Don't Miss the Mining Stock Moon Shot: Buy Now as Prices Hit Historic Lows

Gold and Silver: The Twin Pillars of Financial Stability Amidst Imperial Collapse

What’s Going on?

Presenting Problem

33.7 trillion dollar debt.

Another Government shutdown looming.

Inflation (though the government claims it is cooling) is getting ready for round two because China, Japan, and most of the BRICS have offloaded their US Treasuries, which means they come washing back to US shores, the beginning of hyperinflation.

As of September 2023, maintaining the debt costs $879 billion, which will soon be 20% of the total federal spending.

Think of all the spending (some has gone to great things like our highways, National Parks, and other critical infrastructure). Then think of interest payments exceeding all these great things.

Interest payments now exceed all of these line items below:

Social Security, Medicaid, Medicare, Veteran’s Benefits, Earned Income Tax credit, Supplemental Nutrition Assistance Program, Dept. of Education, Dept. of Transportation, Dept. of Environment, IRS.

Interest payments now exceed Army, Navy, Air Force, Marines, and The Coast Guard COMBINED.

The Commercial Real Estate Disaster will set off what mainstream media may call The Greater Financial Collapse (relative to 2008)

Keep in mind TARP was a $700 billion bailout program authorized by the U.S. Congress in October 2008 to stabilize the U.S. financial system during 2008, and today, interest in servicing the debt again is a whopping $879 billion.

So What?

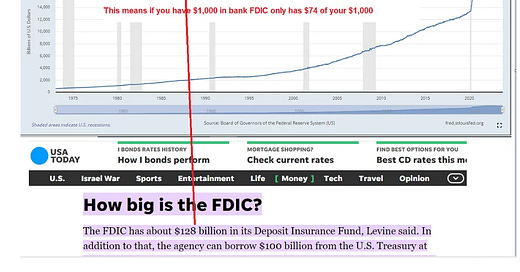

Look at the graphic below.

It shows total deposits in typical US commercial banks at $17.34 Trillion.

Yet there is only 128 Billion in the FDIC Fund.

This means US government and banking deposits are insolvent because funds in FDIC cover .74 of our collective deposits.

Given the simple math (ratio), this means if you have $1,000 in the bank, all of it is wiped out, but you may be able to recover $74 out of your $1,000

Now What?

We have no choice but to start thinking critically. History is our best friend when taking on this challenge. What we live through now has only happened about 6 or 7 times.

This gives us a great advantage because our sample size is large enough to be reliable but not so exhausting that we won't discover what's hidden in these facts.

We don't have to look through libraries, unfurl maps, or get some advanced degree.

Building an IKEA shelf takes more work than examining the simple theme below.

The lesson of the story is simple. The solution is right before our eyes; we just have to open them. We only have to tap into our beautiful brains housed in our skulls.

Rome

Era: 2nd century AD to 5th century AD

War expansion: Rome conquered a vast empire, which stretched from Britain to North Africa to Mesopotamia. This required a large and expensive military.

Colonialism: Rome exploited its colonies for resources and taxes. However, this also required a large and expensive administrative bureaucracy.

Bankruptcy: Rome's war expansion and colonialism eventually led to bankruptcy. The empire was unable to afford its military and administrative costs.

Portugal

Era: 15th century to 19th century

War expansion: Portugal established a global empire, which included colonies in Africa, Asia, and South America. This required a large and expensive navy.

Colonialism: Portugal exploited its colonies for resources and taxes. However, this also required a large and expensive administrative bureaucracy.

Bankruptcy: Portugal's war expansion and colonialism eventually led to bankruptcy. The empire was unable to afford its navy and administrative costs.

Spain

Era: 16th century to 19th century

War expansion: Spain established a vast empire, which included colonies in North America, South America, and the Philippines. This required a large and expensive military.

Colonialism: Spain exploited its colonies for resources and taxes. However, this also required a large and expensive administrative bureaucracy.

Bankruptcy: Spain's war expansion and colonialism eventually led to bankruptcy. The empire was unable to afford its military and administrative costs.

