Citigroup Layoffs: 24,000 Jobs. The Kickoff to the Great Recession. And So it Begins.

The bank also took roughly $1.7 billion in charges related to a special assessment from the FDIC to cover last year's regional bank failures

Backdrop - The US is fighting about 9 wars right now:

1. Next month will be the 2nd-year mark of the US war against Russia, and I've yet to see one Protest sign at a College Campus "US out of Russia." This war like all 57 undeclared wars since WW2 has been normalized and US citizens are desensitized.

2. US in a war in Gaza

3. US Strikes against Iranian-backed Houthis in Yemen.

4. US Gearing up for Standoff against China over Semiconductors

5. These are unending wars

6. Expect to see a tenfold uptick in the Villager Wars at Home with SUVs crashing into small retail many more mass shootings, marked by massive swaths of people without any chance of hell of meeting "quality of life" necessities (food, shelter, healthcare, retirement.) The Political Class will spend billions on the next election cycle. There will be no substantive reforms, just annoying TV ads promising change.

7. Political Wars in DC that have yielded a Congressional approval rating of now under 5%

8. New wars against inflation (as over half the world is busy De-Dollarizing.) Other nations are dropping US Treasury like a hot potato. The 2nd wave of inflation will be beyond the help of the self-serving Central Bankers who will stand at the shores like the helpless Dutch boy trying to plug up the Dam of dollars flooding into circulation at home.

9. But today's article is about our war to survive.

Here is a Pro Tip

Hold on to Your Gold

Never Surrender Your Silver

Here is news yesterday from Citibank, and below that, I want to show you a chart indicating that the FDIC has less than 1% of Our Deposits covered.

If I ran a business, I would have earnest board room discussions about moving cash positions into Gold and Silver ASAP.

In a landscape of shifting interest rates, the looming threat of inflation, and persistent banking vulnerabilities, traditional financial instruments hang on the edge. In these critical times (US in wars with the need for a rock-solid anchor is undeniable. Enter gold – your unwavering ally to sail through these turbulent financial waters. Secure your course with gold.

Citigroup's Financial Turmoil

Citigroup CEO Jane Fraser's bold restructuring plan is wreaking havoc on the bank's finances, incurring costs in the hundreds of millions before any expected savings materialize.

Preparing for a Financial Storm: Fourth-Quarter Earnings Warning

As Citigroup gears up to report its fourth-quarter earnings this Friday, a red flag has been raised. In a late Wednesday regulatory filing, the bank issued a stark warning to investors about significant charges denting revenue and profits in the last quarter of the year. A staggering $780 million hit to profits stems from the ongoing organizational overhaul, encompassing severance packages and structural changes involving reported layoffs of approximately 24,000 employees.

Upfront Costs for a Future Financial Facelift

While the immediate costs may be substantial, Chief Financial Officer Mark Mason insists they are crucial. Mason's message to colleagues, prominently displayed on the company's website, emphasizes that these upfront expenditures are the key to reducing future expenses, streamlining the corporate structure, and fortifying the bank's client-centric approach.

Citi's Dilemma: Lowest Market Value, Lingering Struggles

As the third-largest U.S. bank by assets, Citigroup finds itself in a precarious position. Opting for its most extensive corporate restructuring in nearly two decades, the aim is clear – trim costs, boost profitability, and elevate the stock price. Yet, the bank faces the harsh reality of having the lowest market value among its competitors. Persistent challenges, including falling profit margins and weak stock performance over the years, underscore the urgency of the restructuring efforts.

Shareholder Concerns: Pre-market Trading Takes a Hit

The disclosure of these financial troubles has immediate repercussions. Citi shares experienced a more than 1% decline in pre-market trading yesterday, signaling shareholder concerns and the broader impact on market perception.

Federal Intervention and Escalating Expenses

Adding fuel to the fire, Citigroup revealed an unexpected $1.7 billion charge to its operating expenses. This is linked to a special assessment by the Federal Deposit Insurance Corporation, aiming to recover uninsured deposit losses from regional banking failures in the preceding year. The figure surpassed both Citigroup's initial estimate of $1.5 billion and the revised $1.65 billion projection presented to investors weeks ago.

The Elephant in the Room: Reserves Swell Amidst Global Risks

However, the most alarming revelation lies in the addition of $1.3 billion to Citigroup's reserves. This move is a response to escalating risks in Argentina and Russia, reflecting the bank's proactive stance to shield itself from potential fallout. The devaluation of the Argentine peso led to an $880 million loss in revenues in the fourth quarter, setting the stage for further financial turbulence.

Argentina's Looming Crisis: Citi's Exposure and Market Impact

As Argentina braces for approximately 200% inflation on Thursday, Citigroup's net exposure in the country becomes a critical factor. As of September 30, the net exposure stood at approximately $1.3 billion, down from $1.6 billion at the end of June. This unfolding economic crisis adds another layer of urgency to Citigroup's already tumultuous financial landscape.

In the face of these challenges, Citigroup stands at a crossroads, navigating a path fraught with financial uncertainties and the imperative to regain market confidence.

