BANK RUNS IMMINENT: Massive Bank Failures Signal Impending Financial Crisis - Withdraw Your Money Now?

Banks have a 0% Reserve Requirement. This isn't a Tabloid Headline. Look it up yourself. 5 reasons why ALL YOUR HARD WORK WILL GET WIPED OUT

FACTS:

US is $34 Trillion in debt

Interest on this debt is largest line item on budget (larger than US military which spends more than next 10 militaries COMBINED)

Unfunded liabilities are not captured in this $34 Trillion Number

Unfunded liabilities ARE YOUR RETIREMENT, VA Benefits, Medicare and more

The Treasury reported these unfunded liabilities North of 100 Trillion

5 reasons why ALL YOUR HARD WORK WILL GET WIPED OUT

#1 Banks by Statute are not required to hold any of your money in the bank. This is what is called the recently passed 0% reserve requirement.

Yes, the reserve requirement in the United States has been reduced to zero percent. The Federal Reserve announced on March 15, 2020, that reserve requirement ratios would be set to 0%, effective March 26, 2020, eliminating reserve requirements for all depository institutions[1][2][3]. This action was taken in response to the COVID-19 pandemic to jump-start the economy by allowing banks to use additional liquidity to lend[2]. As a result, depository institutions are no longer required to maintain deposits in a Reserve Bank account to satisfy reserve requirements[4]. This change has been in effect since March 26, 2020, and there are currently no plans to reinstate the reserve requirement[4].

Citations:

[1] https://www.federalreserve.gov/monetarypolicy/reservereq.htm

[2] https://www.investopedia.com/terms/r/requiredreserves.asp

[3] https://www.federalregister.gov/documents/2022/12/01/2022-26065/reserve-requirements-of-depository-institutions

[4] https://www.eidebailly.com/insights/articles/2020/4/federal-reserve-eliminates-reserve-requirements

[5] https://cointelegraph.com/news/why-isn-t-the-federal-reserve-requiring-banks-to-hold-depositors-cash

The reserve requirement for banks, also known as the reserve ratio, is the minimum amount of funds that banks must hold in reserves. Before March 2020, the U.S. central bank, the Federal Reserve, required banks to have a percentage of funds tied up in reserves. The percentage was 3% or 10% of money held in transaction accounts, such as checking accounts, and the percentage depended on a bank’s size. However, in March 2020, the Fed lowered the reserve requirement ratio to 0%, meaning there is no longer a reserve requirement for banks.

This change was made to stimulate the economy, and the 0% reserve ratio has remained in place since late March 2020

Remember, By Law Banks are held to the High Bar of Having a 0% reserve requirement meaning that if you put 1,000.00 in the bank you just made a $1000 unsecured loan to the bank.

#2 - 2023 Bank Failure Watch here in USA

As of today there have been 5 bank failures in 2023 that have been put into FDIC receivership.

These failures include :

1. First Republic Bank, San Francisco, CA

2. Silicon Valley Bank, Santa Clara, CA

3. Heartland Tri-State Bank, Elkhart, KS

4. Citizens Bank, Sac City, IA

5. Signature Bank, New York, NY

The total assets of these failed banks in 2023 amount to billions of dollars

The FDIC has taken various measures to protect depositors, such as entering into purchase and assumption agreements with other banks to assume the deposits and assets of the failed banks.

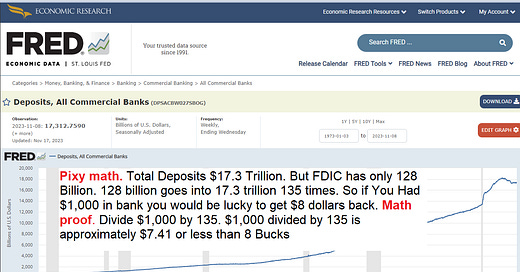

But look at the table below where you can plainly see The FDIC has less than 1% of deposits in their fund.

#3 When you make a Deposit in the Bank it is no longer your money but you are making an unsecured loan to the bank

Exploring Banking Realities: Rethinking the Notion of Deposits as Unsecured Loans

In the realm of banking, the commonly held belief portrays these financial institutions as deposit-taking entities, entrusted with safeguarding funds and facilitating loans. However You are not making a Deposit. By Law you are handing the bank an unsecured loan and they have no legal responsibility to keep any of your money in reserves. ZERO

In the extensive 5,000-year history of banking, studies have been conducted to substantiate the prevailing perception that banks function as deposit-taking institutions while also engaging in lending activities. However, a closer examination of the legal framework reveals a striking contrast to this common belief. The legal reality challenges the notion that banks take deposits and lend money, asserting that they do neither.

