soon. Remember, the market has yet to price this in, not even close. If you want to gain silver leverage exposure, this is a screaming opportunity.

New Mexico: The state has tens of thousands of inactive or abandoned mine features in 274 mining districts, including those for silver, uranium, metals, and industrial minerals

The largest silver mines in New Mexico were Mogollon (Cooney's claim includes Queen Vein, Little Fannie, Kingston's Solitaire Mine, Iron King mine, Georgetown, and the Pinos Altos district).

The Pinos Altos district, located in Grant County, New Mexico, was one of New Mexico’s most significant silver mining areas. The discovery of silver in this district led to a mining boom in the 1870s, and it became one of the largest silver-producing areas in New Mexico.

The Kingston area was known for high-grade gold and silver mines, such as the Log Cabin Gold-Silver Mine and the Comstock Mine, located in the Tierra Blanca Mining District near Kingston, New Mexico. This area was worked up until 2004, but we must all remember that "gold is only mined when it is profitable to do so" (one of the great quotes by James Turk)

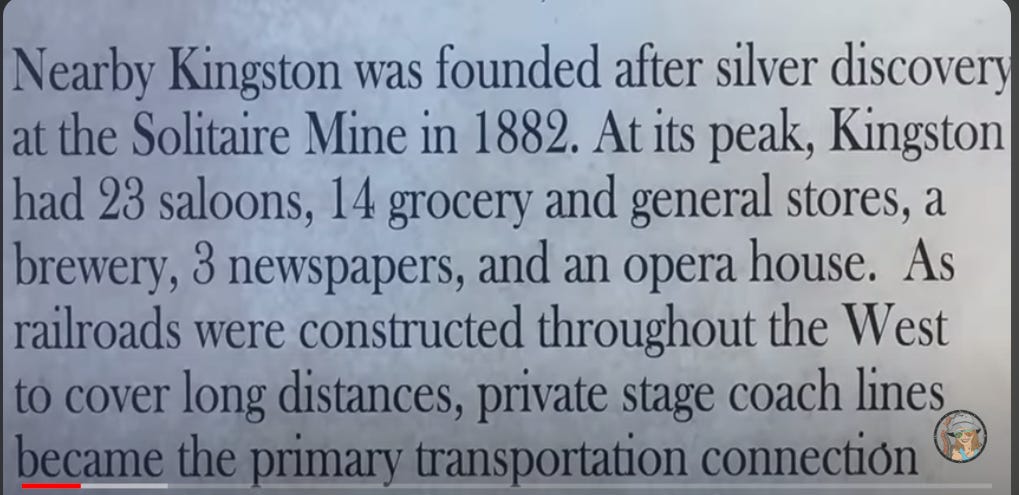

The Solitaire Mine, also known as the Iron King or Silver King Mine, was a significant silver mine near Kingston, New Mexico. Kingston was established in 1882 following Jack Sheddon's discovery of silver at the Solitaire Mine.

The mine was part of the Kingston Mining District, now located within the Gila National Forest in New Mexico.

The Solitaire Mine, or Iron King Mine, was a prominent contributor to the economic and social development of the area, leading to the establishment of various businesses such as grocery stores, general stores, an opera house, and a brewery to support the growing mining community.

The discovery of silver at the Solitaire Mine played a pivotal role in the founding and prosperity of Kingston, and its impact extended to the development of infrastructure and businesses in the area. The mine's significance is reflected in its historical association with the growth and economic activity of the region during the late 19th century.

Summa Silver TSX:SSVR, OTCQX:SSVRF, Frankfurt: 48x

From the Beginning

The Silver and Gold story of Mogollon Revitalized & Revived. An Incredible Investment Opportunity

Far to the west of Socorro, in the Mogollon Mountains, one of the most interesting and productive of New Mexico's mining camps developed. Mogollon grew out of the discoveries made by Captain Cooney in 1875.

Apache bands prevented much development until the mid-eighties when the US Army (policy of genocide) drove back Apaches (driven from the area.)

From 1885 until the end of the century, the story of Mogollon is as spectacular and exciting as the story of any mining camp in New Mexico.

It started as a tent town, hugging the bottom of the narrow canyon,

Mogollon quickly grew into a rip-roaring mining camp near the adjacent camps of Clairmont and Cooney.

