As the World Abandons the Dollar, Gold Sounds the Alarm

James Turk weighs in on "When Silver?"

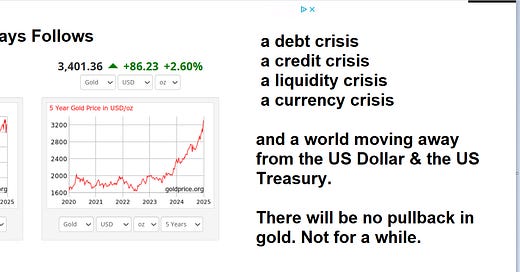

Few truly grasp the logic behind gold’s relentless uptrend. Many are paralyzed by the fear of a correction, waiting for the market to snap back. But what if the real story is that there will be no pullback—at least, not for a while? What if gold’s ascent is not a speculative bubble, but the market’s cold, rational response to a world in the throes of epochal change?

Why is gold, of all assets, soaring while stocks stumble and bonds falter? The answer lies in the tectonic shift from a world dominated by a single superpower to one defined by multipolarity. The U.S.-centric order—once underpinned by the “exorbitant privilege” of the dollar and the safe-haven status of U.S. Treasuries—is unraveling. Central banks and sovereign wealth funds, spooked by policy unpredictability and weaponization of the dollar, are dumping U.S. assets and buying gold. Could this be the market’s verdict on the credibility of the old system?

The hard truth is that the evidence of a global debt crisis is everywhere. Governments, especially in developing nations, are now spending more on interest payments than on health or education. In the U.S., the cost of servicing debt is rising so fast that it’s starting to cannibalize other budget items—forcing impossible choices between paying creditors and funding basic services. What happens when interest payments eat up the national budget, leaving little for roads, schools, or defense?

As fiscal space shrinks, the next domino is a credit crisis. When governments and households are maxed out, businesses feel the squeeze. Credit tightens, layoffs follow, and the “job creators” become job cutters. During the last financial crisis, nearly 9 million jobs vanished as companies slashed costs to survive. What happens when businesses can’t borrow, invest, or even pay their workers?

Then comes the liquidity crisis. Banks, desperate to shore up their own balance sheets, start revoking credit lines and hoarding cash. Even solvent banks can suddenly lose access to short-term funding, triggering a contagion that spreads through the financial system. What happens when the banks themselves can’t make loans or deals—when the very plumbing of the economy seizes up?

And what if all this culminates in a currency crisis? The dollar’s recent 9% plunge against other major currencies is not just a blip; it’s a warning shot. For decades, the U.S. lived beyond its means, importing goods from China and Vietnam and paying with freshly printed dollars—an arrangement only possible because the world needed dollars as reserves. Now, as that “exorbitant privilege” wanes, the cost of living in the U.S. is poised to soar, and the standard of living—propped up by cheap imports and easy credit—may fall by as much as 27% or more19. What happens when America can no longer print prosperity?

Gold’s rise is not a mystery. It is the only benchmark left standing in a world where trust in fiat currencies and sovereign debt is evaporating. With every new high, gold is posing the question that haunts policymakers and investors alike: What if this time, there really is no turning back?