Dutch

Era: 17th century to 18th century

War expansion: The Dutch established a maritime empire, which included colonies in Africa, Asia, and the Americas. This required a large and expensive navy.

Colonialism: The Dutch exploited their colonies for resources and taxes. However, this also required a large and expensive administrative bureaucracy.

Bankruptcy: The Dutch maritime empire eventually collapsed due to a combination of factors, including bankruptcy. The Dutch were unable to afford their navy and administrative costs.

France established a vast empire in the 17th and 18th centuries, which included colonies in Africa, Asia, and North America. This required a large and expensive military.

France also exploited its colonies for resources and taxes. However, this also required a large and expensive administrative bureaucracy.

France eventually went bankrupt in the early 19th century due to a combination of factors, including the cost of its military and administrative bureaucracy.

However, gold prices remained stable after the collapse of the Rome, Portugal, Spain, Dutch & French empire. This is because gold and silver are the only safe haven assets. Every single time in history value it steps up to do the accounting for all the other monetary mistakes.

United Kingdom

Era: 18th century to 20th century

War expansion: The UK established a global empire, which included colonies in Africa, Asia, and North America. This required a large and expensive military.

Colonialism: The UK exploited its colonies for resources and taxes. However, this also required a large and expensive administrative bureaucracy.

Bankruptcy: The UK's war expansion and colonialism did not lead to total bankruptcy and this is another subject. However, the UK did lose its privilege of being the world reserve currency.

How gold and silver stabilized then soared after each collapse

Gold and silver are the only safe assets when Empires act like Rome. In Rome, The Ruling class held over 90% of the wealth. The villagers suffered because The Ruling Class's ambitions and agendas were not in the villagers' interest.

You will hear us talk about the Parasitic Class. You can switch out these three terms (Political Class, Ruling Class, or Parasitic Class). They are all one and the same.

Gold and silver are physical assets that cannot be counterfeited, printed, inflated, or destroyed.

Gold and silver are in limited supply, have the most valued industrial and monetary value. None of the other elements or minerals have these characteristics.

Gold has by far the longest history of being used as money, a store of value, portable, divisible, and fungible (weird word meaning interchangeable with other goods or assets) like the BRICS gold for oil program that is challenging the US right now.

As a result of these factors, gold prices tend to remain stable. When they go on bull runs, the magnitude is often 9 to 10 times, occurring in economic downturns and political instability.

In the case of the Roman, Portuguese, Spanish, Dutch, French, and British empires, gold remained stable and soared after each collapse because gold was seen as a safe haven asset. Investors and governments alike turned to gold to preserve their wealth during these times of turmoil. Central banks throughout the world are buying gold in record volumes (you should do the same; do as they do, not what their media branches advise)

US is actually worse than the 6 cases before because of volume of debt and the aforementioned empires did not have social media - LOL

