Can Silver become more precious than Gold? Opinions from Vedanta's Anil Agarwal and Related Thoughts

The Silver Wars Begin: Amid dwindling inventories U.S. Faces Risks with 79% Reliance on Imports

Anil Agarwal, Chairman of Vedanta Resources, predicts that silver could potentially become more valuable than gold in the future.

He bases this assertion on the increasing demand for silver in various industries, particularly in the production of electric vehicles and solar panels.

Agarwal notes that while gold is primarily used for jewelry and as a store of value, silver has significant industrial applications.

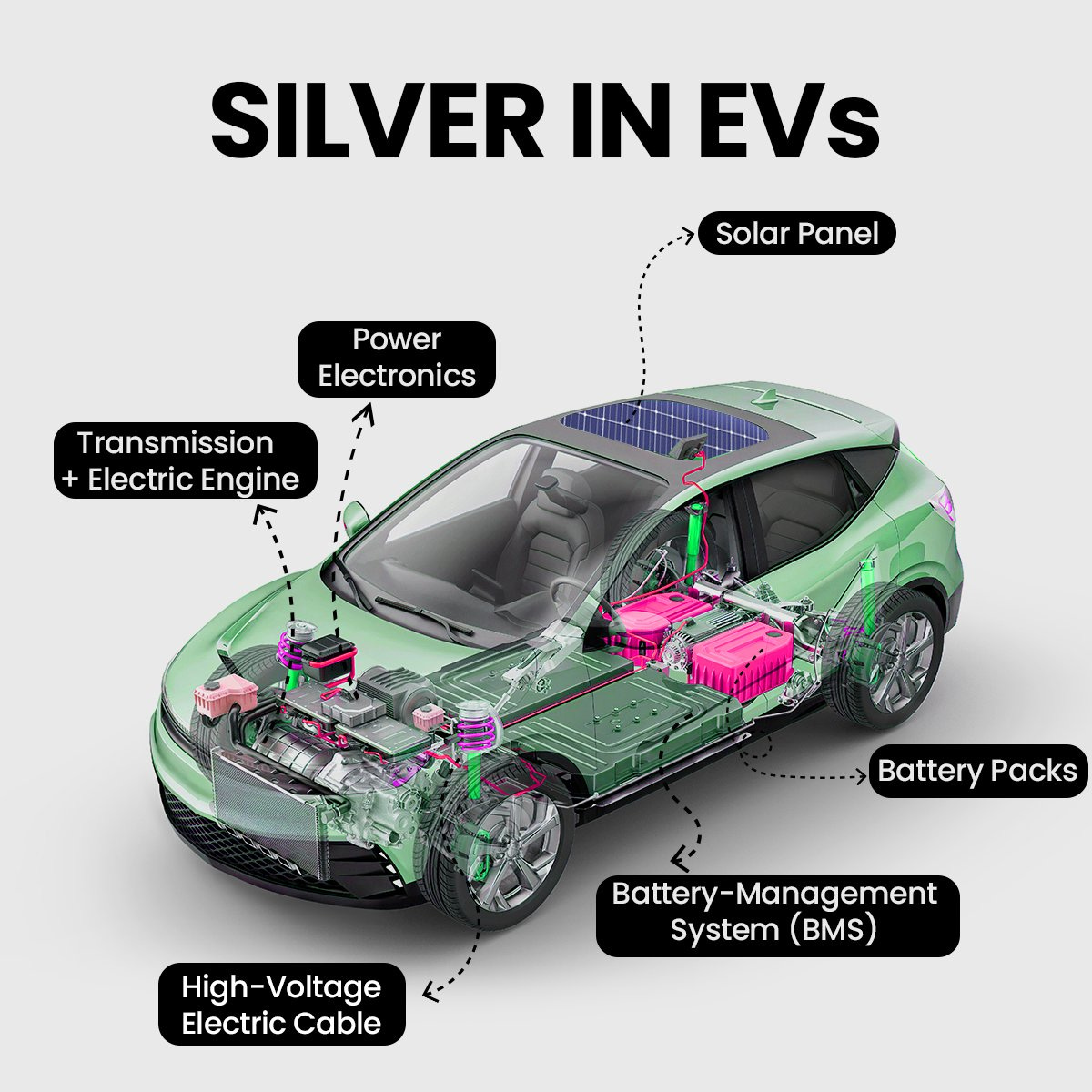

The article highlights that silver is essential in the manufacturing of electric vehicle batteries, with each EV requiring about 25-50 grams of the metal

700,000 ounces of Silver per 1 GW Solar

Additionally, solar panels use approximately 20 grams of silver per panel.

As the world shifts towards renewable energy and electric transportation, the demand for silver is expected to rise substantially.

Agarwal emphasizes that India has abundant silver reserves, particularly in Rajasthan.

He suggests that the country should focus on increasing its silver production to meet the growing global demand and potentially become a major exporter of the metal.

This shift could have significant implications for India's economy and its position in the global metals market.

Lots of Silver in EVs (even using existing Lithium-ion batteries)

All Eyes on Samsung, when will they put their Silver Solid State Batteries into the mainstream?

Samsung's latest breakthrough in solid-state battery technology incorporates a significant amount of silver, potentially using up to 1000 grams (1 kilogram) of silver per vehicle. This silver-based solid-state battery technology represents a major advancement in electric vehicle (EV) energy storage.

The battery utilizes a silver-carbon (Ag-C) composite layer as the anode, which contributes to its impressive performance characteristics.

With an estimated 5 grams of silver per battery cell and a typical 100 kWh battery pack, the total silver content could reach 1 kg per vehicle.

This substantial increase in silver usage compared to traditional lithium-ion batteries has significant implications for the silver market, potentially driving up demand and prices for the precious metal.

