China: 40 Banks Disappeared in ONE WEEK. Non Performing Loans the Root Cause. Situation is Much Worse in USA

Withdraw your Money Before it's Too Late. Convert Federal Reserve Notes into Silver

40 Banks closed in one week (Let that horrific data point sink in)

-Due to exposure from commercial real estate (sound familiar, we’ve written over 15 articles on this very subject

- Plus in US $233 Trillion in derivative exposure (and only 5 banks) if you added them all up the number gets into the quadrillions

-Remember if you spend 1 million dollars every day it would take approximately 2739.73 years to spend 1 trillion dollars at a rate of 1 million dollars per day.

Yesterday, in front of Jiangxi Bank in China, investors protest.

On June 29, people gathered in front of Jiangxi Bank, and shouted "Return my Money".

On July 4, Jiangxi Bank's financial products have defaulted, involving more than 2,200 investors with a total amount of about several billion yuan. The customers are mainly local residents of Nanchang.

Spend 10 seconds listen to the volume of the Angry Mob (Their Money Gone)

This Will Happen in USA too, keep reading as you see the root problem is banks making Non Performing Loans as assets passed off to another bank in overnight swaps

Jiangxi Bank of China goes under

China's banking sector is facing a full-scale crisis. In just one week:

40 banks disappeared, absorbed into larger institutions.

Today, Jiangxi Bank of China went under, further escalating the crisis. China's smaller banks are struggling with bad loans and exposure to the ongoing property crisis.

Scope of the Problem Some 3,800 such troubled institutions exist. They have 55 trillion yuan ($7.5 trillion) in assets—13% of the total banking system—and have long been mismanaged, accruing vast amounts of bad loans. Many have lent to real estate developers and local governments, gaining exposure to China’s property crisis.

In recent years, some have revealed that 40% of their books are made up of non-performing loans. Bank of Jiujiang, a mid-tier lender, recently revealed that its profits might fall by 30% due to poorly performing loans. This rare disclosure highlights the severity of the situation. The authorities have been pushing for more transparency, but the true extent of the bad debt problem is still emerging. The four state AMCs created to manage bad debts are now struggling themselves, with one needing a $6.6 billion bailout in 2021.

Disappearing Banks! China’s main way of dealing with small, feeble banks: making them disappear. Of the 40 institutions that vanished recently, 36 were in the Liaoning province and absorbed into a new lender, called Liaoning Rural Commercial Bank, which was created as a receptacle for bad banks. Since it was set up in September, five other institutions have been established to do similar work, with more expected.

The Root Cause: Property Sector Recession and the way all Banks are Structured (Fractional Reserve Banking)Everything riding on a sea of debt:

China's property sector is in a deep recession. Overextended real-estate developers and local governments have defaulted on loans, creating a cascade of financial instability. Property prices have plummeted, and construction projects have stalled, further straining the financial system.

Hidden Bad Debts and Regulatory Crackdown Adding to the complexity, banks have been using asset-management companies (AMCs) to offload toxic loans, creating a facade of stability. These AMCs buy bad loans but avoid taking on the credit risks, leading to a buildup of hidden bad debts. The National Administration of Financial Regulation (NAFR), a new banking regulator, has been cracking down on these practices, issuing fines and increasing oversight.

Meanwhile in USA - same root issue, Non Performing Loans are Passed to another Institution as an Asset

