BITCOIN WARNING: It would take about 2 months for all users to exit the network in a mass exodus scenario.

Bitcoin exists solely as digital code, without any inherent value

Bitcoin's intangibility is a significant drawback compared to physical assets like gold and silver. Unlike precious metals, which have diverse industrial and practical applications, Bitcoin lacks intrinsic utility.

Gold and silver are valued for their physical properties and uses in electronics, jewelry, and other industries. In contrast, Bitcoin exists solely as digital code, without any inherent value beyond its potential as a speculative investment or medium of exchange. This fundamental difference raises questions about Bitcoin's long-term viability and value proposition.

Bitcoin's Vulnerability to Bank Runs and Systemic Risks

Bitcoin (BTC) faces significant challenges that could potentially lead to a catastrophic bank run scenario. With approximately 33 million on-chain users, the network's limited transaction processing capacity poses a severe risk in the event of widespread panic.

Transaction Processing Limitations

Bitcoin's blockchain can only process about 7 transactions per second (TPS), based on conservative estimates using a 1.66MB block size and 10-minute block time. This translates to roughly 18,144,000 transactions per month.

Given the current user base, it would take approximately 1.82 months for all users to exit the network in a hypothetical mass exodus scenario.

Consequences of Network Congestion

In reality, the situation could be far worse:

The network cannot sustain month-long transaction queues

Transactions may get stuck or dropped after 3 days

Only high-fee transactions from large entities would likely be processed

Smaller participants could find it impossible to exit their positions

Potential Death Spiral

A panic-induced price drop could trigger a vicious cycle:

Falling prices force miners to shut down

Reduced hash rate slows transaction processing

Network congestion worsens, fueling further panic

More miners shut down, exacerbating the problem

This cycle could potentially lead to a complete collapse of the Bitcoin network.

Scalability and Use Case Limitations

Bitcoin's 7 TPS capacity severely limits its practical applications:

Traditional financial networks like Visa and Mastercard process thousands of TPS

Competing cryptocurrencies offer significantly higher throughput without sacrificing decentralization

Centralization Concerns

The current state of Bitcoin contradicts its original vision of decentralized, peer-to-peer electronic cash:

Mass adoption likely requires centralized custodians and banks

Self-custody may be unsafe due to network limitations

The system appears to favor large institutions over individual users

Conclusion

While Bitcoin has garnered significant attention and investment, its fundamental limitations pose serious risks to users and investors. The potential for network congestion, transaction delays, and a possible death spiral scenario should not be underestimated. Investors should carefully consider these factors and the possibility that Bitcoin may not fulfill its promised role as a decentralized, widely-adopted currency.

end of segment

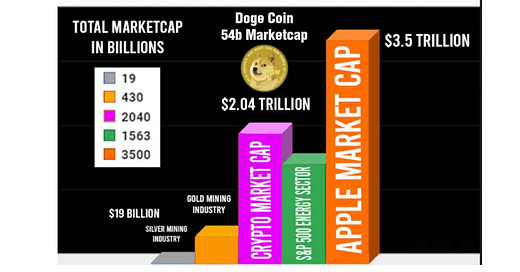

Look at All Silver Miners Combined compared to Crypto market cap

Exter's Pyramid illustrates how capital flows from higher-risk assets to lower-risk ones during economic crises. At the base of this pyramid are tangible assets like gold and silver. The small market cap of silver compared to the S&P 500 presents a significant opportunity when capital shifts towards commodities.

As investors flee riskier assets, even a small percentage of that capital flowing into silver could dramatically impact its price due to the limited size of the market. This potential for outsized gains makes silver an attractive option for investors seeking to capitalize on the flight to safety.

The relatively small silver market could experience substantial price increases as it absorbs capital from larger, bubble-prone markets higher up in Exter's Pyramid.