Extending Maturities & Lowering Coupons on Treasuries held abroad is 100% a U.S. default

This is not just a technical adjustment-it strikes at the core of global trust in U.S. creditworthiness

How Close Is the U.S. to Default-And Who’s Sounding the Alarm?

When Treasury Secretary Scott Bessent publicly floated the idea of extending maturities and lowering coupons on Treasuries held abroad, market veterans like Jeff Gundlach called it what it is: a veiled default. What does it mean when the top U.S. financial official openly discusses breaking faith with foreign creditors? Is this the language of a solvent superpower, or the desperate maneuvering of a debtor on the brink? Bessent’s own words-“we are on the warning track”-evoke a baseball outfielder about to crash into the wall. But who gets crushed when the U.S. hits that wall? And why aren’t foreign holders already dumping Treasuries en masse?

Are Layoffs a Blip, or a Symptom of Systemic Failure?

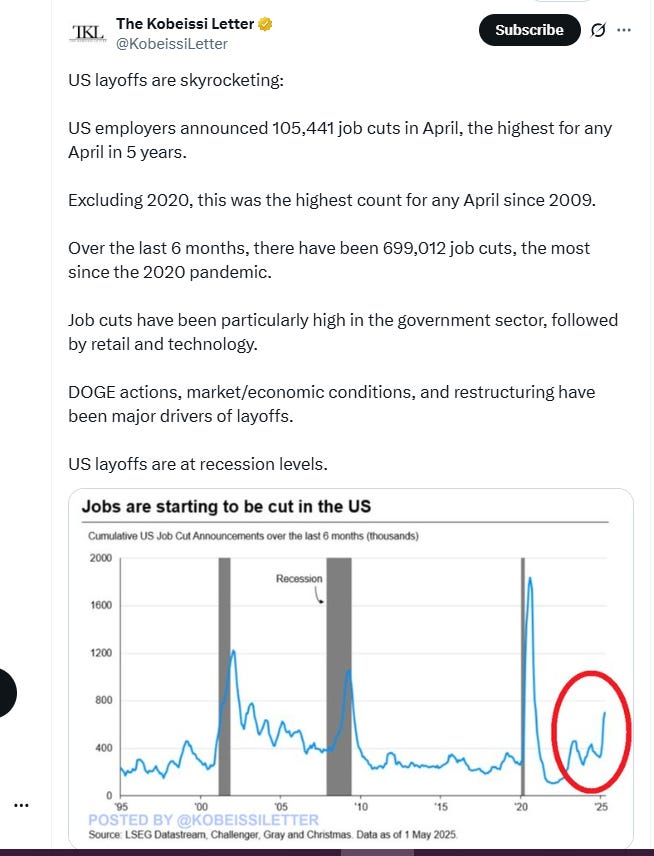

While the Treasury juggles accounting tricks, American workers face a different reality. April saw 105,441 job cuts-the highest for any April in five years, outside the 2020 pandemic collapse. Over the last six months, nearly 700,000 jobs have vanished, led by cuts in government, retail, and technology. The Department of Government Efficiency (DOGE) alone accounts for nearly half of all layoffs this year. Are these numbers just cyclical pain, or do they signal a deeper rot? When government jobs disappear by the hundreds of thousands, who is left to keep the machinery of state running?

What’s Happening on America’s Docks-and Why Does It Matter?

If you want to know the health of an empire, look at its ports. Today, the Port of Seattle sits empty-no container ships, no longshoremen, no trains hauling goods to the heartland. Commissioner Ryan Calkins calls it a “stark reminder” of the real-world impact of President Trump’s 145% tariffs on Chinese imports. A 40% drop in container traffic is forecast for Seattle and Tacoma in the coming weeks. The “canary in the coal mine” is gasping, and the echo is heard in Los Angeles and Long Beach, where imports have plunged by a third. Are we seeing the first dominoes of a trade war-induced supply chain collapse? What happens when the world’s largest consumer market can no longer import-or export-at scale?

Who Profits When the Empire Falters?

As the economy staggers, the Trump family’s net worth surges by $2.9 billion in just six months, thanks to crypto ventures and regulatory rollbacks5. While the president’s family launches meme coins and attracts billions from Abu Dhabi, ordinary Americans get “2 dolls and 5 pencils.” Is this the new American Dream-where the ruling class mints fortunes on digital speculation, while the public is left with trinkets and slogans?

Is Anyone Even Trying to Fix This?

While Trump talks about reopening Alcatraz, denounces China, and rails against trade deficits, Bessent admits he’s “going to address who is talking to whom”-an admission that the U.S. isn’t even pretending to negotiate a trade deal. Is this governance, or theater?

What Does Collapse Look Like-And Are We There Yet?

