Central Banks Intend to Increase their Gold Reserves in the next 12 Months, the Highest Level since survey started in 2018

World Gold Council: 2024 Central Bank Gold Reserves Survey Results

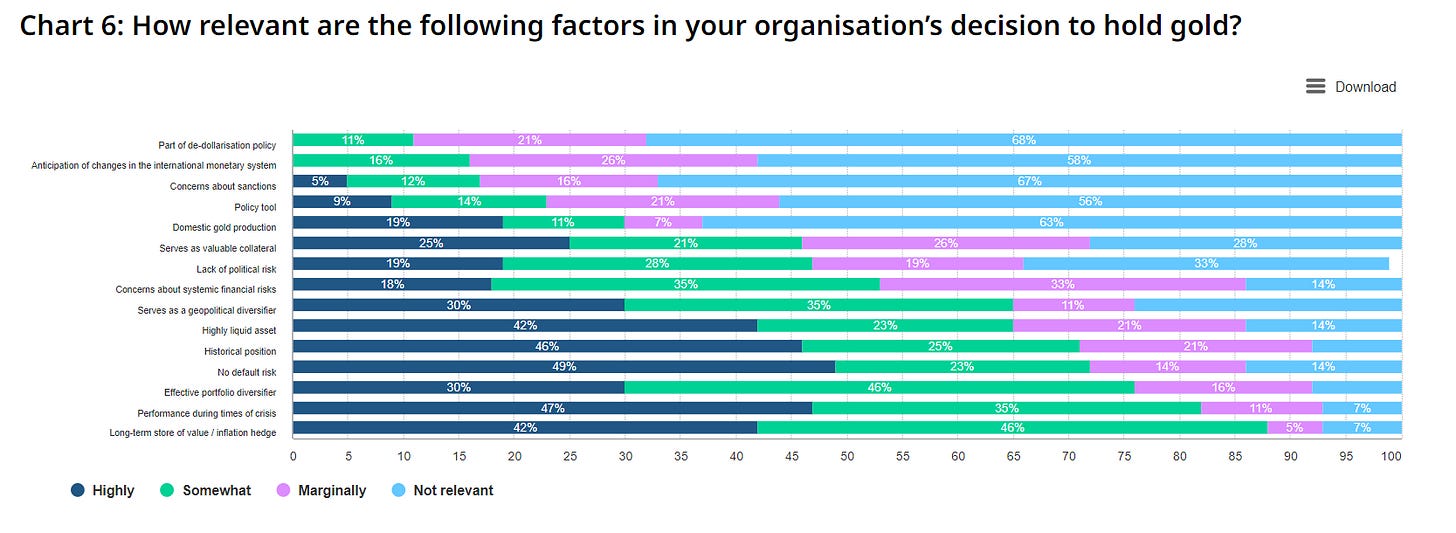

The 2024 Central Bank Gold Reserves (CBGR) survey by the World Gold Council reveals that 29% of central banks intend to increase their gold reserves in the next twelve months, the highest level since the survey began in 2018. This planned buying is primarily driven by a desire to rebalance to a more preferred strategic level of gold holdings, domestic gold production, and financial market concerns including higher crisis risks and rising inflation.

Central banks view gold favorably as a reserve asset, adding 1,037 tonnes in 2023 after a record 1,082 tonnes in 2022, as an increasingly complex geopolitical and financial environment makes gold reserves management more relevant. The survey highlights gold's enduring appeal to central banks as a safe-haven asset amid global uncertainties

Originally published here - https://www.gold.org/goldhub/data/2024-central-bank-gold-reserves-survey

Citations:

[1] https://www.gold.org/goldhub/data/2024-central-bank-gold-reserves-survey

[2] https://www.gold.org/goldhub/data

[3] https://www.gold.org/goldhub

[4] https://www.gold.org/goldhub/data/how-much-gold

[5] https://www.gold.org/goldhub/data/gold-reserves-by-country

[6] https://www.gold.org/goldhub/research/gold-demand-trends