BREAKING: Carson Block of Muddy Waters Fame Bullish On Mining Stocks

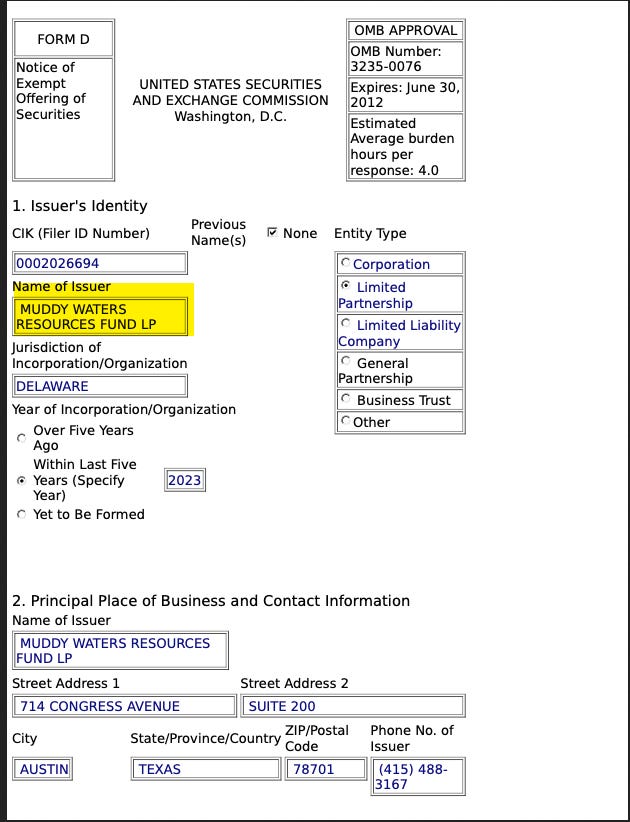

Bloomberg reported earlier today that Carson Block, renowned for his bearish bets against companies, is now shifting gears to capitalize on the rising metals and mining stocks. His firm, Muddy Waters Capital, based in Austin, Texas, has launched the Muddy Waters Resources Fund, securing approximately $1.5 million this month, as indicated by a private placement notice (pictured below) filed with the US Securities and Exchange Commission on Tuesday.

Traditionally known for its aggressive short-selling tactics and confrontations with corporate executives, Muddy Waters Capital is adapting its strategy in response to a soaring stock market. The S&P Metals and Mining Select Industry Total Return Index has seen double-digit percentage increases for the past five consecutive years, prompting some short sellers to explore new investment avenues.

Earlier this year, Block’s firm introduced the Muddy Waters New World Order Fund, a long-only fund aimed at investments in Vietnam. Additionally, over the past year, Muddy Waters has actively engaged in an activist campaign against Canadian miner Mayfair Gold Corp., leveraging a substantial stake.

A spokesperson for Muddy Waters declined to provide comments on the new resources fund. As of the end of last year, the firm managed nearly $440 million in regulatory assets, a figure that includes leverage.

Alternate Version

Carson Block, the renowned short seller, is raising money to bet on rising metals and mining stocks. Block, known for his aggressive short-selling campaigns against companies he alleges are fraudulent or overvalued, is now pivoting to the long side. His firm, Muddy Waters Capital, is launching a new fund focused on investing in metals and mining companies that stand to benefit from the global transition to clean energy and electric vehicles.

Metals and Mining Opportunities

The new fund aims to capitalize on the increasing demand for metals like lithium, cobalt, nickel, and copper, which are essential components in batteries and other technologies driving the green energy revolution. As countries worldwide ramp up their efforts to combat climate change and reduce carbon emissions, the demand for these critical minerals is expected to surge. Block sees significant opportunities in this sector, particularly in companies involved in the exploration, extraction, and processing of these metals. He believes that many of these companies are currently undervalued, presenting attractive investment opportunities for those with a long-term perspective.

Contrarian Approach

While Block's short-selling campaigns have garnered him both fame and notoriety, his decision to launch a long-focused fund highlights his contrarian approach to investing. He is known for his willingness to go against the grain and challenge conventional wisdom, traits that have served him well in his short-selling endeavors. By betting on the metals and mining sector, Block is positioning himself to capitalize on a trend that many investors may have overlooked or underestimated. His deep research and due diligence capabilities, honed through years of short-selling investigations, could prove invaluable in identifying promising investment opportunities in this space.

Regulatory Scrutiny

Despite his success, Block's short-selling activities have also drawn scrutiny from regulators. In the past, he has faced allegations of stock manipulation, which he has vehemently denied. However, his decision to launch a long-focused fund may help alleviate some of the regulatory pressure he has faced in recent years. As the world transitions towards a more sustainable future, the demand for critical minerals is likely to continue rising. Block's new fund aims to capitalize on this trend, leveraging his contrarian investment approach and deep research capabilities to identify undervalued opportunities in the metals and mining sector.

Citations:

https://www.bloomberg.com/news/articles/2024-06-18/carson-block-raises-money-to-bet-on-rising-metals-mining-stocks

https://www.institutionalinvestor.com/article/2bswvw9n02kg7ksdcd62o/corner-office/the-rage-of-carson-block

https://www.cityam.com/betting-on-human-nature-short-seller-carson-block-on-fraud-death-threats-and-why-hes-sniffing-around-uk-firms/

https://www.bnnbloomberg.ca/carson-block-shorts-blackstone-s-publicly-traded-mortgage-reit-1.2008132

https://www.reuters.com/business/finance/muddy-waters-shorts-canadas-fairfax-financial-alleging-asset-value-manipulation-2024-02-08/