Fed's Dilemma: Trapped by Debt, Yet Wielding Unprecedented Power

The Anatomy of Feudalism 2.0. The Fed is Trapped Yet Getting More Powerful by the Hour.

Before the push brooms had even picked up the rubber balloons, campaign signs, and confetti from the euphoric celebration of a new president, the harsh reality began to set in. The cheering crowds, still hoarse from their victory cries, were blissfully unaware that their chosen leader held no real power over the true rulers of the economy - the fiat overlords.

As whispers of a potential Federal Reserve rate cut grow louder, we must consider the unintended consequences that such a move could unleash. While the intention may be to stimulate economic growth, the reality is that it could reignite the inflationary cycle and set in motion the often-overlooked Cantillon effect.

The Cantillon effect, named after 18th-century French economist Richard Cantillon, describes how changes in money supply lead to an uneven redistribution of purchasing power.

When the Fed cuts rates, it effectively increases the money supply, but this new money doesn't spread evenly across the economy. Instead, it flows first to those closest to the financial spigot – typically banks, large corporations, and wealthy individuals.

This uneven distribution creates a ripple effect throughout the economy. As the initial recipients of this new money spend it, they drive up prices in specific sectors before the increased money supply reaches the broader population.

This distorts relative prices, sending false signals to entrepreneurs and investors about where to allocate resources.

The result? A misallocation of capital that can lead to economic bubbles and eventual busts. Moreover, by the time this new money trickles down to the average citizen, inflation has already eroded its purchasing power, exacerbating wealth inequality.

Critics of expansionary monetary policy have long pointed to the Cantillon effect as a reason to be cautious about such interventions.

.While mainstream economists argue that recessions can be countered by boosting aggregate demand through monetary expansion, they often overlook the real, distortive effects this can have on the economy's structure.

As we contemplate the possibility of a Fed rate cut, we must ask ourselves: Are we prepared to embark on another inflationary cycle? Are we willing to further distort market signals and potentially misallocate resources? The Cantillon effect serves as a stark reminder that monetary policy is not a precise tool, but a blunt instrument with far-reaching and often unforeseen consequences.

Before we embrace a new round of monetary expansion, we should carefully consider whether the short-term gains are worth the long-term costs to economic stability and equality.

The Federal Reserve finds itself in a precarious balancing act, teetering on a high wire with no safety net below. On one side, the crushing weight of interest payments on the $36 trillion national debt threatens to topple the country's fiscal stability, currently draining an average of $3 billion per day from the nation's coffers. On the other side, the temptation to cut rates and ease this burden looms large, but doing so risks unleashing a whirlwind of inflation and intensifying the Cantillon effect.

This economic tornado would further distort the economy, widening the chasm of wealth inequality. Policymakers find themselves in a lose-lose situation, where addressing one crisis inevitably fuels another. This impossible dilemma underscores the urgent need for a radical rethinking of fiscal and monetary policies to forge a sustainable path forward for the U.S. economy before the high wire snaps under the strain.

end of segment

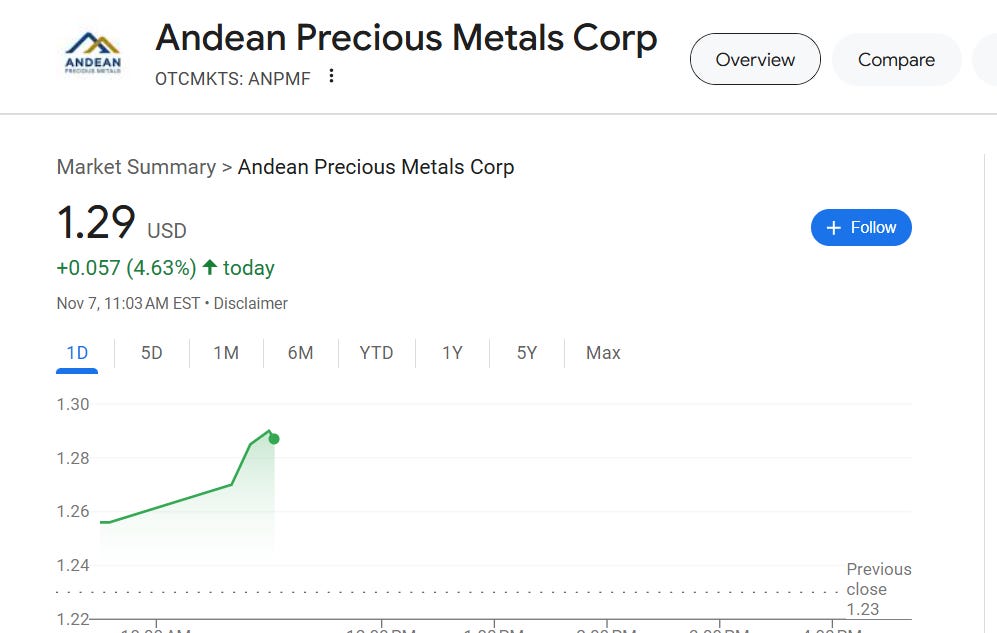

We asked our subscribers to Buy the Dip on the heels of yesterday’s artificial smash

Glad you all listened.

David Stein (CEO of KUYA Silver) Explaining how Silver’ ETFs work

Our opinions are not our sponsors opinions.

The views expressed on TheSilverIndustry.substack.com are not necessarily those of the Silver Academy.

Not financial advice