The adoption of this technology by even a fraction of global car production could have a dramatic impact on silver demand, potentially requiring a significant portion of current global silver production

The transition from older technologies to newer, more feature-rich alternatives is a well-established pattern in consumer behavior. This principle applies to Samsung's groundbreaking solid-state battery technology for electric vehicles. The new battery offers significant improvements over traditional lithium-ion batteries, including:

The ability to charge in just 9 minutes, less than half the time of current batteries.

A 600-mile range, approximately double that of current EVs.

An estimated 20-year lifespan, twice that of current batteries.

The solid-state design allows for a lighter battery pack.

Solid state (Silver) eliminate the risk of fires associated with Lithium-ion in high-moisture environments.

This said adoption will be fast and furious and the Lithium ion equipped cars will exist at the same ratio we see pagers to mobile phones (carrying out the metaphor to its logical conclusion)

India is the World’s Largest Silver Importer this year

India has witnessed a remarkable surge in silver imports, driven primarily by the booming solar energy sector. In the first four months of 2024, the country imported an astonishing 4,172 metric tons of silver, a figure that has already surpassed the total imports for all of 2023, which stood at 3,625 metric tons. This trend indicates that silver imports are on track to double again in the near future.

The increase in demand for silver has also had a significant impact on prices. In January 2024, silver was priced around ₹1,980 (approximately $23.02) per ounce. Today Silver averages $33.60 representing a remarkable 45.96% increase in 10 months.

The primary driver of this increased demand is the solar energy industry, where silver plays a crucial role as a key component in solar cell production due to its superior conductivity.

The shift towards advanced solar cell technologies, such as Tunnel Oxide Passivated Contact (TopCon) and Heterojunction (HJT) technologies, has significantly boosted the demand for silver paste.

In addition to solar energy applications, the electrical and electronics sectors have also contributed to this surge in demand. Notably, global demand for silver in these industries saw a substantial increase of 20% compared to the previous year.