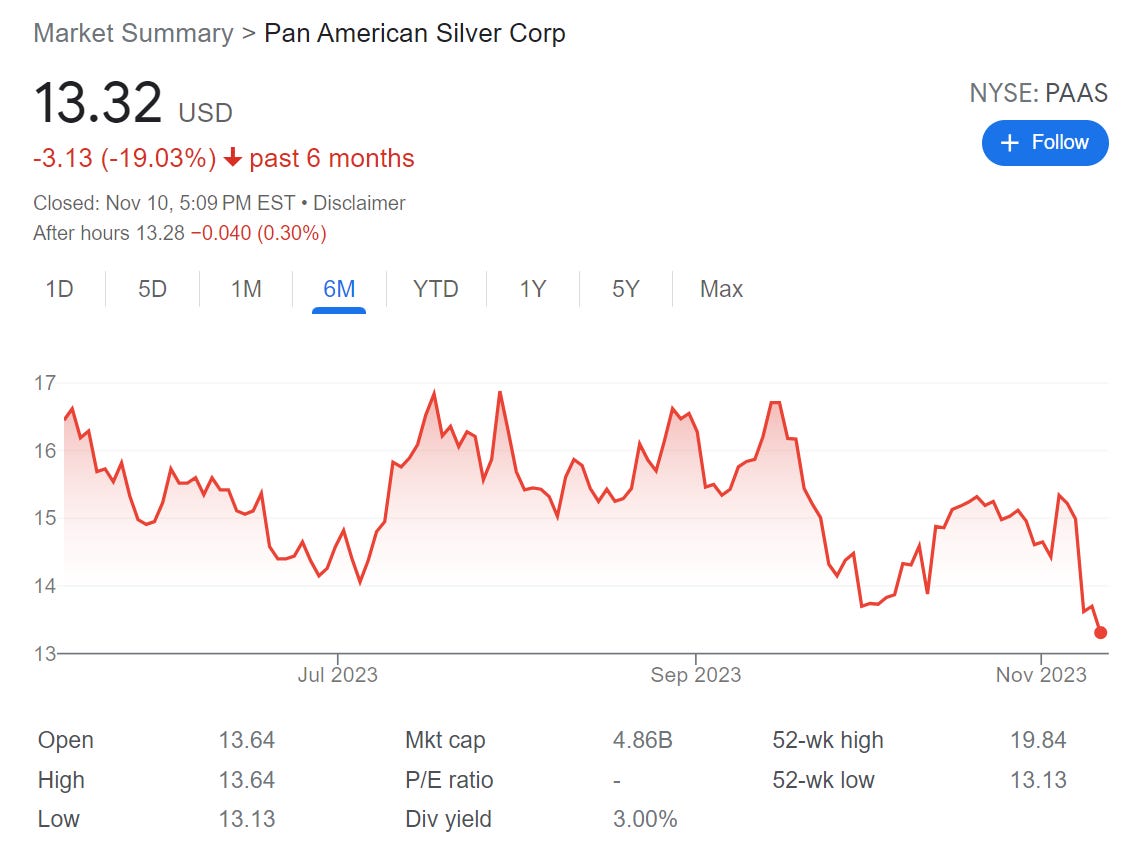

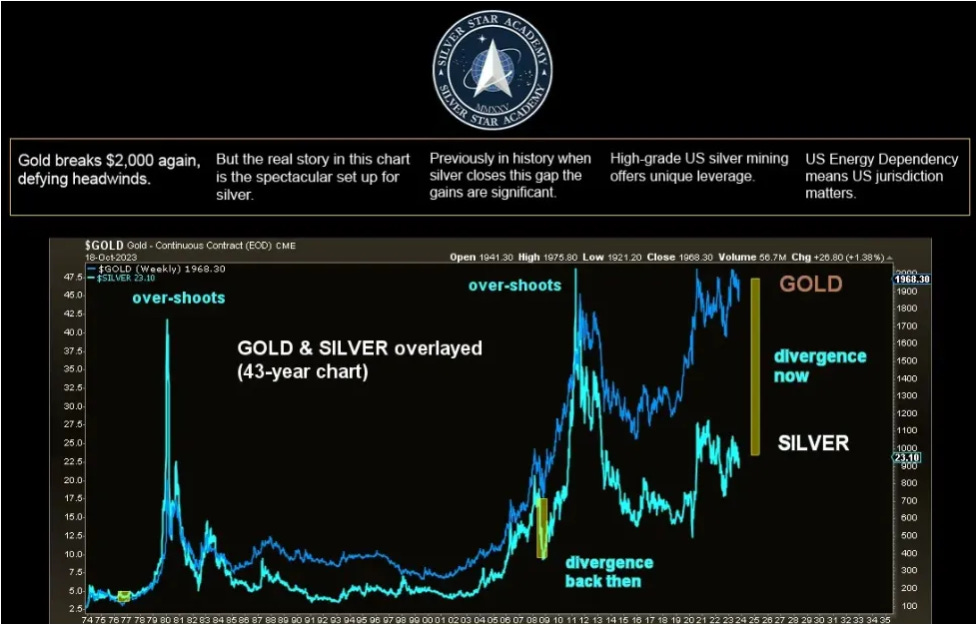

Silver is on sale. Look at these screen shots below

Silver and Gold below ground compared to where silver and gold are headed

Here is what these screenshots above indicate.

