Central & Fractional Reserve Banking. War Profiteering & Currency Debasement.

Getting to the Root of Most of our Problems.

Sunday feature by Carmine Lombardi

Twelve years after 12-year-old Victoria Grant delivered a fiery critique of Canada’s debt-based monetary system at the 2012 Public Banking in America Conference, her warnings about fractional reserve banking and central bank collusion have proven alarmingly prescient. The problems she outlined—soaring national debt, currency devaluation, and wealth transfer to private banks—have not only persisted but intensified, exposing a systemic failure to address structural flaws in global finance.

The Unheeded Warnings

Grant’s speech centered on three pillars: the historical role of the Bank of Canada, the mechanics of modern debt creation, and a path toward reform. She highlighted how Canada’s government abandoned the Bank of Canada’s original mandate—to issue interest-free currency for public benefit—in favor of borrowing from private banks at compound interest. This shift, she argued, trapped Canadians in a cycle of taxation to service ever-growing debt while enabling banks to profit from money “created out of thin air” through loans.

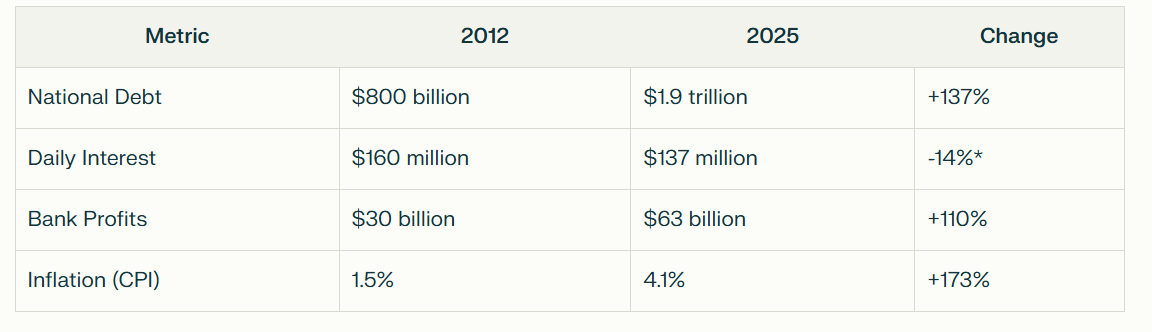

Her analysis aligned with critiques of fractional reserve banking, where banks lend multiples of their reserves. In 2012, she noted Canadian banks held $4 billion in reserves but issued $1.5 trillion in loans—a leverage ratio of 375:1. Today, Canada’s banking sector operates with even thinner reserves, amplifying systemic risk. The national debt, then at $800 billion, now exceeds $1.9 trillion, with annual interest payments surpassing $50 billion, enriching private financial institutions.

Escalating Crises: Debt and Inflation

Grant’s claim that debt-based money fuels inflation has materialized starkly. Canada’s money supply (M2) grew by 37% between 2020 and 2024, far outpacing economic growth. This expansion, driven by bank lending and central bank quantitative easing, correlated with a 17% cumulative inflation rate over the same period—eroding purchasing power and exacerbating wealth inequality. Meanwhile, the top five Canadian banks reported $63 billion in combined profits in 2024, underscoring Grant’s assertion that banks “pad their pockets” at public expense.

*Adjusted for inflation, daily interest costs rose 22% in real terms.

Systemic Complicity and Inaction

Grant accused governments of enabling this system, citing a 1939 exchange between Prime Minister William Lyon Mackenzie King and Bank of Canada Governor Graham Towers. When asked why Canada borrows privately at interest instead of creating money directly, Towers conceded Parliament could reform the system—a power never exercised. Today, political leaders still defer to central banks, despite mounting evidence that austerity and rate hikes disproportionately harm middle- and working-class citizens.

Critics argue this inertia stems from regulatory capture. The “Big Five” Canadian banks spent $27 million lobbying federal officials between 2020 and 2024, while central bankers often transition to lucrative private-sector roles. This revolving door incentivizes maintaining the status quo, even as household debt reaches 177% of disposable income and 48% of Canadians report being “$200 away from insolvency”.

A Path Forward?

Grant’s proposed solution—having the Bank of Canada issue debt-free currency directly—remains legally viable but politically untested.