The dis produced nearly $5,000,000 between 1885 and 1900. After 1900. the camp declined rapidly and nearly died. It had two significant revivals in the 20th century and remained an active milling center until World War II.

Everything necessary for an active mining camp like machinery, tools, hardware, food, had to be hauled long distances by wagon over hazardous and difficult roads.

Ore concentrates had to be transported out by mules, hand-walked wagons, or Stage over the roughest terrain in the Southwest. The transportation problem was never solved.

Silver exploration and production have undergone four distinct phases in SW New Mexico. The first by the indigenous people dates back over 800 years. The second era was by Spain. The third era was by New Mexico as a territory. The fourth era was of New Mexico as a state. We are now entering a fifth era, set up to be the most prosperous, but we must first dissect the volatile past to get clues on how this will likely play out.

The idea of great mineral wealth in New Mexico was initially conceived from the ambitions of Spain’s Cabeza de Vaca, who reached New Mexico in 1536. Cabeza de Vaca wanted to be the next Cortés, who had stolen the Aztecs’ gold in 1520.

Many citizens of New Spain (Mexico) believed that one territory north (New Mexico) was a vast treasure chest. They had heard accounts of people seeing brilliant silver jewelry, vases, plates, ingots, and figurines.

Moreover, there were other accounts that the indigenous had practiced advanced metallurgy. The hope was that southern New Mexico would be another “Aztec score” that had provided so much for Cortés and his troops.

Before mining activity in New Mexico, vast quantities of silver were already discovered near Chihuahua, Zacatecas, and Durango, Mexico. As a result, these regions quickly became leading silver producers worldwide. Enthusiasm emerged because the topography and geology of SW New Mexico are similar to the Northern Mexico silver-rich mountains called the Sierra Madre Occidental.

Discoveries of silver were made in the mountains just west of Socorro, leading to the formation of the Socorro Peak Mining District, which boomed in the 1880s.

In 1866, high-quality silver ores discovered in Georgetown (Silver City area) sparked a frantic search for silver ores all over the territory. It sent silver prospectors back into a region already combed for gold. While some prospectors were locating the first claims around Georgetown, others continued to search the Magdalena Mountains west of Socorro, and this search continued westward toward Mogollon.

At Georgetown, where high-quality silver ores were found in 1866, a mining rush in 1873 became a full-fledged boom by 1875.

Meanwhile, in 1870, a U.S. Cavalry soldier named James Cooney from Fort Bayard was patrolling in nearby Mineral Creek Canyon. Cooney discovered rich gold and silver deposits, and he kept his find a secret.

He could not pursue his discovery because his military service obligation to the Army was not yet complete, and he returned to his Army duties.

Several years later, when Cooney was discharged in 1876, he returned to the area, filing several claims. Then Cooney and his partner, Harry McAllister, were chased out of the region by the Apache community.

Cooney and McAllister returned two years later and began diligently working these rich veins. Word spread, and soon the area was crawling with numerous prospectors looking for their own fortunes.

The scrappy Chiricahua Apache targeted the miners because Apache land had been stolen by the U.S. Army. Critical thinkers report that their vengeance was just.

In April 1880, Chiricahua Apache led by Chief Victorio once again raided the area, including Cooney’s claim, and Cooney was killed by Chief Victorio. Victorio’s people celebrated the kill as it represented killing off the enemy who had once been a member of an army that had unleashed genocide on hundreds of thousands of indigenous people.

Michael Cooney inherited the claim and continued his brother’s mining operations. Several mines were developed in the area, including the Deep Down, Last Chance, and the biggest and most profitable—the Little Fannie. In 1909, it was recorded that nearly 70% of the precious metal of New Mexico was produced by the mines of Mogollon, amounting to $5,500,000.

During their lifetime, over 18 million ounces of silver were taken from the mines of the Mogollon Mountains. Close to $20 million in gold and silver were extracted. Silver accounted for about two-thirds of the total.

Mogollon earned a reputation as one of the wildest mining towns in the West, as gamblers, stage-coach robbers, claim jumpers, and gunmen all called the mining camp home.