The term "deposit," traditionally associated with a secure placement of funds within a bank, is debunked by legal intricacies. Contrary to the conventional understanding, a deposit is not a bailment and is not held in custody at law.

Legal authorities, including courts and various judgments, unequivocally declare that when individuals provide money to a bank under the label of a deposit, it essentially constitutes a loan to the bank. This legal perspective renders the term "deposit" devoid of substantive meaning.

Deposit Clarification: The term "deposit" is deemed meaningless in legal terms. Courts and judgments emphasize that money given to a bank is essentially a loan.

Deposit as Record of Debt: What is commonly called a "deposit" is revealed to be the bank's record of debt to the public, challenging traditional understanding.

explained by Professor Richard Werner who is blacklisted by The Parasitic Class

#4 Smoke and Mirrors. Banks are Insolvent. FDIC Receivership is a SCAM. Here’s Why?

Look at the graphic below.

It shows total deposits in typical US commercial banks at $17.34 Trillion.

Yet there is only $128 Billion in the FDIC Fund.

This means US government and banking deposits are insolvent because funds in FDIC cover .74% of our collective deposits. That’s far less than 1%

Given the simple math (ratio), this means if you have $1,000 in the bank, all of it is wiped out, but you may be able to recover $7.41 out of your $1,000

Math formula below

#5 - Japan, Euro and USA Banks on Brink of Collapse

UBS circling the drain

HSBS insolvent

Credit Suisse on the Brink of Collapse

Dominoes falling in Japan, Europe, USA

Money Metals Exchange is the USA's #1 Gold and Silver Dealer (Quality, Customer Service, Consumer Reviews), endorsed by The Silver Academy, World Gold Guild, Mineral Wealth, and The Pickaxe.

Get started with the Money Metals Silver Starter Stack, where you get nine pieces of Silver at employee pricing (about $100)

1 - American Silver Eagle

1 - Canadian Maple

1 - Walking Liberty

1 - 1/2 ounce Walking Liberty fractional

5 - 1/10 ounce Walking Liberty fractional

Total of 4 ounces of .999 Silver

Just submit your email in link below (no obligation)

The banks have been making use of the BTFP/reserve interest ratio arb that the Fed “overlooked” when constructing the BTFP program (oops? Yeah, sure....), to make up for the income lost by declining loan activity. That arb was a built-in stealth bailout within a bailout, IMO, and has been helping to keep banks afloat for the last year until smart analysts figured it out. Now that the cat’s out of the bag, the Fed is making a virtuous stink to the public about how they’re shutting down the BTFP on schedule in March. Is that going to be when they’re planning to collapse the banking system and panic herd us all into CBDC’s and UBI? Or is there a teensy asterisk behind their promise, which leads to a footnote written in two point stating that the BTFP will simply be replaced by a another, but more complex and secretive bailout program? My guess is the latter, and the beat will go on until everything necessary for the final entrapment of humanity is in place.

IMO, the best strategy is to keep pulling your cash out of whatever depository institutions you’re in, stack harder, and put together communities of likeminded individuals who will be happy to jump into the parallel economy as soon as the monetary trap door finally opens under the paper economy. “T-bill and chill” for some of your paper so you don’t lose all of the value to inflation. Cash in when the yield curves in-invert, and turn the rest into Constitutional money. In the meantime, buy durable stuff you’ll need in the future (appliances, furniture, clothing, etc.) need now, when it’s on sale, and before the next supply shock or higher interest rates hit. Keep your head during the mania of the dying empire and focus on financial self-preservation. Silver and gold will survive what’s coming just as they always have. Put your faith in what’s real, and starve the beast of it’s lifeless blood of worthless “assets” in the meantime.

My opinion is that noone is under the limit, I think you will get your fiat back. They will just print whatever they need. But, by the time you get it it won’t be worth much. Or, even worse, they will give it back to you but if, and only if, you accept it as a CBDC.

To me, that is what makes the most sense. We know their objective. So how do they get there.

First they soften things up with serious inflation, all while gaslighting us on how good things are. Then they crash the banking system, people can’t get their cash out for weeks. Can’t buy food, can’t pay the rent. Then they offer the solution to the banking crisis. A new digital currency. Call it whatever you like. Cloward-Piven. Hegelian Dialectic.

The real question is when. The FED NOW payment system trial was a disaster. I’ve had the same bank rep for 20 years and he told me that they participated in the trial last summer and it did not work. Assuming he was truthful, you have to wonder whether they are anywhere near being in a position to roll out a CBDC.