As Grant concluded, “We are being defrauded and robbed by the banking system and a complicit government.” With debt burdens now threatening intergenerational equity, her challenge endures:

If a 12-year-old could diagnose this crisis, why do those in power persist in denial? The answer may lie less in economic complexity than in political will—or lack thereof.

Is the Dire Situation the Same in USA?

Twelve years after Victoria Grant’s critique of Canada’s debt-based monetary system, the same systemic issues she described have taken root more deeply in the United States, driven by the Federal Reserve’s monetary policies and the mechanics of fractional reserve banking.

Despite warnings from economists and activists, the U.S. government has continued to rely on debt financing, allowing the Federal Reserve and private banks to profit while taxpayers shoulder the burden of rising national debt and inflation.

The Federal Reserve, as the central bank of the United States, has played a pivotal role in this dynamic. By setting interest rates and controlling the money supply, it has enabled unprecedented levels of borrowing. Between 2008 and 2023, the Fed expanded its balance sheet from $900 billion to nearly $9 trillion, largely through quantitative easing programs designed to stabilize financial markets during economic downturns. While these measures temporarily boosted liquidity, they also fueled government borrowing and asset inflation, creating long-term risks.

Today, America’s national debt stands at a staggering $36.2 trillion, up from $16.1 trillion in 2012—a 125% increase in just over a decade.

The cost of servicing this debt has surged alongside interest rates. In fiscal year 2025 alone, interest payments are projected to reach $952 billion, nearly triple the amount paid in 2012.

These payments now exceed spending on Medicare and defense, making interest on the debt the second-largest federal expenditure after Social Security. Over the next decade, cumulative interest payments are expected to total $13.8 trillion, crowding out funding for critical programs like infrastructure, education, and healthcare.

The mechanics of fractional reserve banking exaggerate this problem. Banks are allowed to lend far beyond their reserves, effectively creating money out of thin air.

For example, when issuing loans or mortgages, banks generate digital credits rather than transferring existing funds. This practice inflates the money supply but also increases systemic risk, as loans represent liabilities that must eventually be repaid with real dollars. The Federal Reserve’s policies have facilitated this by keeping interest rates artificially low for years, encouraging excessive borrowing by both governments and consumers.

Inflation has emerged as a hidden tax on American households, eroding purchasing power while benefiting financial institutions that control capital flows. - Jon Forrest Little

Officially measured at 2.8% in 2025—up from 2.1% in 2012—this figure understates real-world impacts on housing costs, food prices, and wages. Since 2020 alone, home prices have risen by 47%, while wages have grown by just 14%, widening income inequality and making it harder for middle-class families to maintain their standard of living.

The cozy relationship between the Federal Reserve and private banks further underscores systemic collusion. The top six U.S. banks now control 54% of all banking assets and reported combined profits of $304 billion in 2024—more than double their earnings from a decade earlier. These institutions benefit directly from Fed policies that prioritize financial stability over economic equity. Meanwhile, lobbying efforts by Wall Street—totaling $2.9 billion since 2012—have ensured that regulatory reforms remain minimal.

Despite these alarming trends, political leaders have failed to address structural flaws in America’s monetary system. Proposals to bypass private banks by having the Treasury issue debt-free currency have been dismissed as radical or impractical, even though they align with historical precedents like Lincoln’s greenbacks during the Civil War. Instead, policymakers continue to rely on deficit spending and debt issuance, perpetuating a cycle that enriches financial elites at public expense.

As Victoria Grant observed years ago, “We are being robbed by a complicit system.” Her words resonate even more strongly today as America faces mounting fiscal challenges that threaten intergenerational equity and economic stability. Unless voters demand accountability from both Congress and the Federal Reserve, this trajectory will only worsen—leaving future generations trapped in a debt-based economy designed to benefit a select few at the expense of many.

Are the USA and Canada Alone in Falling for the Central Banking, Fractional Reserve Banking, War Profiteering, and Currency Debasement Scheme?

In ancient Rome, the Temple of Saturn served as the state treasury, safeguarding the empire’s silver and gold reserves to finance wars and legions. The denarius, Rome’s primary silver coin, initially contained ~95% silver but was progressively debased by emperors to fund deficits. By the 3rd century CE, its purity plummeted to 2%, accelerating hyperinflation and economic collapse. This erosion of real value forced laborers to work harder for diminishing purchasing power—a dynamic mirrored today through central bank money printing and fractional reserve banking practices.

