A Little Story about a Little Shiny Rock that Sky Rocketed From $35 to $2,500 in EXACTLY 53 Years

A staggering 71.4x increase! Keep this Fact in Mind as it could be a Question on Final Jeopardy

The U.S. Entry into World War II

During World War II, the United States initially maintained a position of neutrality, supplying its allies with essential resources through programs like Lend-Lease, which began in September 1940. This program allowed the U.S. to provide Great Britain and other nations with military supplies and other assistance without immediate payment, effectively supporting the Allies against Germany before officially entering the war in December 1941. The U.S. supplied vital resources such as oil, munitions, and equipment, which were crucial for the war effort.

The Bretton Woods Conference and the Dollar's Rise

The Bretton Woods Conference in 1944 established the U.S. dollar as the world's global reserve currency. This system allowed countries to peg their currencies to the dollar, which was convertible to gold at a fixed rate. This arrangement granted the U.S. significant economic influence, as it could print dollars to facilitate international trade.

The Exorbitant Privilege of the U.S. Dollar

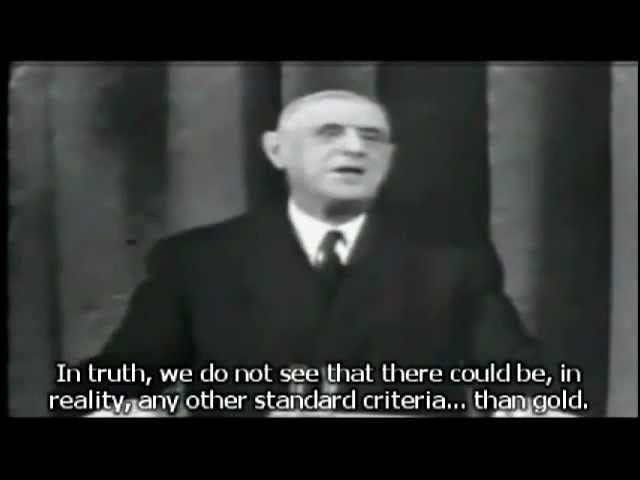

French President Charles de Gaulle famously criticized this system, coining the term "exorbitant privilege" to describe the U.S.'s ability to print money and exchange it for tangible goods globally. This privilege was seen as advantageous to the U.S., as it could finance its spending by issuing currency that other countries held as reserves.

The Nixon Shock and the End of Gold Convertibility

In 1971, the situation reached a critical point when France, under de Gaulle's influence, sent a naval ship to the U.S. to demand the conversion of its dollar reserves into gold. This action highlighted the growing distrust in the dollar's value and the sustainability of the Bretton Woods system. In response, President Richard Nixon announced the suspension of the dollar's convertibility into gold, a move known as the "Nixon Shock." This effectively closed the "gold window," ending the Bretton Woods system and transitioning to a fiat currency system where the dollar was no longer backed by gold.

Defaulting on Gold Obligations and the Impact on U.S. Spending

This decision was seen as a de facto default on the U.S.'s obligation to exchange dollars for gold, as promised under the Bretton Woods agreement. By closing the gold window, the U.S. removed the constraint of gold backing, allowing it to print money more freely. This shift enabled the U.S. to finance deficit spending, including military expenditures and other domestic projects, without the limitations imposed by gold reserves. The transition to a fiat currency system thus allowed for greater flexibility in monetary policy, but also marked a significant change in the global economic landscape.

On 8/15/1971, Nixon decoupled gold from the dollar, ending the $35/oz fixed rate.

Just yesterday, 53 years later on Friday August 16th, 2024 gold hits $2500/oz,

A staggering 71.4x increase

Zero Coverage from Bloomberg, Yahoo Finance, Forbes, Wall Street Journal, etc

U.S. media ignored this milestone, reflecting Federal Reserve influence.

The situation echoes the Nathan Mayer Rothschild quote on monetary control

“I care not what puppet is placed upon the throne of England to rule the empire on which the sun never sets. The man who controls the British money supply controls the British Empire, and I control the British money supply.”

Now the News gets much better.

Now do you see why the projections below are modest in nature?

The following numbers ARE IN PLAY

GOLD, Game On!

Luke Gromen Projects Gold at $20,000 per Ounce.

Luke Gromen, a financial analyst, has suggested that gold could reach $20,000 per ounce if the Federal Reserve decides to back U.S. Treasuries with gold. This idea is rooted in the context of the U.S. potentially revaluing gold to stabilize its financial system.