Furthermore, there has been a notable rise in China's silver industrial demand, which climbed by 44% to reach 261.2 million ounces, primarily fueled by growth in green applications like photovoltaics.

Looking ahead, the demand for silver in the photovoltaic industry is expected to continue its upward trajectory. Projections indicate that silver usage in photovoltaics will rise from 193.5 million ounces in 2023 to an estimated 232 million ounces in 2024.

By 2030, this demand could increase by nearly 170%, reaching approximately 273 million ounces and accounting for about one-fifth of total silver demand.

This surge in imports and usage highlights India's rapid expansion in solar cell and module manufacturing, positioning the country as a significant player in the global renewable energy sector.

Russia's recent decision to add silver to its state reserves alongside gold, platinum, and palladium marks a significant shift in global monetary strategy.

As a world leader in setting monetary value for precious metals, Russia's move could have far-reaching implications for the global economy.

Russian economist Sergey Glazyev, a key architect of Russia's economic strategy, has proposed a system where a gram of gold is equated to a barrel of oil, potentially revolutionizing commodity pricing.

Yesterday, as I flew from Pittsburgh to Louisville, I was patted down by security. I thought about how I could carry 10 ounces of gold—5 in each pocket—without a problem.

This small amount has the same value as 311 barrels of oil. While I could easily pass through security with those 10 gold coins, I doubt they would allow me to board with 311 barrels of oil. You think carry on regulations are restrictive now right?

Russia, India and China are teaching 30 other nations a broader strategy to challenge the dominance of the US dollar in international trade.

While gold has long been considered the money of bankers and kings, silver's role in everyday transactions makes it equally crucial.

Russia's inclusion of silver in its reserves acknowledges this dual nature of silver as both an industrial commodity and a potential financial asset

China stacking Silver fiercely

Interestingly, this approach mirrors China's strategy, where citizens are encouraged to accumulate both gold and silver as a hedge against potential banking crises. China has been promoting silver stacking among its population, recognizing silver's importance in preserving wealth during economic uncertainties.

Russia's move, combined with China's strategy, could significantly impact the global silver market, potentially driving prices up as these major economies increase their silver holdings.

This shift may signal a new era in which silver plays a more prominent role in national reserves and individual wealth preservation strategies.

The Silver rule, he who has the Silver makes the rules

As these major economies - India, Russia, and China - increase their silver holdings and influence, the traditional dominance of Western markets and the COMEX in setting silver prices is being challenged. The combined demand and strategic stockpiling by these nations are creating a new paradigm in the silver market, potentially shifting the center of price discovery away from the West. This evolving landscape suggests that the future of silver pricing may be increasingly influenced by Asian and Eurasian economic powerhouses, rather than being solely determined by Western financial institutions and exchanges.

Silver demand across various high-tech industries is experiencing a significant surge. In artificial intelligence (AI), silver is crucial for the massive amount of energy AI requires as well as the manufacturing of advanced semiconductors and electronic components.

The rollout of 5G networks requires silver in antennas, base stations, and other infrastructure elements.

Solar panel production continues to be a major consumer of silver, with each gigawatt consuming 700,000 ounces of Silver.

Electric vehicles (EVs) use silver in battery management systems, electric motors, transmissions and charging stations.

In the military and aerospace sectors, silver is essential for radar systems, silver zinc batteries, torpedoes, bombs, rockets, missile guidance, and satellite technology.

This increasing demand across multiple industries is putting pressure on global silver supplies.

The BRICS nations' efforts to challenge U.S. dollar dominance in global trade and finance are gaining momentum, reshaping the international economic landscape.

As silver inventories dwindle and demand surges, the United States faces significant risks due to its heavy reliance on silver imports, with 79% of its supply coming from foreign sources.

Mexico's Diplomatic Tightrope: The Open Relationship Strategy That Could Shift Global Power Dynamics

Mexico's approach to balancing its relationships with BRICS and the United States can be aptly likened to an "open relationship" rather than a monogamous commitment. This metaphor captures the nuanced diplomatic strategy that Mexico is likely to employ in the coming years.