When you make a Deposit in the Bank it is no longer your money but you are making an unsecured loan to the bank

Exploring Banking Realities: Rethinking the Notion of Deposits as Unsecured Loans

In the realm of banking, the commonly held belief portrays these financial institutions as deposit-taking entities, entrusted with safeguarding funds and facilitating loans. However You are not making a Deposit. By Law you are handing the bank an unsecured loan and they have no legal responsibility to keep any of your money in reserves. ZERO

In the extensive 5,000-year history of banking, studies have been conducted to substantiate the prevailing perception that banks function as deposit-taking institutions while also engaging in lending activities. However, a closer examination of the legal framework reveals a striking contrast to this common belief. The legal reality challenges the notion that banks take deposits and lend money, asserting that they do neither.

The term "deposit," traditionally associated with a secure placement of funds within a bank, is debunked by legal intricacies. Contrary to the conventional understanding, a deposit is not a bailment and is not held in custody at law.

Legal authorities, including courts and various judgments, unequivocally declare that when individuals provide money to a bank under the label of a deposit, it essentially constitutes a loan to the bank. This legal perspective renders the term "deposit" devoid of substantive meaning.

Deposit Clarification: The term "deposit" is deemed meaningless in legal terms. Courts and judgments emphasize that money given to a bank is essentially a loan.

Deposit as Record of Debt: What is commonly called a "deposit" is revealed to be the bank's record of debt to the public, challenging traditional understanding.

explained by Professor Richard Werner who is blacklisted by The Parasitic Class

Smoke and Mirrors. Banks are Insolvent. FDIC Receivership is a SCAM. Here’s Why?

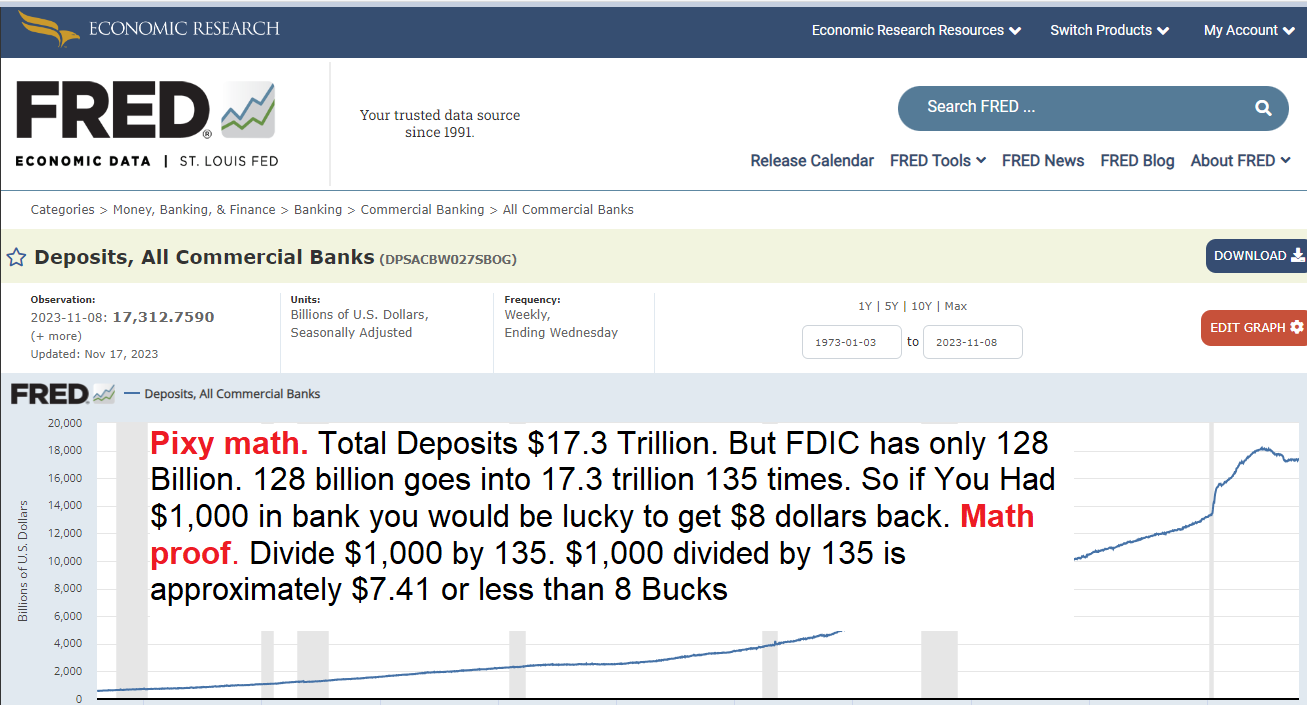

Look at the graphic below.

It shows total deposits in typical US commercial banks at $17.34 Trillion.

Yet there is only $128 Billion in the FDIC Fund.

This means US government and banking deposits are insolvent because funds in FDIC cover .74% of our collective deposits. That’s far less than 1%

Given the simple math (ratio), this means if you have $1,000 in the bank, all of it is wiped out, but you may be able to recover $7.41 out of your $1,000

Math formula below

Conclusion