Gromen's assertion is based on the notion that by backing Treasuries with gold, the U.S. could address issues related to debt and currency stability, potentially leading to a significant increase in gold's value.

The concept of revaluing gold involves the U.S. government setting a new, higher price for gold, which would increase the value of gold reserves and potentially strengthen the balance sheet of the Federal Reserve. This move could be seen as a way to restore confidence in the U.S. dollar and manage the national debt more effectively.

By backing Treasuries with gold, the Federal Reserve would essentially be tying the value of U.S. debt instruments to a tangible asset, which could enhance their appeal to investors concerned about inflation and currency devaluation.

Gromen's theory also considers the historical context, where gold has been used as a monetary standard, and its potential role in modern financial systems as a hedge against economic instability. The idea of a gold-backed Treasury could be seen as a return to a modified gold standard, which could help stabilize the economy by providing a more secure foundation for the currency.

This perspective is part of a broader discussion on how the U.S. might navigate its current economic challenges, including high levels of debt and inflationary pressures. While the revaluation of gold and its impact on the economy is speculative, it underscores the ongoing debate about the role of gold in the global financial system and its potential as a tool for economic stabilization

Judy Shelton: Trump’s Pick as Federal Reserve Chair

Judy Shelton, a proponent of the gold standard, has expressed views that align with the idea of using gold to stabilize the U.S. monetary system, similar to Luke Gromen's suggestion of backing U.S. Treasuries with gold. Shelton argues that a return to the gold standard could provide stability and prevent currency manipulation by governments, thus supporting free trade principles.

She believes that pegging the dollar to gold would offer a reliable store of value and serve as a safeguard against inflation, which is a concern in the current economic climate.

Shelton's advocacy for the gold standard is rooted in the belief that it could impose fiscal discipline by limiting the government's ability to issue new money, thereby controlling inflation and maintaining economic stability.

This perspective is controversial among mainstream economists, who argue that the complexity of the modern economy makes a return to the gold standard impractical and potentially harmful. Critics point out that the gold standard could restrict the Federal Reserve's ability to respond to economic crises, as it would tie monetary policy to gold prices, which are influenced by external factors like mining output.

Despite these criticisms, Shelton maintains that a gold-backed system could enhance trust in the currency by anchoring it to a finite resource, thereby promoting economic harmony and stability

Her views, while considered fringe by some, highlight a debate about the role of gold in modern monetary policy and its potential to address issues of debt and currency devaluation. This aligns with Gromen's idea of revaluing gold to strengthen the U.S. financial system, suggesting that both see gold as a tool for economic stabilization in uncertain times

Jim Rickards sets $27,000 per Ounce Gold Target

Jim Rickards arrives at his prediction of $27,000 per ounce for gold through a detailed analysis based on the potential return to a gold standard.

His calculation involves the U.S. M1 money supply and a historical gold backing ratio. Rickards assumes a scenario where central banks might be forced to revert to a gold-backed system due to a collapse in confidence in fiat currencies, driven by excessive money creation, competition from cryptocurrencies, or a financial crisis.

Rickards uses the U.S. M1 money supply, which is approximately $17.9 trillion, as the basis for his calculation. He applies a 40% gold backing ratio, a standard historically used by the Federal Reserve. This implies that $7.2 trillion worth of gold would be needed to back the money supply. Given that the U.S. holds 261.5 million troy ounces of gold, Rickards calculates the price of gold as follows:

This price reflects a significant increase from current levels and is based on the assumption that such a monetary system could be implemented. Rickards emphasizes that this is not merely speculative but a result of rigorous analysis, considering historical precedents and current economic indicators.

He also discusses the implications for investors, advising them to invest in gold now to capitalize on potential future gains.

Rickards highlights the importance of gold as a hedge against inflation and economic uncertainty, suggesting that physical gold, gold stocks, or gold IRAs could be strategic investments

Gold at $60,000 per Ounce is Plausible, Possible and Also in Play.

History teaches us

If we were to have a repeat of the 1970s

Moon Shot gold by 24 X

$2,500 x 24 Equals?

That would price Gold at $60,000.

Gold today backs the dollar by only 9% marked to market.

In 1971, it was 12%.

Meaning, gold is lower now than it was in 1971 by this metric.

Price Implications for Silver

Recommendation

Convert Federal Reserve Paper Notes into Real Gold and Silver

Use the #1 Trusted Name in Precious Metals