Modern quantitative easing and fractional reserve banking dilute currency value, transferring wealth from wage earners to financial elites.

Jesus recognized this systemic exploitation when he overturned money changers’ tables in the Temple, condemning their profiteering off sacred spaces. The Roman elite, who controlled 95% of wealth, pacified the masses with “bread and circuses,” just as modern policymakers distract with partisan theater while enabling Wall Street’s capture of the Federal Reserve. The result is unchanged: workers bear the brunt of inflation and austerity, while oligarchs hoard assets.

A contemporary equivalent of Jesus’ defiance would involve direct action against central banks and megabanks like JPMorgan Chase, which profit from debt monetization and speculative trading.

Overturning their literal or metaphorical “tables” symbolizes rejecting a system where $36.2 trillion in U.S. debt and $2.6 billion daily interest payments enrich financiers as wages stagnate. Just as Rome’s collapse followed currency debasement, today’s monetary policies risk repeating history—unless citizens challenge the “money changers” controlling our economic temples.

Concluding Thoughts - Another Sunday Silver Sermon

While both Donald Trump and Elon Musk have focused their energy on government efficiency, tariffs, and trade policy, a critical question remains: why have they not addressed the root cause of economic instability—the debt-based monetary system perpetuated by the Federal Reserve and Fractional Reserve banking? (which now has a zero reserve requirement)

The answer

Central banking policies, including fractional reserve banking (which creates money out of thin air) and money creation through debt, lie at the heart of the very inefficiencies and inequalities that both leaders claim to oppose.

The Federal Reserve’s ability to print money at will, (same with banks loaning out deposits that are not theirs but their customers) coupled with its role in setting interest rates, has created a system where debt fuels economic growth.

This approach consistently devalues the purchasing power of workers while enriching financial elites. For instance, the U.S. national debt has surged from $16.1 trillion in 2012 to $36.2 trillion today, with daily interest payments exceeding $2.6 billion. Inflation, often understated in official metrics, erodes wages and savings, forcing Americans to work harder for less—a phenomenon that mirrors the currency debasement that contributed to the collapse of ancient Rome.

Trump and Musk’s push for tariffs are political stunts but do not address surface-level economic issues and fail to confront the structural flaws of a debt-driven economy. When you levy tariffs on others you are interfering with the free market, its protectionist and the same as starting a war (economic wars almost always are the precursor of kinetic wars)

The Federal Reserve’s unchecked power to create money benefits Wall Street at the expense of Main Street. Without addressing this foundational issue, efforts to improve government efficiency or balance trade are akin to treating symptoms while ignoring the disease.

Jesus recognized the destructive nature of such systems. His act of overturning the money changers’ tables in the temple was a direct challenge to financial exploitation masquerading as economic necessity. In today’s context, a modern equivalent would involve confronting institutions like JPMorgan Chase, Bank of America, or even the Federal Reserve itself—demanding transparency and accountability in monetary policy.

If Trump and Musk truly aim to reform government inefficiencies and empower workers, they must go beyond tariffs and bureaucracy.

They should focus on dismantling a central banking system that prioritizes debt over equity and perpetuates wealth inequality. Until this root issue is addressed, any other reforms will remain superficial distractions from the deeper economic injustices at play.

So let’s ask this question one more time:

Why haven’t Trump and Musk targeted central banking’s debt-driven system, the root of economic instability, despite their focus on tariffs and efficiency?

Napoleon Bonaparte, reflecting during his exile, warned: “When a government is dependent upon bankers for money, they control the situation—the hand that gives is above the hand that takes.” His words underscore how central banks, by financing governments through debt, wield ultimate power. Today, the Federal Reserve’s zero-reserve fractional system perpetuates this dynamic, enabling private banks to profit from money creation while taxpayers bear inflation and debt burdens. Until leaders confront this structural issue, efficiency reforms remain superficial

end of sermon

Below is an astounding video under 7 minutes by then 12 year old Victoria Grant speaking at the Public Banking in America Conference, Philadelphia, PA

our opinions are not the opinions of sponsor(s)

editorial is separate from promotions

not financial advice