Creative Accounting Indeed: Citigroup's recent revelation of $94.93 billion in "securities sold, not yet purchased"

Can you Believe Janet Yellen was right for once. Beware of Banking Sector's Fraudulent Schemes.

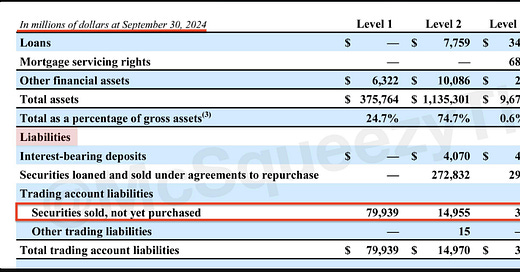

Citigroup's recent revelation of $94.93 billion in "securities sold, not yet purchased" is yet another glaring example of the financial industry's penchant for creative accounting. This staggering figure, which represents a massive short position, raises eyebrows and questions about transparency and risk management in banking practices. While regulators demand meticulous reporting on long positions, these opaque short positions seem to slip through the cracks, allowing banks to engage in speculative behavior without the same level of scrutiny.

The term "securities sold, not yet purchased" essentially means that Citigroup has received cash for securities it doesn't actually own—an arrangement that could easily lead to market manipulation or, at worst, outright fraud. The fact that such practices are legal is a testament to the regulatory environment that often prioritizes the interests of financial institutions over those of the average investor.

As we watch these colossal figures fly under the radar, one must wonder: how much longer will we tolerate a system where banks can gamble with our money while cloaked in jargon that obscures their true activities? This isn't just an accounting trick; it's a symptom of a deeper malaise within our financial system that desperately needs reform.

Fractures in Banking System (Remember two weeks ago when Janet Yellen warned everyone about pervasive fraud in Banking Sector?)

The banking sector is currently facing significant systemic risks that demand our immediate attention. While the Warren Buffett indicator (Wilshire 5000 to GDP ratio) soaring above 200% signals potential overvaluation in the stock market, a more pressing concern lies within the banking system itself.

Recent analyses reveal that unrealized market-value losses on banks' securities and loan investments have accumulated to over $1.5 trillion as of September 2023.

These losses, largely stemming from aggressive stimulus policies and subsequent interest rate hikes, have eroded more than 70% of the banking system's reported Tier 1 regulatory capital.

Alarmingly, banks holding 54% of total assets in the system now have mark-to-market adjusted Tier 1 leverage ratios below the 4% regulatory threshold for "undercapitalized" status.

The situation is exacerbated by the procyclical nature of systemic risk, where risks build up over time and remain hidden until strains develop

“This creates a dangerous cycle where complacency regarding risk itself becomes a source of risk.” - Jon Forrest Little

While regulatory measures like Basel III aim to strengthen bank capital and liquidity requirements, they may not be sufficient to address the full scope of systemic risk.

The interconnectedness of large banks and their engagement in market-based activities further amplify the potential for systemic disruption.

As renowned financial experts Jim Rickards, Jim Rogers, Warren Buffett and Ray Dalio have warned, we may be on the brink of a significant banking crash.

However, this crisis also presents opportunities for astute investors. Silver, currently trading around $30 per ounce, remains well below its all-time high and could potentially double or triple in value.

In these uncertain times, diversifying one's portfolio with tangible assets like silver coins could prove to be a prudent strategy. The key is to act decisively on this knowledge, as inaction in the face of impending financial turmoil could prove costly.

As we navigate these treacherous muddy financial waters, it's crucial to remain vigilant, accumulate gold and silver. This is the best practice against systemic banking risks. The coming months may well determine who sinks and who swims in this volatile economic environment.

Stanley Druckenmiller, the legendary investor known for his macroeconomic insights, has recently been accumulating gold in his portfolio. This move aligns with his cautious outlook on the current economic landscape.

Druckenmiller's interest in gold reflects his concerns about potential inflation risks and the long-term consequences of expansionary monetary policies.

While Druckenmiller has sold his entire stake in Nvidia, citing overvaluation in the AI sector, he has been increasing his exposure to gold as a hedge against economic uncertainties.

This shift in strategy underscores his belief in gold's role as a safe-haven asset during times of market volatility and currency devaluation.

Druckenmiller's gold accumulation serves as a noteworthy indicator for investors closely monitoring macroeconomic trends and seeking to protect their wealth in an uncertain financial environment