CME Group Invests Millions in Golf Sponsorship: Integrity or Irony

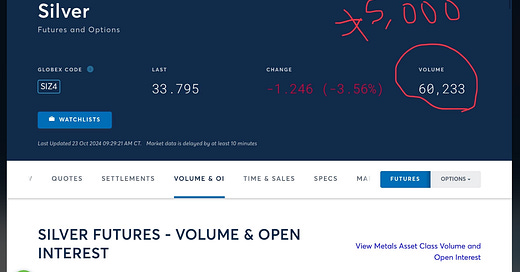

300 million shares dumped this morning to smash the silver price down. Buy the dip!

by Jon Forrest Little

The merger between CME Group (which included the Chicago Mercantile Exchange) and COMEX (Commodity Exchange, Inc.) occurred in 2008, not as a direct merger but as part of a larger acquisition

In 2008, CME Group acquired NYMEX Holdings, Inc., which was the parent company of both the New York Mercantile Exchange (NYMEX) and COMEX

This acquisition effectively brought COMEX under the CME Group umbrella, creating one of the largest and most diverse derivatives marketplaces in the world.

While the merger was publicly announced and approved by shareholders, almost all aspects of the deal raised concerns about transparency and the formalizing of theft ( aka potential conflicts of interest)

The merger further consolidated power in the derivatives market, giving CME Group control over an unprecedented range of futures and options contracts. This concentration raised concerns about reduced competition and the potential for market manipulation.

With such a large and complex organization, regulators faced challenges in effectively overseeing all aspects of CME Group's operations. The sheer size and scope of the combined entity made it difficult to detect and prevent potential abuses.

Pricing Influence

The merger gave CME Group absolute influence over pricing in multiple commodity markets, including precious metals traded on COMEX. This power would be used to benefit certain market participants at the expense of others.

Conflicts in Clearing. Most speculate there is NO SILVER REMAINING

New Data shows there are over 400 paper versions of Silver for every unit of Physical Silver

As both an exchange operator and a clearing house, CME Group faced potential conflicts of interest. The company could theoretically use its clearing operations to gain insights into trading patterns and positions, which could be exploited for profit.

The combined entity had access to vast amounts of trading data across multiple markets. Questions arose about how this data might be used and whether it could give CME Group or its favored clients an unfair advantage.

The merger complicated the existing membership structures of the exchanges, potentially disadvantaging some long-time members while benefiting others. The process of integrating different membership tiers and rights was not always transparent.

Market Making Activities

There were concerns about how market making activities would be managed across the combined platforms, and whether certain firms would receive preferential treatment.

While these issues were not necessarily unique to this merger, the scale and importance of the combined entity magnified their potential impact on global financial markets.

The opaque nature of some aspects of the deal left many market participants and observers questioning whether all potential conflicts had been adequately addressed.

Market Maker Funds Honor System: CME's Curious Golf Alliance

CME Group has sponsored the LPGA Tour Championship since 2011. The purse has grown significantly, from $1.5 million in 2011 to $7 million in 2022. For 2024, it will reach $11 million, with a $4 million winner's prize.

Golf is widely celebrated for its unwavering emphasis on integrity and self-regulation. Players are expected to uphold the rules, often calling penalties on themselves for even the most minor infractions.

In golf, every player must putt out, even short putts, to uphold integrity and protect the entire field. This contrasts sharply with local weekend games, where players often give each other "gimmes."

This commitment to honesty forms the very foundation of the sport, creating an environment where trust prevails. Each player navigates the course with a keen sense of accountability, plotting their way around obstacles and making strategic decisions that reflect both skill and character.

In stark contrast, the 2008 acquisition of NYMEX Holdings, which included COMEX, by CME Group raised significant concerns about market consolidation and potential conflicts of interest. Unlike golf, where actions are transparent and rules are straightforward, the financial world can often be shrouded in complexity. The merger created a vast entity that required extensive regulatory oversight to ensure fair practices, yet the intricate nature of financial instruments can obscure clarity.

As golfers face challenges on the course—deciding whether to play conservatively or take calculated risks—the CME Group's motives in acquiring COMEX were framed as efforts to address market inefficiencies. However, this consolidation also introduced new challenges that could undermine fairness. The merger concentrated significant power within a single organization, raising questions about the potential for market manipulation and reduced competition.

Moreover, the size and complexity of the combined entity made effective regulatory oversight increasingly difficult. As both an exchange operator and a clearing house, CME Group found itself in a position where conflicts of interest could easily arise. The access to vast amounts of trading data across multiple markets further complicated matters, leading to concerns about whether all participants could compete on an equal playing field.

While golf exemplifies individual integrity and the art of problem-solving, the CME Group's acquisition of COMEX represents a complex financial maneuver with far-reaching implications for market structure and regulation.

This contrast starkly highlights the challenges of maintaining transparency and fairness in a world where financial power is increasingly concentrated. In the end, as golfers strive for excellence through personal accountability, the financial markets must grapple with the consequences of consolidation that can obscure integrity in pursuit of profit.

Concluding thoughts

CME Group sponsoring golf, a game renowned for integrity, is akin to a pack of foxes volunteering to guard a chicken farm. Just as foxes have a natural inclination to prey on chickens, CME Group's involvement in complex financial instruments and market operations raises questions about conflicts of interest. Golf demands honesty and self-regulation from players, while CME Group operates in a world where oversight is crucial yet the key players on the CME tour are frauds and thieves. They are cheating (google people put in jail for manipulating the price of silver)

The irony lies in a derivatives marketplace giant aligning itself with a sport that prides itself on transparency and fair play. This sponsorship, while beneficial for women's golf, creates a stark contrast between the values of the sport and the perceived practices of high finance.

The Shanghai Gold Exchange offers an alternative to Western-dominated precious metals markets. Unlike CME Group's COMEX, (having a 400-1 paper to physical ratio) faces our scrutiny for its market concentration and potential conflicts, the Shanghai Gold Exchange emphasizes physical gold and silver delivery and aims for greater transparency.

This exchange represents China's efforts to increase its influence in global gold pricing and provide a counterbalance to established Western exchanges.

For investors seeking alternatives to traditional markets, the Shanghai Gold Exchange offers a different approach to gold trading and price discovery.

——————————————-

Our opinions are not our sponsors opinions.

The views expressed on TheSilverIndustry.substack.com are not necessarily those of the Silver Academy.

BTW its absolutely imperative that "gimmes" become more prevalent. I am sick and tired of playing behind a 30-handicapper (or a 2-3) lining up a 3rd putt from 2 feet away. Its ruining our planet, and more importantly adding an hour to the worlds most important events that should take 3 hours (or thereabouts) as opposed to 5 hours. Not sure why the politicos have not ran on this. These (often overweight and low IQers) should be banned.