Finding itself in a unique position, Mexico is caught between its long-standing economic ties with the United States and the allure of emerging partnerships with BRICS nations. The United States remains Mexico's largest trading partner, with about 75% of Mexican exports directed northward. This deep economic integration serves as a primary relationship, providing stability and familiarity that Mexico values.

However, the potential offered by BRICS is hard to ignore. The prospect of diversifying its economic and diplomatic portfolio through new trade partnerships, investment opportunities, and increased global influence is enticing. Mexico is likely to nurture its crucial ties with the US while simultaneously seeking to deepen engagement with BRICS nations.

This strategy allows Mexico to maintain a delicate balance. By continuing to foster strong economic relations with the United States, Mexico ensures it retains the benefits of this vital partnership. At the same time, it can explore new avenues for collaboration with BRICS countries, participating in summits and seeking out trade opportunities that could enhance its standing on the global stage.

As a potential "Silver Swing Vote" in the dynamic between BRICS and the US, Mexico finds itself in a position of leverage. This role adds complexity to its diplomatic maneuvering, as it must navigate carefully to avoid alienating either side while maximizing its own interests. - Jon Forrest Little

Opting for this open relationship approach allows Mexico to keep its options open, enabling it to maximize economic benefits from diverse partnerships while maintaining diplomatic flexibility.

However, this strategy is not without risks; Mexico must tread carefully to avoid being caught in the crossfire of geopolitical tensions or facing economic retaliation from either side.

Mexico's diplomatic strategy resembles an open relationship more than a monogamous commitment. By keeping its options open, Mexico hopes to reap the benefits of multiple partnerships while preserving its independence and flexibility on the global stage.

As all roads lead to Mexico in this unfolding geopolitical landscape, it will be fascinating to see how this strategy plays out in the months and years ahead.

Our opinions are not our sponsors opinions.

The views expressed on TheSilverIndustry.substack.com are not necessarily those of the Silver Academy.

Not financial advice

sources:

https://tass.com/world/1683411

https://strikesource.com/2023/04/08/how-mexicos-admission-to-brics-could-impact-national-security/

https://www.wilsoncenter.org/article/growing-together-economic-ties-between-the-united-states-and-mexico

https://foreignpolicy.com/2024/02/09/united-states-mexico-immigration-border-china-trade-bri/

https://www.brookings.edu/articles/what-can-we-expect-from-the-2024-brics-summit/

https://tass.com/world/1754993

https://think.ing.com/articles/de-dollarisation-more-brics-in-the-wall/

https://www.chathamhouse.org/2023/08/does-expanded-brics-mean-anything

https://m.economictimes.com/industry/indl-goods/svs/metals-mining/can-silver-become-more-precious-than-gold-heres-what-vedantas-anil-agarwal-thinks/articleshow/114571499.cms

https://www.mintstategold.com/investor-education/cat/news/post/russia-set-to-boost-silver-reserves-a-major-precious-metals-strategy-shift/

https://goldinvest.de/silver-to-become-part-of-russian-foreign-reserves/

https://www.jpost.com/business-and-innovation/precious-metals/article-825455

https://www.jpost.com/business-and-innovation/precious-metals/article-823167

https://www.fxempire.com/forecasts/article/silver-xag-daily-forecast-russias-central-bank-silver-reserves-boost-bullish-sentiment-1470019

https://www.fxempire.com/forecasts/article/silver-xag-forecast-geopolitical-tensions-and-russian-reserves-drive-silver-market-outlook-1470139

https://etftrends.com/gold-silver-investing-channel/demand-russia-could-add-silvers-upside/

https://www.moneymetals.com/news/2024/10/06/how-russian-buying-could-help-drive-silver-to-50-and-beyond-003521