Bloomberg: Silver Rises Highest Since 2011 as US Premiums Grow

Silver Nears 2011 Highs as Physical Market Fractures: | by Jon Little intern Mr. Carmine Lombardi

Silver markets are flashing red as the amount of physical silver available for immediate delivery in London has plunged to the lowest levels ever recorded.

According to Daniel Ghali, senior commodity strategist at TD Securities, the so-called “free-float” inventory at the London Bullion Market Association (LBMA) has dropped to just 155 million ounces. That’s less than a single day’s worth of trading volume for spot silver in London, and it marks an unprecedented squeeze in the world’s most important silver trading hub.

What’s driving this crisis? A perfect storm of factors. The first is relentless demand from both industrial users—especially solar panel manufacturers—and investors, who have been pouring money into silver-backed ETFs at a record pace. These exchange-traded funds now hold about 500 million ounces of silver in London vaults, but that metal is essentially locked away and unavailable for trading or lending. Recent US tariffs have also accelerated the movement of silver out of London and into the US, further draining LBMA inventories.

The result is a dramatic spike in the cost of borrowing silver, with one-month lease rates in London soaring as high as 8%—a level almost never seen in this market. Ghali warns that the illusion of liquidity is about to be shattered, and that the market will only rebalance through some form of a physical squeeze. In other words, if a major player suddenly demands delivery of a large amount of silver, there simply may not be enough metal to go around.

TD Securities’ analysis is stark: the headline numbers for LBMA silver inventories are misleading, because so much of that metal is tied up in ETFs and can’t be touched. In January alone, TD estimates that the pool of truly available silver shrank by 64 million ounces. If current trends continue, the free-float could be completely depleted within two years.

With the market already running an annual deficit for the fifth year in a row, and with liquidity now thinner than ever, any further draws on London’s silver could trigger sharp price spikes and force the market to find a new equilibrium at much higher levels. As Ghali puts it, the LBMA’s stockpile of free-floating silver is now so low that the very structure of the market is at risk. The world’s silver traders are watching nervously, knowing that the next big move could be explosive.

Meanwhile in China

We will most definitely see higher silver because of what's happening in Shanghai. Silver analyst and friend Chen Lin posted this chart that shows silver stocks on the exchange are running low, and the trend is accelerating

Silver Squeeze Hero Mr. David Bateman

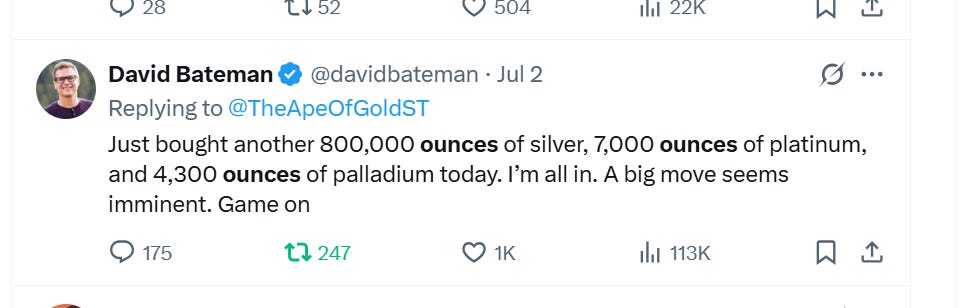

It’s worth revisiting David Bateman’s tweet on why he stood for delivery on a recent purchase

Purchase 1: 12,690,000 ounces

Purchase 2: 800,000 ounces

Total: 13,490,000 ounces

Bateman stands for delivery, 12 million 690 thousand ounces of silver

David Bateman wrote:

Here are the reasons I invested close to a billion dollars in precious metals over the past six months—including the purchase of 1.5% of the annual global silver supply (12.69 million ounces) :

The global monetary system is about to collapse (The Great Reset, or Basel Endgame).

The biggest credit bubble in history will soon pop ($300T).

There is no way the US can refinance its $28T in maturing treasuries in the next 4 years without an obscene amount of printing.

Trump tariffs are hastening the collapse, and it’s by design.

Gold and silver are the only meaningful life raft.

Physical possession is everything. The whole world right now is a sophisticated game of musical chairs; the chairs are precious metals.

Crypto is a psyop.

Those who purchase will have no chair when the music stops.

Real estate, crypto, stocks and bonds will all lose significantly compared to precious metals.

The banking system has been meticulously designed to seize your assets to buoy up a collapsing banking sector (see The Great Taking).

You have ZERO counter party risk with precious metals.

I’m up 20% already, on most of my purchases.

This is not a drill. Your grandkids someday will either muse or lament this financial decision you’re now faced with.

Don’t fail them.

Not financial advice.

For educational purposes only

#silversqueeze