The challenges to silver mining came next. This goes to the risk known as jurisdiction. Even after the treaty of Guadalupe Hidalgo, disputes over land claims were highly problematic. Court records indicate that these numerous disputes were so chaotic that they significantly dampened mining activity. The bitter reality was that NM was a territory with no legal autonomy. Thus, the only way to resolve land claim disputes was via lobbying in Washington, which was costly and took up to 15 years.

This is the same situation we see today when evaluating jurisdiction risk, even when considering the most exceptional ore quality, technology, geologists, and management. Often this is no match for exhaustive government restrictions, interference, or inefficiencies.

Here was the three-punch combination knockout to mining activity in Mogollon, New Mexico:

Mining in New Mexico was devastated by the national political arguments over silver and its role in the national monetary system. Senator John Sherman, chairman of the Senate Finance Committee, had been determined to demonetize silver from at least 1867 and had arranged to have a bill to that effect drafted at the end of 1869. From then on, Sherman, Linderman, John Jay Knox (deputy comptroller of the currency and then comptroller), and Secretary of the Treasury George Boutwell cooperated to push a coinage bill that included the demonetization of silver.

World War I

Supply Chain Issues/Diesel and water?

Geology

Mogollon covers an extensive, silver/gold-bearing epithermal vein field on a caldera margin of the Tertiary Bursum Volcanic Center. The Mogollon Silver/Gold Deposits are classic epithermal veins demonstrating good grade and thickness continuity for strike lengths of up to 4,000 ft (1,219 m) in the Little Fannie and Last Chance mines and through a remarkably consistent, elevation-controlled vertical range of about 1,000 ft (305 m).

There are two sets of veins at Mogollon, an east-west set represented by the productive Little Fannie and Last Chance veins and a north-south set defined by the Queen Vein developed in the Consolidated Mine.

Past Work

Recorded historical production, mainly from the Little Fannie and Last Chance mines during the period 1905 to 1925, and the Consolidated Mine from 1937 to 1942, consists of 15,700,000 ounces silver and 327,000 ounces gold from about 1.7 million tons (1.5 million tonnes) of ore.

Mining ceased in 1942 due to the wartime cessation of all gold and silver mining in the United States. Modern exploration activity at Mogollon has been limited to small programs by St. Joe Minerals, Cordex, and John Livermore in three programs between 1982 and 1988 and consisted of 40,000 ft (12,192 m) of drilling in 53 rotary and core holes which were successful in outlining a partially delineated silver/gold deposit in the Queen Vein. Significant intercepts of gold and silver were also encountered in many other veins, including Anna E, Last Chance, South Fork, Mascot, and Graveyard.

Excellent resource expansion potential exists at Mogollon, as only 4.8 km of the total 72 km epithermal vein system has been developed.

Drilling is in progress at the Consolidated Extension Target where Summa Silver anticipates that a minimum of 15,000 m of drilling is necessary. This first target represents only 1.5% of the total vein and structure strike length present on the property.

The project features poorly explored to completely unexplored veins with strong potential for further mineralization immediately surrounding historically producing high-grade mines. There are also a number of undrilled veins with documented small-scale underground exploration workings that were driven above the main mineralized target elevation window. The depth projections of these veins represent strong conceptual drill targets.

The three main targets are the Queen Vein, Independence, and Gold Dust targets.

A 29 km² high resolution LiDAR survey identified previous areas of surface disturbance.

LiDAR (Light Detection and Ranging) is a method of measuring and examining the surface of an open-pit mine or a pre-mining location using laser sensors attached to drones. Lasers continually scan the surface, measuring the time it takes for the light to bounce off the earth and back to the sensor. This technology lets you look at the surface by eliminating all the plants and trees. Think of an archaeologist wanting to see if there was evidence of past roads, burial chambers, or lost villages. This technology gives you a treasure map from above, versus walking the entire property.

Multiple Targets / Ore Grade

Galen McNamara, CEO & Director – Co-founder and geologist with over 15 years of discovery and capital markets experience; former Senior Project Manager at NexGen Energy; Co-founder and Chairman of Goldshore Resources and Angold Resources.

Chris York, VP Exploration – Economic geologist with over 12 years’ experience focused on sediment hosted and epithermal narrow vein deposits; former Exploration Manager for Klondex Gold and Silver running all field activities.

Galen McNamara and Chris York in Mogollon, New Mexico

Photo by Jon Forrest Little of The Pickaxe