Don't Time the Top. Weak Hands Could Cost you 10X to 15X Move on Gold & Silver

The Real Gold & Silver Gains Go to Patient Investors—Not Market Timers"

Everyone wants to call the top. In the wake of gold’s recent surge past $3,000 an ounce, pundits and traders are lining up to declare victory when the next correction arrives.

But history—and the underlying dynamics of our financial system—suggest that trying to “pick a high” and cash out now is a fool’s errand. The real winnings, as history shows, accrue to those with the patience to hold through the inevitable volatility and corrections, riding the secular bull market to its true climax years, even decades, down the road.

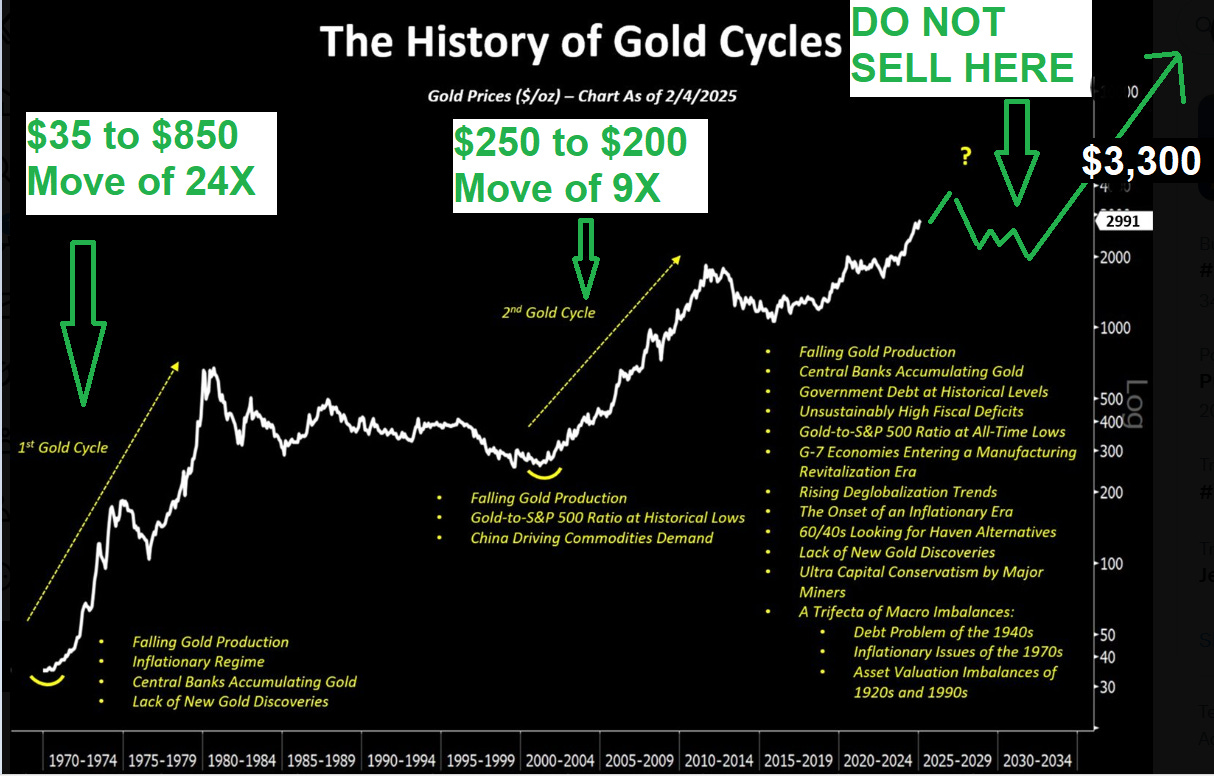

Zoom out and the parallels to the 1970s are striking. Back then, gold rocketed from $35 to $850 an ounce—about a 24-fold increase—while silver soared even further, fueled by the collapse of the Bretton Woods system, runaway inflation, and geopolitical chaos.

The catalyst? The world’s loss of faith in the U.S. promise that dollars could be converted to gold. Once that trust was broken, the floodgates opened. Investors, burned by the debasement of paper currency, stampeded into hard assets.

Central Banks Accumulating Gold

US debt approaching 37 Trillion and growing

Interest Servicing that Debt the #1 line item in US budget

Lack of New Gold Discoveries

Bond Market facing possible default

Bond yields spiking indicating desperation

More inflation from Tariffs, supply chains choked, more money printing, and US treasuries coming home to roost

Tariff chaos

next black swan (cyber, chemical, virus, act of God, et al)

Fast forward to today. The broken promise is even more profound. Quantitative easing (QE)—the Federal Reserve’s strategy of printing money to buy government debt—has replaced the gold standard as the ultimate sleight of hand. Instead of honoring debts through taxation or growth, the U.S. increasingly relies on the printing press, inflating away obligations and eroding the value of the dollar. This is debt debasement by another name, and it’s driving a new generation of investors to seek refuge in gold.

The evidence is everywhere. Foreign holders of U.S. Treasurys, once the bedrock of global finance, are running for the exits, spooked by America’s fiscal trajectory and the weaponization of its own currency. The traditional safe haven status of Treasurys is under threat, and gold is filling the void. Since the start of the year, gold has outperformed both the dollar and U.S. government bonds by a wide margin.

And what of the money supply? M2—the broad measure of dollars in circulation—has grown at an average of nearly 7% annually over the past century, with explosive bursts during crises. Since 2020 alone, over a quarter of all dollars ever created have been conjured out of thin air. Historically, gold prices have tracked this monetary expansion, and some analysts argue that, at current money supply levels, gold could justify a price as high as $30,000 an ounce.

The lesson from history is clear: gold bull markets are not fleeting, speculative manias—they are multi-year, sometimes decade-long, responses to systemic breaks in monetary trust. The corrections will come, as they did in the 1970s, but the real gains accrue to those who resist the urge to time the top and instead hold for the long haul.

In a world where promises are broken and debts are printed away, gold’s bull run is likely just getting started. Few will have the conviction to hang on for the ultimate ride—but those who do may be rewarded beyond their wildest expectations.

It’s Logical to Expect Gold to Move +75% by this Rationale

end of segment

editorial department is separate from promotions department

our opinions are not our sponsors opinions

not financial advice

Buy Gold and Silver (a new class of millionaires will emerge from stacking gold and silver)

Convert fiat Government issued currency into Gold and Silver Money

Become your own Central Bank