Ports are empty, jobs are vanishing, the Treasury toys with default, and the ruling family cashes in. Is this a recession, or something worse? When the basic functions of government, commerce, and diplomacy break down-when the only growth industry is political profiteering-are we not witnessing the unraveling of an empire?

The question is no longer whether the U.S. is in recession. The evidence points to something deeper: the hollowing out of the American state, the endgame of a failed empire. And as the warning track ends, the wall is coming fast.

Addendum RE US Default

Extending maturities and lowering coupons on Treasuries held abroad is widely recognized in financial markets and sovereign debt law as tantamount to a U.S. default, even if not labeled as such by officials.

Why is this considered a default?

Debt restructuring-such as extending maturity dates or reducing coupon payments-means investors receive less than what was originally promised, either in terms of timing, interest, or both. According to S&P Global Ratings, such measures are classified as a “selective default” if investors are not adequately compensated and if the restructuring is undertaken to avoid an imminent conventional default. The International Monetary Fund and sovereign debt experts note that while maturity extensions and coupon adjustments are common in sovereign restructurings, they are still seen as a form of default by markets, especially if imposed unilaterally.

What are the implications for the U.S. and global markets?

If the U.S. government were to unilaterally alter the terms of its debt-forcing foreign holders to accept longer-dated, lower-yielding bonds-this would be perceived as an act of bad faith or even financial expropriation.

The likely outcome would be a loss of investor confidence, a selloff of Treasuries by foreign central banks and sovereign wealth funds, higher U.S. borrowing costs, and destabilization of global financial markets. The U.S. dollar’s status as the world’s reserve currency would be at risk, and the reputation of Treasuries as the world’s safest asset would be severely damaged.

Bottom line:

Extending maturities and lowering coupons on Treasuries held abroad would be interpreted by markets as a U.S. default, triggering severe financial and political consequences.

This is not just a technical adjustment-it strikes at the core of global trust in U.S. creditworthiness.

Gold and Silver Cheer when Sovereign Nations Default (Well they can’t really cheer like a cheerleader but are the ultimate BS detectors)

Over the past five centuries, sovereign defaults have repeatedly exposed the fragility of fiat systems, driving investors toward gold and silver as trust erodes. These metals have historically acted as "canaries in the coal mine" for fiscal crises, a trend now amplified by regulatory shifts like Basel III.

Historical Superpower Defaults and Precious Metals

1. Spanish Empire (1557–1596)

Philip II of Spain defaulted four times on debts exceeding 60% of GDP, relying on Genoese bankers to fund imperial ambitions. Each default involved coercive debt restructurings (30–58% write-offs) and new taxes, eroding trust in Spain’s credit. While the empire used gold and silver from the Americas to temporarily placate creditors, repeated defaults ultimately collapsed its financial system. Precious metals became the only trusted collateral, foreshadowing their role as crisis hedges.

2. United States (1933)

FDR’s administration repudiated gold clauses in Treasury bonds, devaluing the dollar by 40% against gold. This technical default, upheld by the Supreme Court, led to gold confiscation and a revaluation from $20.67 to $35/oz. Gold’s price surged 69% overnight, illustrating how currency debasement directly fuels demand for hard assets.

3. United States (1979)

A technical default on T-bills due to administrative failures caused a 60-basis-point spike in yields. While minor, it revealed systemic risks in fiat debt management. Gold prices rose 24% that year, reflecting growing skepticism of government reliability.

Gold and Silver as Crisis Sniffers

European Debt Crisis (2010–2012): Gold prices climbed 150% as Greek and Italian bond yields soared, peaking at $1,900/oz. Investors fled euro-denominated assets for metals.

2008 Financial Crisis: Gold surged 50% ($800 to $1,200/oz), while silver jumped 82%, as faith in financial institutions collapsed.

COVID-19 Pandemic: Gold hit $2,075/oz (2020) and silver $29/oz amid money-printing fears, despite no sovereign defaults

Basel III: The 2025 Catalyst

Effective July 2025, Basel III reclassifies physical gold as a Tier 1 asset (zero risk-weighting), while devaluing paper gold (ETFs, futures). This forces banks to hold allocated bullion, triggering a supply squeeze:

Central banks bought 1,136 tonnes of gold in 2024, a 60-year high, preparing for Basel compliance.

Physical gold demand has driven prices to $3,444/oz (May 2025), up 80% since October 2024.

Analysts project $4,500/oz by 2026 as Basel III’s NSFR rules dismantle paper gold markets.

The Bull Run Accelerates

Gold’s 2025 rally reflects both regulatory tailwinds and preemptive moves against potential U.S. debt risks. As Treasury Secretary Bessent flirts with maturity extensions (a de facto default), Basel III’s framework signals a broader shift: gold is reclaiming its role as the bedrock of global finance. With sovereign defaults historically preceding monetary resets, the metals’ surge suggests markets are hedging against a fractured fiat era