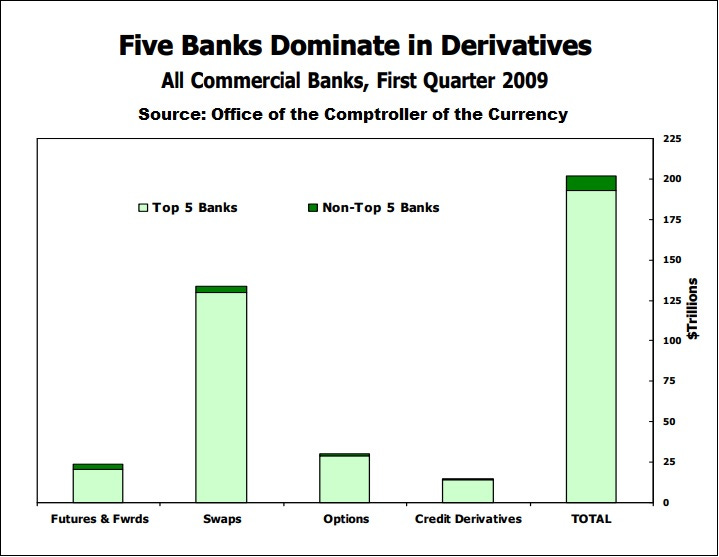

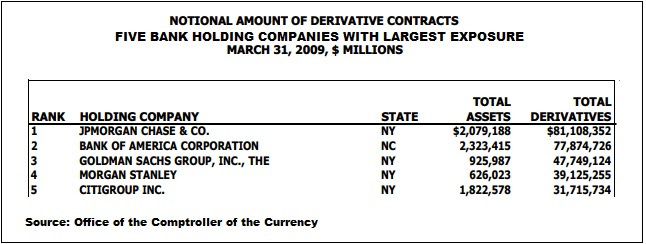

Five Wall Street Banks Hold $223 Trillion in Derivatives — 83 Percent of All Derivatives at 4,600 Banks

By Pam Martens and Russ Martens:

February 13, 2024 ~ originally posted on WallStreetonParade.com

According to the Financial Crisis Inquiry Commission (FCIC), derivatives played a major role in the financial crash of 2007 to 2010 in the United States, the worst financial crisis in the U.S. since the Great Depression of the 1930s. The FCIC wrote in its final report: “…the existence of millions of derivatives contracts of all types between systemically important financial institutions — unseen and unknown in this unregulated market — added to uncertainty and escalated panic….”

Americans believed that the Dodd-Frank financial reform legislation of 2010 would fulfill its promise of reining in concentrated risks like derivatives. It did not. (See our report from 2015: President Has His Facts Seriously Wrong on Financial Reform.)

According to data from the Office of the Comptroller of the Currency (OCC), the regulator of national banks, as of March 31, 2009, five bank holding companies held $277.57 trillion in derivatives (notional/face amount). At that time, according to the FDIC, there were 8,249 federally-insured commercial banks and savings associations in the U.S. but just five bank holding companies held 95 percent of all derivatives at all U.S. banks. Those financial institutions were: JPMorgan Chase, Bank of America, Goldman Sachs Group, Morgan Stanley and Citigroup.

Now flash forward to the most recent report from the OCC for the quarter ending September 30, 2023. According to that report, those same five bank holding companies hold $223 trillion of the $268 trillion in derivatives held by all banks in the U.S., or 83 percent.

Equally alarming, those same five bank holding companies control 96 percent of the most dangerous form of derivatives – credit derivatives. The five bank holding companies account for $5.8 trillion in credit derivatives versus $6 trillion in credit derivatives for all banks in the U.S.

The Federal Reserve secretly funneled $16 trillion in cumulative loans at below-market interest rates to prop up the Wall Street casino banks from December 2007 through June of 2010, in no small part because of the systemic contagion that spread from their concentrated positions in derivatives.

To prevent a replay of the Wall Street mega banks blowing themselves up as they did in 2008, federal banking regulators in July of last year released a proposal that would impose higher capital rules on just 37 banks (out of the 4,600 banks in the U.S.). The proposed new capital rules would impact just those banks significantly engaged in derivatives and other high-risk trading strategies.

The backlash has been fierce from Wall Street’s mega banks, with the banks even running television ads painting a bogus and distorted picture of what the capital increases would do.

Another major area of concern is who is on the other side of these derivative trades with the mega banks – their so-called “counterparty.”

According to federal researchers, there are both mega bank counterparties as well as “non-bank financial counterparties” – which could be insurance companies, brokerage firms, asset managers or hedge funds. There are also “non-financial corporate counterparties” – which could be just about any domestic or foreign corporation. To put it another way, the American people have no idea if they own common stock in a publicly-traded company that could blow up any day from reckless dealings in derivatives with global banks.