First thing Monday Morning.

Locate the Trading App on your phone or laptop.

Punch in Scottie Resources Corp

Ticker SCTSF (or the others listed below)

Hit BUY and just wait 6 to 9 months.

You bought close enough to the bottom

Google Dollar Cost Averaging if you want to be a pro.

Buy and Hold

Hecla Mining Company

Hercules Silver

Summa Silver

Outcrop Silver and Gold

Dolly Varden Silver Corp

West Red Lake Gold

Scottie Resources Corp

KUYA Silver (Pixy Video tomorrow on MineralWEALTH)

Pickaxe Projections

are assessed across six key categories

Macro Economics (e.g., market price of silver and gold)

Jurisdiction

Management

Financials

Engineering / Metallurgy

Geology / Ore grade

Disclaimer / Disclosure

Information contained herein has been obtained from sources believed to be reliable, but there is no guarantee as to completeness or accuracy. Because individual investment objectives vary, this Summary should not be construed as advice to meet the particular needs of the reader. Any opinions expressed herein are statements of our judgment as of this date and are subject to change without notice. Any action taken as a result of reading this independent market research is solely the responsibility of the reader.

The Pickaxe & MineralWEALTH is not and does not profess to be a professional investment advisor, and strongly encourages all readers to consult with their own personal financial advisors, attorneys, and accountants before making any investment decision. The Pickaxe & MineralWEALTH and/or independent consultants or members of their families may have a position in the securities mentioned. Mr. Little does consult on a paid basis both with private investors and various companies. Investing and speculation are inherently risky and should not be undertaken without professional advice. By your act of reading this independent market research letter, you fully and explicitly agree that The Pickaxe & MineralWEALTH will not be held liable or responsible for any decisions you make regarding any information discussed herein.

Greetings once more. Quick question. Is the content on Pickaxe and Silver Academy mostly the same? Do paid subscribers need to have a paid subscription to both to ensure they are getting all content? I note in the free versions the bulk of content provide via Silver Academy and Pickaxe are very similar. So is the same true for paid subs.

I don’t have any issues paying for both if there is unique content on both. But I don’t want to pay for both if there is no reason to do so. Thanks.

Ok. I finally got around to paying for a subscription after lurking for a bit. The content is stellar. And I’m in love with Pixy.

This morning I added Scottie Resources to my holdings. I also added shares in West Red Lake and Summa, both of which I already owned before I started following you all. I don’t have the liquidity to add all of your ideas (well I have it, but I’m keeping my total equity exposure across all categories at 25% or below) but I will likely do some more research and choose a couple others.

And, not unexpectedly and akin to every one of my junior resource firms (except as noted below) the additions are already in the red for the day, and certainly for the time I have owned them.

One exception is Radisson Mining $RMRDF. While it is down 2.3% today, YTD it is up nearly 10%. Stellar performance, given that my other holdings range from -2% to -45%.

My dad died 2 years ago at age 96. He was an avid coin collector, a sometimes stacker, and he had an IRA that he used to invest in Jr Miners. I inherited that, kept most of what he had in there as a legacy, sold a couple of -80s, then added a few of my own. No doubt he is turning over in his grave at how bad the market is. I’d love to be able to ask him whether he would be continuing to hang on, even though the portfolio is down nearly 50% since I got it. And to think that in March of 2021 it was up 22% I thought he was a genius…now that it’s down 60%+ from the highs his genius designation is on hold. LOL.

But, the beauty of the inherited IRA is threefold. 1. Zero of my own Capitol. 2. 10 year timeframe before it needs to be emptied (and I’m slowly emptying it already to avoid paying taxes when it eventually turns around. 3. Despite the losses it reminds me of my dad every day. I sure miss his counsel.

Keep up the great work. Eric V. S/V Blessings.