Wall Street has a history of blowing up things with derivatives. Merrill Lynch blew up Orange County, California with derivatives. Some of the biggest trading houses on Wall Street blew up the giant insurer, AIG, with derivatives in 2008, forcing the U.S. government to take over AIG with a massive bailout.

According to documents released by the Financial Crisis Inquiry Commission, at the time of Lehman Brothers’ bankruptcy on September 15, 2008, it had more than 900,000 derivative contracts outstanding and had used the largest banks on Wall Street as its counterparties to many of these trades. The FCIC data shows that Lehman had more than 53,000 derivative contracts with JPMorgan Chase; more than 40,000 with Morgan Stanley; over 24,000 with Citigroup’s Citibank; over 23,000 with Bank of America; and almost 19,000 with Goldman Sachs.

We are asking our readers to do their part to stop Wall Street mega banks and their legions of lobbyists from gutting the proposed capital rules. Please contact your U.S. Senators today via the U.S. Capitol switchboard by dialing (202) 224-3121. Tell your Senators to demand that banking regulators hold firm on the stronger capital rules for the casino banks on Wall Street.

end of section

Root cause of Bank Failures is that everything rides on a sea of debt.

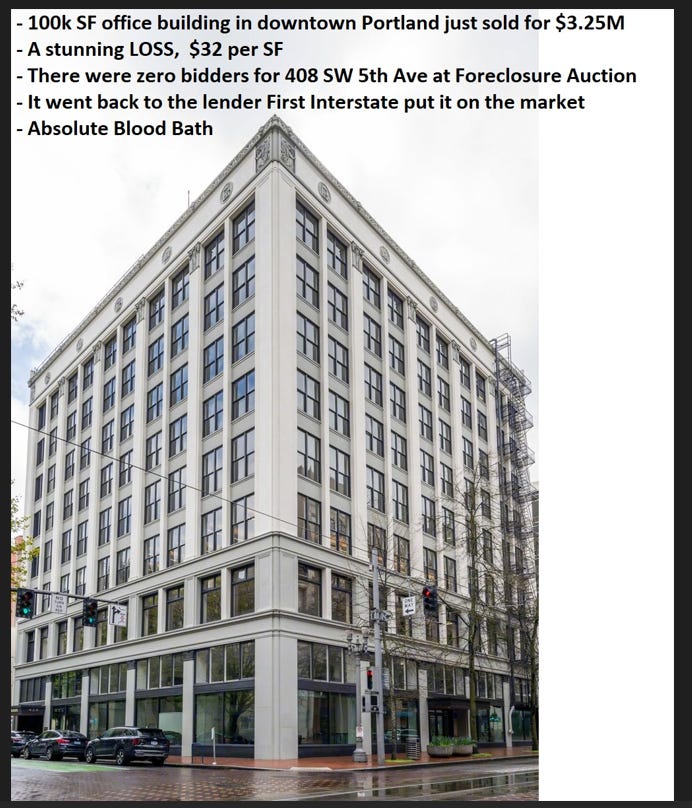

Our commercial real estate watch list is happening and expanding so fast we don’t have time to document them all. They started in San Francisco then spread quickly to DC, New York, Houston, Austin, Seattle, Los Angeles, Miami, Las Vegas

Now This just happened in Portland

For single-story office buildings, the average cost is approximately $313 per square foot.

For mid-rise office buildings, the cost increases to about $562 per square foot.

For high-rise office buildings, the average cost is around $660 per square foot.

San Francisco is Collapsing: 2 largest hotels have lost STAGGERING $1+ BILLION in value since 2016. SF is a WARZONE

San Francisco's 2 largest hotels have lost a shocking $1+ BILLION in value since 2016 The Union Square and Parc 55 Hotels were valued at $1.56B in 2016 but their value has plunged to $554M according to Kroll Bond Rating Agency This is absolutely troubling times for the city as values of all types of commercial real estate have fallen off a cliff.

Commercial Office Buildings are a thing of the past.